Get approved for up to $50,000 and choose your loan term from anywhere between 6-60 months. We offer rates as low as 4.6% APR from Canada’s top lenders.

Banks and Lenders should be competing for your business, not the other way around. Use the power of MyChoice and compare the best offers from Canada’s top lenders today!

*Searching for a Personal Loan WILL NOT Affect Your Credit Score

What Exactly Is a Wedding Loan?

Weddings are expensive. The cost of the average wedding in Canada is approximately $29,000. When you compare that cost to the average annual salary for Canadian employees ($52,600), it’s not hard to understand why many soon-to-be-newlyweds are searching for wedding financing.

A wedding loan is a personal loan to finance a wedding. You can take out personal loans for various reasons, from paying off medical bills to home improvements, but most people don’t realize that you can also apply for a loan to fund your wedding. Most personal loans are unsecured loans, meaning that you don’t have to put up collateral to secure it, but the trade-off is that you’ll pay a higher interest rate.

How Does a Loan For a Wedding Generally Work?

When you qualify for a wedding loan, you’ll get the money up front and pay it back (plus interest) each month. One benefit of obtaining a wedding loan and paying it off (if you pay on time each month) is that it will improve your credit score. Personal loans tend to have lower interest rates than credit cards, so if you are looking for a way to fund your wedding, a wedding loan may be the best option for you.

Some Other Ways You Might Pay for Your Wedding

Traditionally, the bride’s parents pay for most of the wedding expenses, but this tradition is not a guarantee, and many couples find themselves fronting the costs themselves. When parents aren’t on board with picking up the tab for the wedding, you may have few options left. You can try to cut back your expenses, stop unnecessary spending, and save your money. You could try to make more money by taking on another job or turning one of your hobbies into a side gig.

Another option is to cut down your guest list and plan a more intimate gathering. You could throw the wedding in the backyard of someone you know or get a friend to donate her catering services as your wedding gift. You could get creative and throw a DIY wedding for which you make the invites, decorations, and flower bouquets yourself.

Deciding if You Should Get a Wedding Loan

If cutting back your expenses, increasing your income, or throwing a more intimate wedding are not options for you, a wedding loan might be your best bet. When deciding if you should get a wedding loan, you should consider the debt you’ll be taking on and if it will be worth it for you. Ultimately, only you can decide if taking out a wedding loan to create the wedding of your dreams would be a worthwhile trade-off.

While it’s ideal to pay for your wedding outright, if that isn’t an option, some benefits exist to taking out a wedding loan. For starters, loans are a relatively easy and quick way to get the money you need to start paying deposits for your big day. It’s no secret that venues and services in the wedding industry book up far in advance, so once you start planning, you need to be ready to put down some money right away. If you need help financing your wedding, a wedding loan will give you better interest rates than charging your wedding expenses on a credit card.

How to Get a Loan for Your Wedding

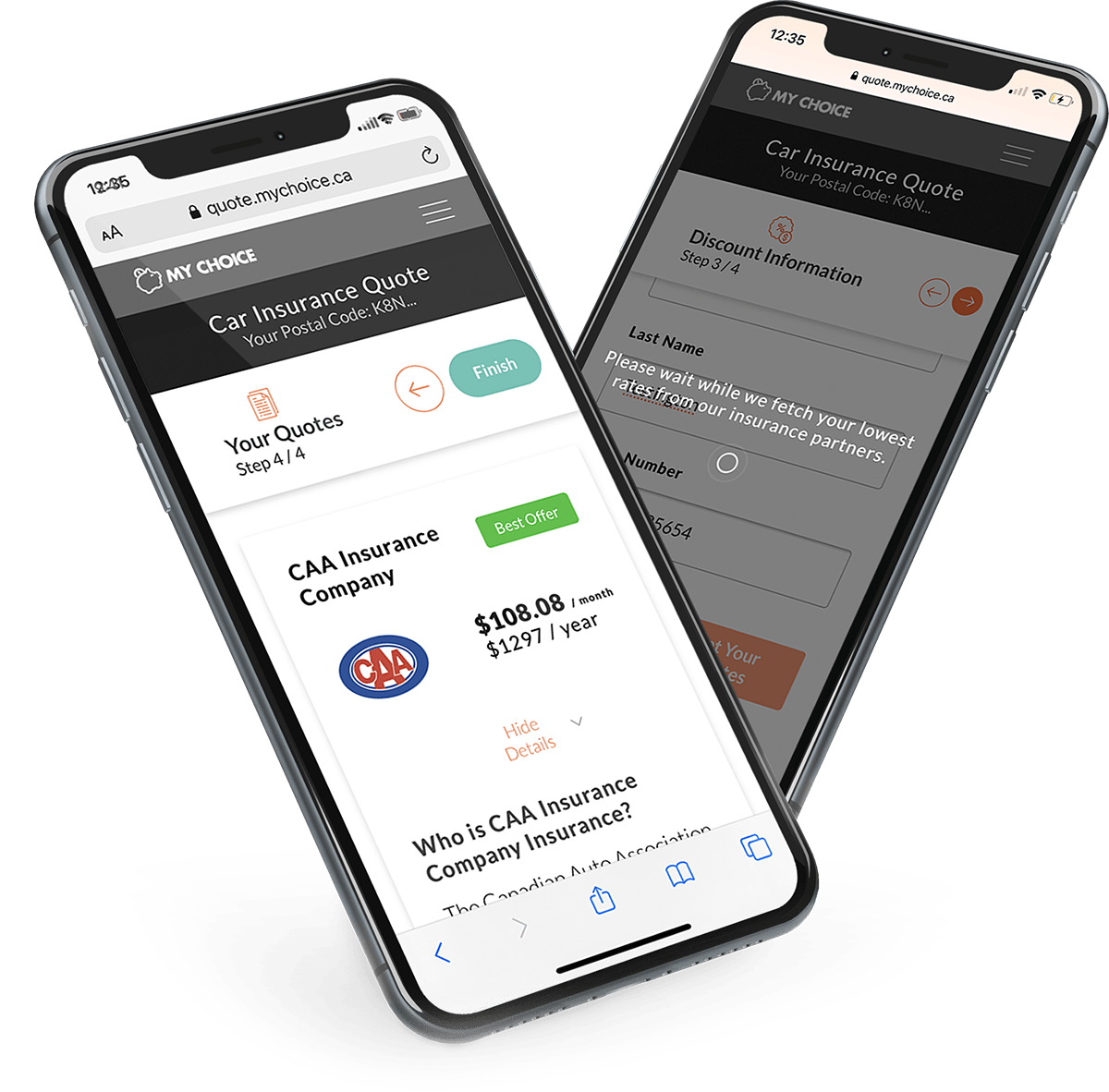

Applying for wedding loans in Canada has never been more convenient than with MyChoice. You can fill out the application in minutes and get an answer immediately. Applying for a wedding loan will not negatively impact your credit score. If you receive approval, you’ll become connected with a list of lenders from which you may choose. Review the terms and rates available and choose the best one for you. Finally, you’ll complete your loan application and could have the money in your account within 24 hours.

At MyChoice, we want to make the process fast, easy, and secure. We will keep your information encrypted for your safety. We work with Canada’s top lenders to help you get the best rates possible. You can choose a loan of up to $50,000 with terms between 6-60 months and interest rates as low as 4.6%.

If you have bad credit and are concerned about applying for a wedding loan, we understand entirely. We know it can be more challenging for a person with bad credit to get approved for a personal loan. At MyChoice, we are proud to provide loan options for most people even if they have a bad credit score or insufficient credit history in Canada.

We work with several bad-credit lenders to provide loans to people that most lenders typically overlook and negatively judge. We believe everyone deserves a second chance and that your credit score doesn’t tell the whole story. We understand that extenuating circumstances beyond your control can negatively impact your credit score and that everyone deserves a chance to start over and rebuild their credit. We believe you should have the wedding you deserve, whether you need help paying for it or not.

When you have bad credit and want to apply for a wedding loan, it is important to understand that if you get approval, you can expect to see higher interest rates than those offered to people with good credit scores. If you can stay on top of your payments each month and pay off that loan, however, you will see your credit score improve, and you will become eligible for loans with lower interest rates and better terms in the future.

Apply for a Personal Wedding Loan

You’ve said “Yes“ to forever with your partner. Now, it’s time to say “Yes“ to the dress, the wedding venue, and the wedding budget. If you are ready to explore your wedding financing options, say “Yes“ to applying online at MyChoice to find out your wedding loan options. We will match you with Canada’s top lenders to choose the best loan for you. We hope that whatever you decide and however you choose to celebrate your marriage, you’ll enjoy looking back on your special day for years to come.