Get approved for up to $50,000 and choose your loan term from anywhere between 6-60 months. We offer rates as low as 4.6% APR from Canada’s top lenders.

Banks and Lenders should be competing for your business, not the other way around. Use the power of MyChoice and compare the best offers from Canada’s top lenders today!

*Searching for a Personal Loan WILL NOT Affect Your Credit Score

What Is an Auto Loan?

Most people don’t have a pile of cash sitting around to buy a new vehicle. Often, people use car loans in Canada to help them purchase a new vehicle. An auto loan breaks the high cost of a new car down into monthly installments that are easier to pay, although you pay interest for the privilege of doing so. Auto loans are secured loans, which means that the borrower uses an item of value as collateral to secure the loan. For auto loans, the vehicle purchased becomes collateral to secure the loan.

How Does a Loan For a New Car Work?

Getting a personal loan for a new car can be intimidating the first time you do it, but at MyChoice, we aim to make the process as seamless and painless as possible. When taking out an auto loan, you receive the money up front and then pay it back to the financial institution over time (plus interest). The amount you will need to borrow, how long it will take you to pay it back, and the interest rate the lender offers you will determine how much your monthly payment will be.

You will want to consider a few factors when shopping for an auto loan. While paying less per month may sound best at first, it could mean that you will end up paying more overall. Depending on your personal situation, it may be easier for you financially to take on a smaller monthly payment and pay more overall than to have a difficult payment each month.

Why Car Financing Might Be the Best Solution for You

Car financing may be the best solution for you if you cannot purchase a car outright. While you may know ahead of time that you need to buy a new car soon and might start saving your money, you could end up needing the car before you have saved up enough. The great thing about an auto loan is that, even if you end up needing a new car before you can save up the amount you wanted to put down, you can borrow 100% of the car’s purchase price and be able to drive the car off the lot in no time.

Another benefit to car loans is that they can help you establish credit if you don’t already have good credit built up by paying off other loans, a mortgage, or credit cards. Even if you have bad credit or no credit history in Canada, MyChoice may be able to help you get a loan. By paying off your auto loan on time each month, you can increase your credit score.

How Does an Auto Loan Differ From a Car Lease?

The difference between an auto loan and a car lease is that, with a loan, once you have it paid off, you own the car. When you lease a car, it’s a lot like renting an apartment. You pay money up front (like you would with a security deposit), then you pay a monthly fee until the end of the lease period (typically 2-3 years). At the end of the lease, you turn the car back in. It does not belong to you. An auto loan works more like a mortgage, where you get the money and the vehicle upfront, then you pay it off each month for a few years until you own it.

So, which is better? It depends entirely on what you want and how long you need a car. Leases are typically for much shorter terms (24 to 60 months). You may find lower upfront costs and lower payments overall with a lease. On the other hand, just as with rent, your payments aren’t building equity in the car as you would with an auto loan.

Once you’ve paid off your auto loan, you own the car and won’t have any more monthly payments. If you take care of your vehicle, it can last for years after you have paid it off, providing you with some significant savings. Then, when you are ready to buy a new vehicle, you can trade yours in or sell it.

Can You Get Auto Financing With Bad Credit?

You can get auto financing with bad credit. While most auto loan lenders require a 550 credit score or better, at MyChoice, we have options available to those with bad credit or no credit history in Canada. Whether you are new to Canada, have had a bankruptcy or repossession in your past, have bad credit—or no credit—we are committed to helping you find an auto loan. We partner with several bad-credit car loan lenders who specifically work with people in these circumstances. While getting a loan with poor credit can be more challenging and result in higher interest rates, it’s not impossible.

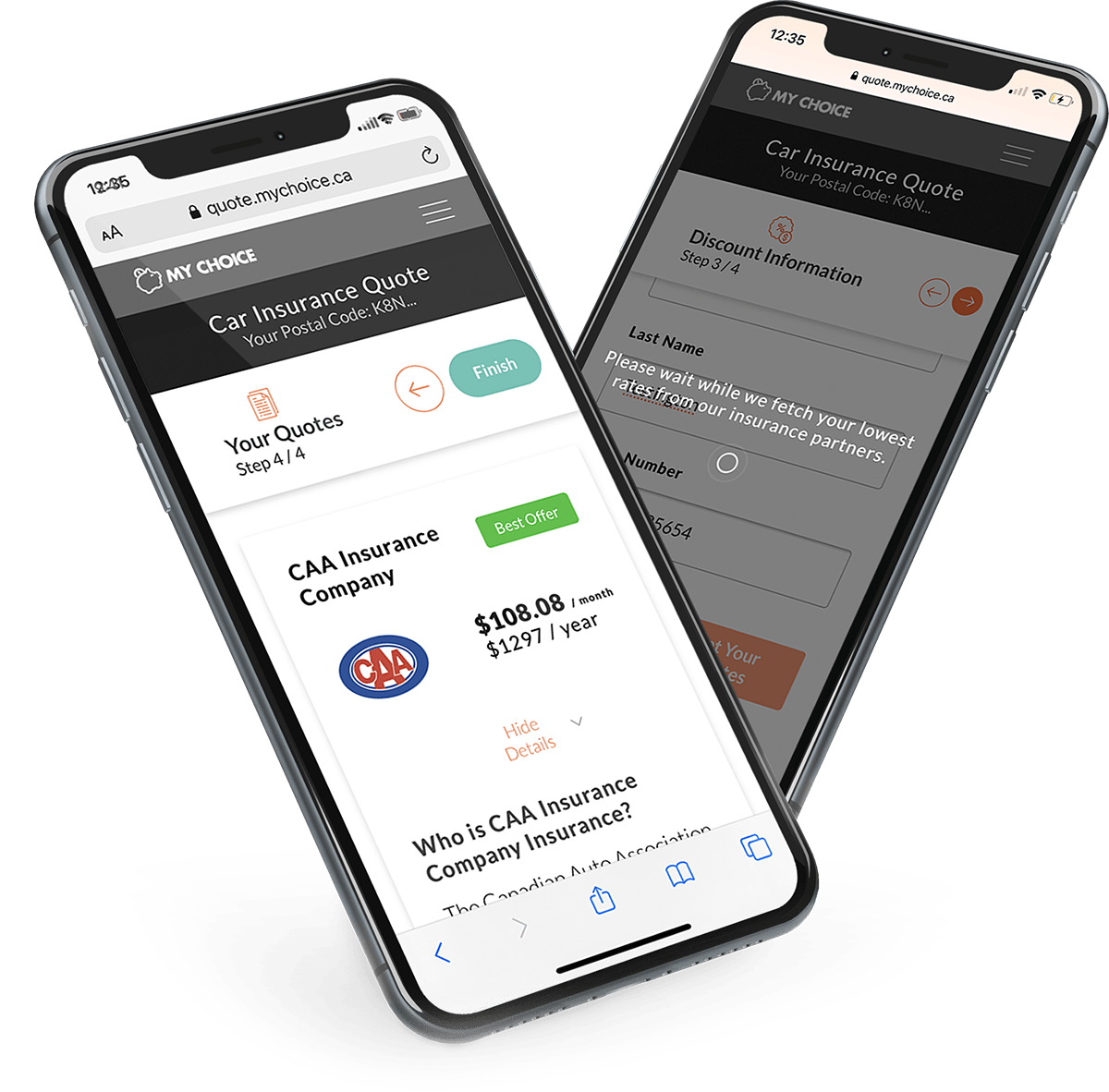

How to Apply for a Car Loan Online

It’s never been easier to apply online for car loans. At MyChoice, we take the guesswork out of auto loans with our secure, quick, and easy application process. We keep all entered information encrypted and secure for your safety. Once you fill out the application, we’ll show you a list of options from Canada’s top auto loan lenders so you can compare rates and terms to find the best option for you.

For reference, common loan terms range from 24 to 84 months, with the most common being 69 months for a new car and 65 months for a used car. On average, Canadian auto loan interest rates average 4.5-6% for those with good credit and 7-20% for bad-credit auto loans.

To secure an auto loan, you will need a valid driver’s license, proof of income, and proof of Canadian residency. Depending on the lender, you may also need to supply information about monthly expenses and any other debts you may have. If you’re ready to start the process, fill out the application, and see what kind of auto loan you may be eligible for in minutes.