Quote data from MyChoice.ca, November 2025

Windsor Tenant Insurance Overview

Rental properties are very popular in Windsor, reflected by its record-low vacancy rate in 2022. People often live in rentals due to the flexibility and relative affordability compared to buying a home. Another perk of living in a rental is that the landlord is responsible for building maintenance.

But one caveat about living in a rental property is that your landlord’s home insurance doesn’t extend to your belongings. If your rental home is damaged by fire, earthquake, or other perils, you’ll need lots of money to repair or replace all your things. Fortunately, tenant insurance can foot the bill needed for repairs or replacements.

Lots of companies offer tenant insurance in Windsor, so picking the right one can be challenging. Here, learn more about tenant insurance for renters in Windsor to help you make informed decisions and find the right policy for your needs.

How Much Does Tenant Insurance in Windsor Usually Cost?

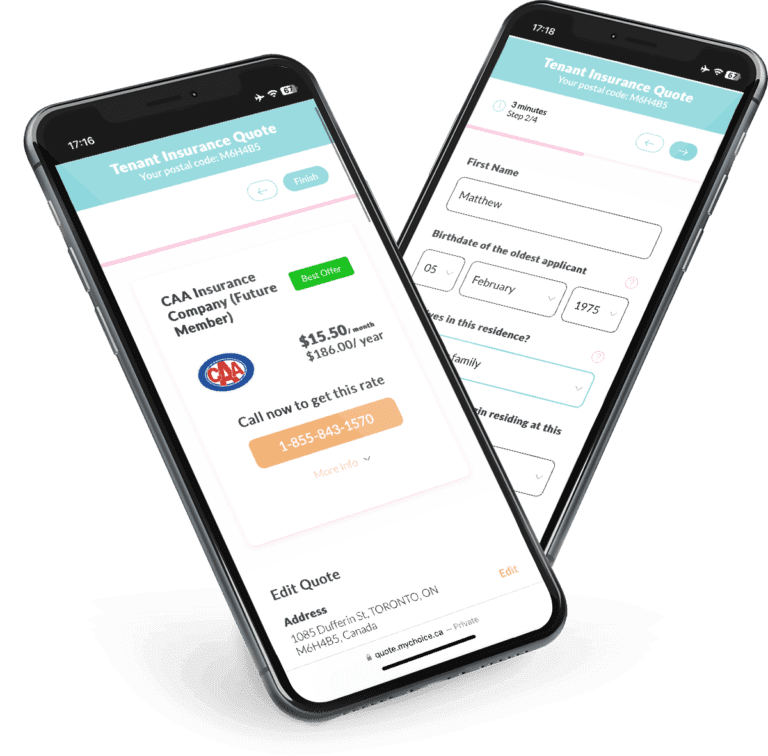

On average, tenant insurance in Windsor costs $312/year, which is more expensive than the Ontario average of $275 per year. Your tenant insurance policy rates may rise or fall depending on the insurance company and multiple other factors. Use MyChoice to compare policy offers and find the one that fits your needs without going over your budget.

Quote data from MyChoice.ca, November 2025

A Snapshot of Windsor Renters

Is Windsor a good place to rent a home? We can turn to the 2021 Census of Population for the answers. Here’s a look at the rental landscape in Windsor.

From the 25% sample data gathered, the census shows that 37.5% of Windsor’s 94.270 residents live in rentals. Apartments are also relatively popular, with duplexes, low-rises, and high-rises making up 28.6% of the city’s total dwellings.

The Canada Mortgage and Housing Corporation’s January 2023 rental report put Windsor’s vacancy rate for purpose-built rentals at 1.8%, a record low.

Meanwhile, rent prices for a two-bedroom home rose by 3.9% to $1,197. Growing demand due to the influx of international migrants and high homeownership prices drove rental prices higher, with vacant units often having much higher rent than occupied ones.

Another challenge to renting for lower-income households is that they need to compete for available apartments with higher-income households.

Average Monthly Rent in Windsor

Below are average monthly rent prices in Windsor, categorized by apartment type.

| Apartment Type | Average Monthly Rent |

|---|---|

| Bachelor | $856 |

| 1 Bedroom | $1,055 |

| 2 Bedroom | $1,246 |

| 3 Bedroom + | $1,334 |

Windsor Rent Price Over The Years

Rent prices in Windsor have steadily increased from 2018 to 2023 across most apartment types. Bachelor apartments increased by 42.7% from $600 in 2018 to $856 in 2023, while one-bedroom apartments rose 36.8%, reaching $1,055 in 2023.

Windsor Vacancy Rate Over the Years

Bachelor apartments in Windsor experienced a notable decrease in vacancy rates, from 5.9% in 2018 to 2.4% in 2023, a 59.3% decrease.

Windsor Population Growth

Windsor’s population increased steadily from 217,188 to 229,660 people between 2016 and 2021, a 5.7% increase over the 5-year period.

What Is Not Included in a Typical Windsor Renters Insurance Policy?

Even if you’ve opted for a highly comprehensive tenant insurance policy, there are some risks that insurers explicitly don’t include as a covered peril. These are called “exclusions” by Windsor insurance companies.

Here are the most common tenant insurance exclusions:

Note that a tenant insurance policy doesn’t cover loss or damage to items that aren’t yours, so it won’t cover a roommate’s belongings or your landlord’s possessions. Also, the list above is by no means an exclusive enumeration of risks typically excluded from a tenant insurance policy in Windsor. Talk to your tenant insurance provider to see what’s covered by your policy in case of loss or damage.

How You Can Get Cheap Tenant Insurance in Windsor?

If you’re trying to save money on your tenant insurance coverage in Windsor, visit our Ontario page for a list of practical tips.