Quote data from MyChoice.ca, November 2025

Oshawa Tenant Insurance Overview

While it isn’t the lowest, Oshawa’s average rent is still relatively cheaper than in cities like Toronto and Mississauga. Its rent vacancy rates, while still lower than the provincial average, still signify a competitive rental market. A competitive rental market in the city means people are still interested in renting homes.

One major benefit of renting a home is that your landlord handles property maintenance. If your rental home is damaged in a disaster, you don’t have to pay for anything since the landlord’s home insurance covers the damage. Naturally, this gives you extra peace of mind knowing you won’t spend anything for repairs.

However, a caveat to your landlord’s home insurance is that it doesn’t cover your belongings. If the same disaster damages your belongings, you still need to pay to repair them, which may stretch your finances thin. That’s where tenant insurance comes in.

Tenant insurance offers peace of mind by protecting your belongings from various perils. It covers the repair and replacement costs, so you don’t have to worry if a disaster damages your rental home.

Getting tenant insurance is a good idea, but picking the one that addresses your protection needs can be tough. Discover more about Oshawa tenant insurance and learn how to make informed insurance decisions.

How Much Does Tenant Insurance in Oshawa Usually Cost?

The average cost for tenant insurance in Oshawa is $228/year. It’s about $52 lower than the Ontario average renters insurance rate, which is around $274/year. Broken down, that’s about $19/month for tenant insurance protection.

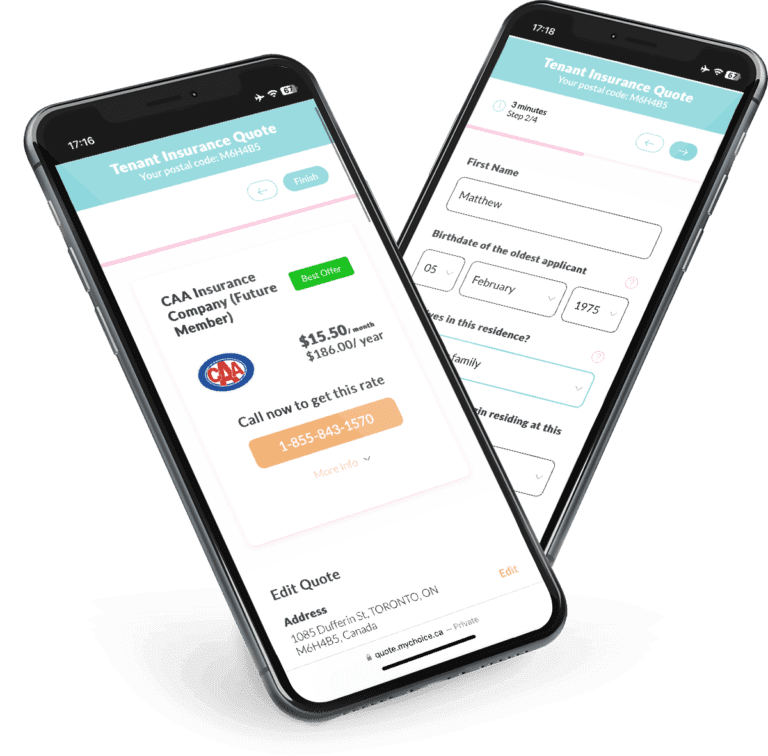

Your actual rate quotes may be higher (or even lower) depending on your chosen insurance company, the type of belongings in the house, and your home’s location, among other factors. Make sure you get the best deals by using MyChoice to compare offers from various insurance companies.

Quote data from MyChoice.ca, November 2025

A Snapshot of Oshawa Renters

What’s it like for renters in Oshawa? Looking at census data helps us understand more about a city’s rental landscape. Here’s a look at how rental properties and renters fare in Oshawa from the 2021 Census of Population.

Out of the 66,630 households surveyed, 35.8% or about one-third of Oshawa’s residents rent their homes. However, only 7.2% of all households live in condominiums.

Apartments are the second-most popular type of dwelling in Oshawa. 26.6% of the city’s households live in duplexes, low-rises, and high-rises.

A June 2023 rental report puts Oshawa in the middle of the most expensive rent rankings, with an average rent of $1,836 for one-bedroom apartments and $2,082 for two-bedroom apartments. Between June 2022 and June 2023, rent for one-bedroom units rose 8.4%, while rent for two-bedroom units rose 9.5%.

While rent vacancy in Oshawa is low, it’s still higher than the provincial average. CMHC data reported that Oshawa has a 2.5% vacancy rate, 0.7% more than the provincial rate of 1.8%.

Average Monthly Rent in Oshawa

According to CMHC, the average monthly rent in Oshawa for a bachelor apartment is $1,041 for a one-bedroom apartment at $1,397 for a two-bedroom apartment at $1,623 and for a three-bedroom or larger apartment at $2,067.

| Apartment Type | Average Monthly Rent |

|---|---|

| Bachelor | $1,041 |

| 1 Bedroom | $1,397 |

| 2 Bedroom | $1,623 |

| 3 Bedroom + | $2,067 |

Oshawa Rent Price Over The Years

Rent prices for 3-bedroom apartments increased substantially from $1,412 in 2018 to $2,067 in 2023, a growth of about 46.4%.

Oshawa Vacancy Rate Over the Years

3-bedroom apartments maintained relatively low vacancy rates, decreasing from 1.9% in 2018 to 1.1% in 2023, suggesting strong demand for larger units.

Oshawa Population Growth

Oshawa’s population increased steadily from 159,458 to 175,383 people between 2016 and 2021, a 10% growth rate across five years. This is high relative to other cities in Ontario

What Is Not Included in a Typical Oshawa Renters Insurance Policy?

Even if you’ve opted for a highly comprehensive tenant insurance policy, there are some risks that insurers explicitly don’t include as a covered peril. These are called “exclusions” by Oshawa insurance companies.

Here are the most common tenant insurance exclusions:

Note that a tenant insurance policy doesn’t cover loss or damage to items that aren’t yours, so it won’t cover a roommate’s belongings or your landlord’s possessions. Also, the list above is by no means an exclusive enumeration of risks typically excluded from a tenant insurance policy in Oshawa. Talk to your tenant insurance provider to see what’s covered by your policy in case of loss or damage.

How You Can Get Cheap Tenant Insurance in Oshawa?

If you’re trying to save money on tenant insurance coverage, compare Oshawa tenant insurance rates with MyChoice, or visit our provincial page for a list of practical tips on how to get cheap tenant insurance.