Quote data from MyChoice.ca, March 2025

Ontario Tenant Insurance Overview

Renting in Ontario can be very convenient because your landlord will have to take care of building maintenance and restoration. However, your landlord’s home insurance policy won’t protect your personal belongings. Getting a tenant insurance policy can help you pay for replacement or repairs in case of risks like accidents or natural disasters.

Learn why you should get tenant insurance, the average cost of tenant insurance in Ontario, and what may affect your quotes. We’ll also walk you through the standard and additional coverages in tenant insurance, as well as where you can get and compare quotes for the most affordable deal.

Is tenant insurance mandatory in Ontario?

No, tenant insurance is not mandatory in Ontario. However, your landlord may require you to get tenant insurance as a condition in your lease agreement. Further, you may want to get tenant insurance anyway to protect your personal belongings in the rented property from loss or damage.

Why Do I Need Tenant Insurance in Ontario?

It’s highly recommended that you get coverage for your rented home. Here are some of the most compelling reasons why you should get Ontario tenant insurance:

How Does Tenant Insurance in Ontario Work?

There are three types of tenant insurance policies that you can buy in Ontario. Here’s a basic overview of each type:

What Is Not Included in a Typical Ontario Renters Insurance Policy?

Even if you’ve opted for a highly comprehensive tenant insurance policy, there are some risks that insurers explicitly don’t include as a covered peril. These are called “exclusions” by Ontario insurance companies.

Here are the most common tenant insurance exclusions:

Note that a tenant insurance policy doesn’t cover loss or damage to items that aren’t yours, so it won’t cover a roommate’s belongings or your landlord’s possessions. Also, the list above is by no means an exclusive enumeration of risks typically excluded from a tenant insurance policy in Ontario. Talk to your tenant insurance provider to see what’s covered by your policy in case of loss or damage.

What Determines The Cost of Renter’s Insurance in Ontario?

The cost of Ontario renter’s insurance will vary based on several factors, such as your location, your past claims history, and your rented property’s internal construction. Here are some of the different considerations which may make your renter’s insurance quotes more or less affordable in Ontario:

How Much Does Ontario Tenant Insurance Usually Cost?

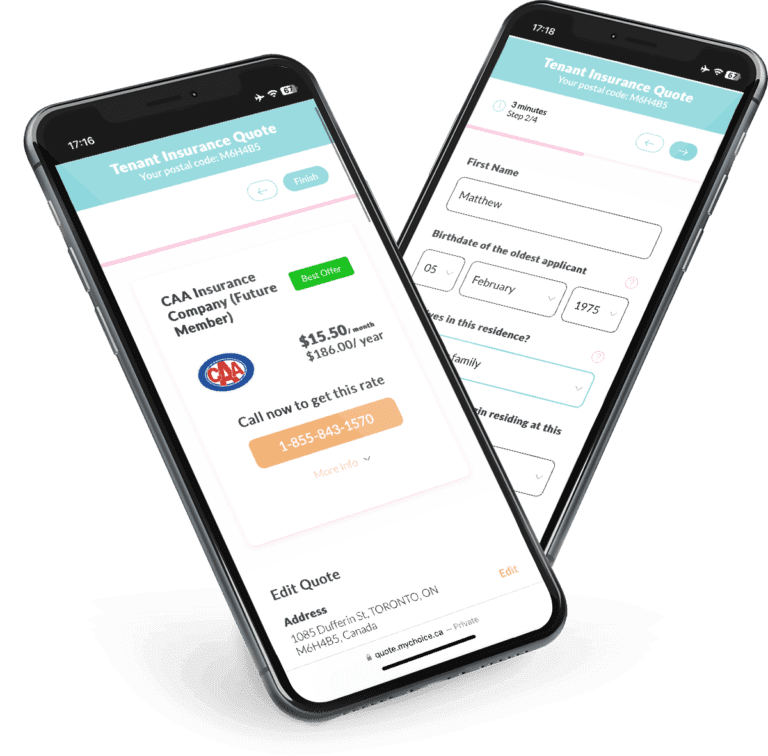

Ontario tenant insurance is quite affordable at an average cost range of $206 to $392 annually, depending on which city you live in. At a cheap range of $15 to $33 per month, you can get an Ontario policy that protects your personal belongings in your rented property from insured perils.

Here’s a list of average rates for tenant insurance in different cities in Ontario. Check to see how much the average is in your city:

| City | Average Rate |

|---|---|

| Barrie | $206 |

| Burlington | $211 |

| Cambridge | $242 |

| Hamilton | $206 |

| Kitchener | $201 |

| London | $209 |

| Markham | $347 |

| Mississauga | $202 |

| Oshawa | $227 |

| St. Catharine’s | $232 |

| Sudbury | $332 |

| Toronto | $216 |

| Vaughan | $294 |

| Windsor | $310 |

Note that while these are the average rates in these cities, your tenant insurance premium in Ontario will be affected by a variety of factors apart from your location. Get a quick quote from MyChoice to compare offers from different insurance companies and get the most affordable deal for your needs.

Quote data from MyChoice.ca, March 2025

A Snapshot of Ontario Renters

Wondering how many people in Ontario rent their homes? Based on the 2021 Census of Population, in the sample size of 5,491,200 private households, 31.4% (1,724,970 households) were renting their homes compared to 68.4% who owned their Ontario homes.

As of May 2023, many Ontario cities have rental rates well above the Canadian nationwide average rate of $2,002 for a one-bedroom property. Toronto has the second-highest rate in Canada, with renters paying an average of $2,526 for a single-bedroom property. Mississauga and Etobicoke rank fourth and fifth highest with asking average rents of $2,260 and $2,239 respectively.

How You Can Get Cheap Tenant Insurance in Ontario

If you’re trying to save money on your preferred tenant insurance coverage, here are some important steps to take:

Who Provides Tenant Insurance Quotes In Ontario

There are different ways that you can get a tenant insurance quote in Ontario. Here are the four providers that you can use or contact for tenant insurance rates:

FAQs About Tenant Insurance in Ontario

Do you need renter’s insurance in Ontario?

Yes, you may need renter’s insurance in Ontario. While tenant insurance isn’t mandatory in Ontario, some landlords may require tenants to get renter’s insurance. You will also need renter’s insurance to protect your possessions and valuables from certain risks like fire or theft, as your landlord’s insurance won’t cover your personal belongings.

Can landlords require renter’s insurance in Ontario?

Yes, landlords can require renter’s insurance in Ontario as a lease condition. While renter’s insurance isn’t legally required, landlords have the right to set certain terms and conditions when renting out their properties, including requiring tenants to have renter’s insurance. Carefully review your lease and talk to your landlord to discuss any insurance requirements.

How quickly can I get renter’s insurance in Ontario?

The timeframe for getting renter’s insurance in Ontario varies between insurance companies and your circumstances. In some cases, you can get renter’s insurance in a matter of hours, especially if your chosen insurer has online platforms or phone services that let you purchase policies directly after giving some personal information.

The timeline for getting renter’s insurance may be affected by factors such as the complexity of your chosen policy, the amount of coverage you need, and other documents or information that your provider may require. Once you’ve chosen your policy and made all required payments, your insurance company will give you policy documents or a certificate of insurance which you can use as proof of your coverage.

What is tenant liability insurance in Ontario?

Tenant liability insurance is a type of insurance in Ontario that covers a tenant’s legal responsibility for accidental damage to the rental property or injuries that happen in the rented property. This covers potential financial losses from costs like repairs, medical bills, and replacements, as well as legal expenses in the event that a tenant is liable.

Some insurance providers provide tenant liability insurance separately from renter’s insurance, as this policy type focuses primarily on covering a tenant’s personal possessions. However, other providers may offer tenant liability coverage as part of a comprehensive renter’s insurance policy.

Some Ontario landlords may require tenants to have tenant liability insurance, so check your lease’s fine print and talk to your landlord to see if you’ll need this extra protection.

Do I need tenant insurance in Ontario?

You don’t “need” tenant insurance in Ontario, but you may still choose to get it because it protects your belongings from natural disasters, accidents, or other risks that cause loss or damage. Without tenant insurance, you may find yourself struggling to repair or replace damaged property out of pocket.

What’s the difference between home insurance and tenant insurance in Ontario?

Ontario home insurance typically covers your dwelling, personal belongings, and liability protection in case of loss or damage from insured risks like fire or hail. It also covers additional living expenses in case a covered risk makes your home temporarily uninhabitable.

Tenant insurance, on the other hand, covers a tenant’s personal belongings from risks like fire, theft, or other covered risks while they’re renting a property in Ontario. It also has liability protection known as tenant liability coverage in case someone gets injured in the rented property or the rental property is accidentally damaged.

Tenant insurance doesn’t cover repairs or replacements to the actual building or unit owned by your landlord. Instead, the landlord takes responsibility for these issues. Further, you won’t need home insurance if you’re renting your home.