Quote data from MyChoice.ca, March 2025

Oakville Tenant Insurance Overview

A January 2023 report shows that Oakville is one of the most expensive places to rent homes in Canada. Despite high rent, there’s still a sizable renter population in Oakville, which may be attributed to even higher homeownership costs.

A potential reason that people might prefer renting is its convenience. When you rent, the landlord is responsible for maintaining and repairing the property if it’s damaged due to a fire, earthquake, or other perils. However, that doesn’t mean you don’t need to spend anything when disaster strikes.

The landlord’s home insurance only protects the rental property, not its contents. This means you don’t have protection for your belongings unless you have tenant insurance. Tenant insurance foots your repair bills to fix any damages from covered perils. Knowing that your belongings are protected if something happens to them gives you peace of mind.

Many insurers offer tenant insurance, so choosing can be difficult. An understanding of Oakville’s insurance landscape ensures you make informed decisions. Here, learn more about tenant insurance in Oakville.

How Much Does Tenant Insurance in Oakville Usually Cost?

On average, tenant insurance in Oakville is $385/year. That means it’s more expensive than Ontario’s average tenant insurance rate, which is around $272/year. If you break the annual cost down, you’re paying nearly $32 monthly, which is relatively steep compared to many other cities.

Fortunately, $385/year is just the average tenant insurance rate. You may get lower rates depending on your insurer and various factors like your belongings and your rental property’s location. That said, you might also land higher rates than the average. To ensure you find the best tenant insurance deals, compare offers from multiple insurers using MyChoice.

Quote data from MyChoice.ca, March 2025

A Snapshot of Oakville Renters

Examining a town’s rental landscape is a good way to determine whether it’s a good place to rent a home. Here’s an overview of the rental market in Oakville from the 2021 Census of Population.

Of the 73,560 surveyed households, 22.5% rent their homes. This means just under a quarter of Oakville’s residents are renters. About one-fifth of Oakville’s dwellings are apartments in duplexes, low-rises, and high-rises, making up 19.9% of the town’s total dwellings.

In October 2022, the rental vacancy rate in the Halton region, including Oakville, was at 0.5%. This incredibly low vacancy rate usually comes from high demand and low supply. Naturally, this led to price spikes. The average asking price for purpose-built and condo rental apartments in Oakville as of May 2023 is $3,373.

While other factors may come into play, there’s a good chance that high rental rates also come with higher tenant insurance costs. You should be ready to spend a fair bit of money if you’re planning to live in Oakville.

Average Monthly Rent in Oakville

Below are the average rent prices in Oakville categorized by dwelling type:

| Apartment Type | Average Monthly Rent |

|---|---|

| Detached | $4,700 |

| Semi-Detached | $3,950 |

| Townhouse | $3,750 |

| Apartment | $2,600 |

Oakville Rent Price Over The Years

Oakville’s rent prices have been on a steady rise over the years. Back in 2014, you could find a place for around $2,100, but now in 2024, the median rent has shot up to $3,400. This jump reflects the increasing demand for housing in Oakville, which has remained a popular choice for families and professionals alike.

Oakville Vacancy Rate Over the Years

Vacancy rates in Oakville have stayed relatively steady over the years. In 2023, the overall vacancy rate sits at 1.6%, with bachelor units at 1.0% and 1-bedroom units at 1.6%. Oakville’s rental market remains competitive, especially with larger 2 and 3-bedroom units, which have consistently low vacancy rates.

Oakville Population Growth

Oakville’s population grew from 193,832 to 213,759 people between 2016 and 2021, a 10.3% increase over the five years. That’s a pretty high population growth rate relative to other cities in Ontario.

What Is Not Included in a Typical Oakville Renters Insurance Policy?

Even if you’ve opted for a highly comprehensive tenant insurance policy, there are some risks that insurers explicitly don’t include as a covered peril. These are called “exclusions” by Oakville insurance companies.

Here are the most common tenant insurance exclusions:

Note that a tenant insurance policy doesn’t cover loss or damage to items that aren’t yours, so it won’t cover a roommate’s belongings or your landlord’s possessions. Also, the list above is by no means an exclusive enumeration of risks typically excluded from a tenant insurance policy in Oakville. Talk to your tenant insurance provider to see what’s covered by your policy in case of loss or damage.

How You Can Get Cheap Tenant Insurance in Oakville?

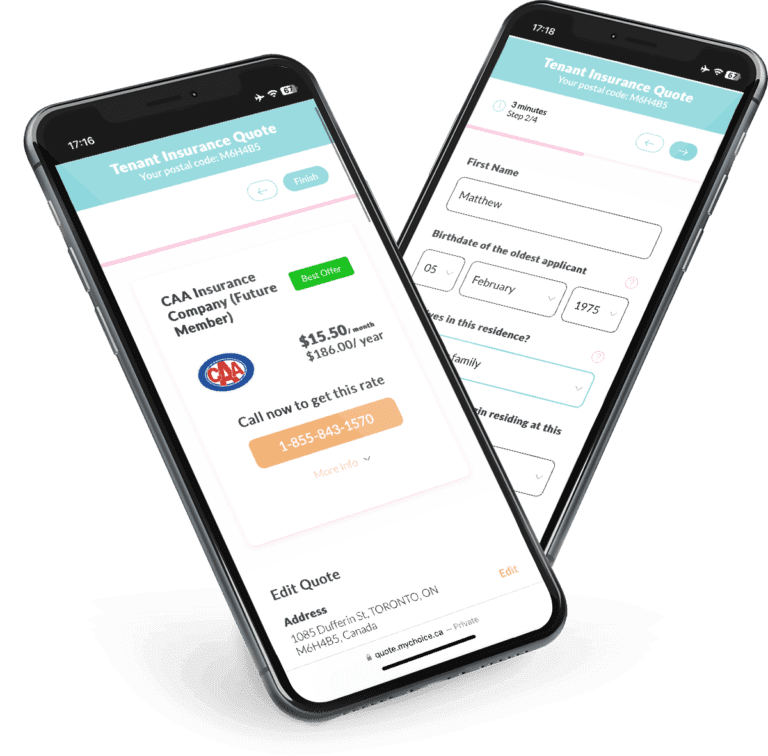

Compare Oakville tenant insurance rates with MyChoice, or go to our provincial page for practical tips on how to get cheap tenant insurance.