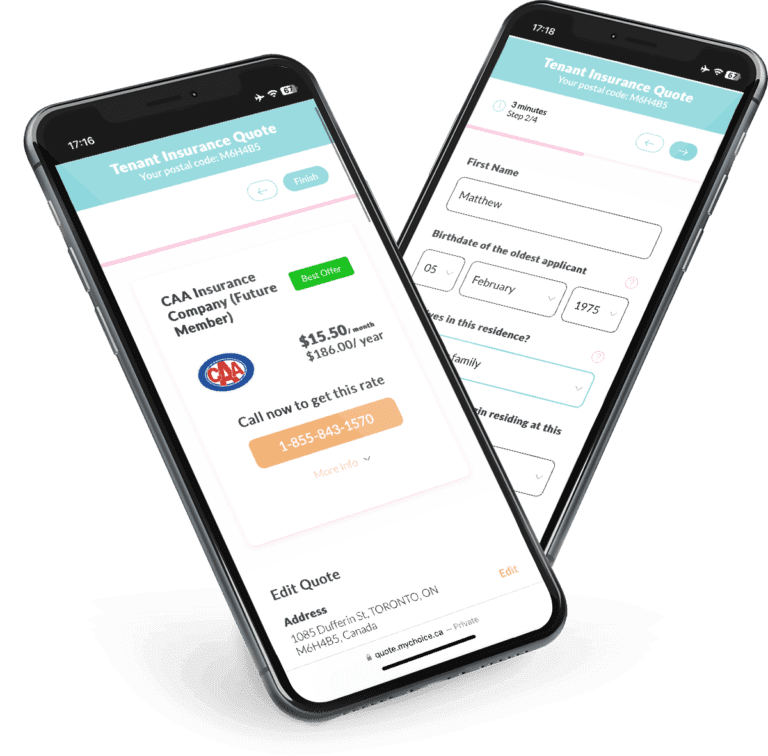

Quote data from MyChoice.ca, March 2025

North York Tenant Insurance Overview

According to a June 2023 national rent report, North York is within the top ten most expensive cities in Canada for rentals. Its rental market is also one of the fastest-growing markets in the country, meaning there’s still a lot of interest in rental properties.

People prefer living in rentals for various reasons, from flexibility to high home prices. One of the most enticing perks of renting a home is that the landlord is responsible for property maintenance. If something gets damaged in a fire, flood, or other perils, you can rest assured since their home insurance will pay for repairs.

However, the landlord’s home insurance policy doesn’t cover your belongings. If they get damaged in the same event, you won’t get coverage from their policy. Fortunately, you can get tenant insurance to protect your things. Tenant insurance can cover repair or replacement costs if various perils damage your belongings.

Tenant insurance isn’t mandatory, but it’s a good idea if you have valuables to protect. Learn more about the ins and outs of tenant insurance for North York renters to ensure you make the right insurance decisions.

How Much Does Tenant Insurance in North York Usually Cost?

On average, the annual cost of tenant insurance in North York is $371 per year, which makes it almost $103 more expensive than the provincial rate, which is around $272 annually. If you break it down into a monthly fee, tenant insurance protection costs around $31/month.

Quote data from MyChoice.ca, March 2025

A Snapshot of North York Renters

Is it a good idea to rent a home in North York? Examining a city’s rental statistics is a good way to learn about its rental landscape. North York is a part of the City of Toronto, so it wasn’t surveyed separately in the 2021 Census of Population. However, we can still look at its statistics in the 2016 City Planning Census.

There’s a good balance between renters and owners in North York, with 46% renters and 54% homeowners.

Apartments are very popular in North York. Out of the 254,240 households surveyed, 48% lived in apartments in buildings over five storeys, while 12% and 3% lived in low-rise apartments and duplexes, respectively.

North York is the eighth-most expensive city for rentals in Canada as of June 2023. The average rent for a one-bedroom apartment is $2,192 (up 18.9% from June 2022), while the average for a two-bedroom apartment is $2,711 (up 15.1% from June 2022).

Rental vacancies are also low in North York, with a January 2022 report giving North York a 2.3% vacancy rate. Low supply and high demand make you more likely to encounter expensive rent.

Average Monthly Rent in North York

Below are the average rent prices in North York categorized by dwelling type:

| Apartment Type | Average Monthly Rent |

|---|---|

| Detached | $3,200 |

| Semi-Detached | $2,550 |

| Townhouse | $3,950 |

| Apartment | $2,700 |

North York Rent Price Over The Years

Over the years, North York has seen its rental prices steadily climb. In 2014, the median rent was around $1,700, while it’s $2,750 at the moment. The market did experience a bit of a slowdown around 2020, likely due to the pandemic, but prices quickly bounced back and have continued to rise. Whether you’re a student, professional, or family – living in North York comes with a higher price tag these days.

North York Vacancy Rate Over the Years

In 2018, the vacancy rate for bachelor apartments was low at 1.0%, spiking to nearly 6% in 2021. 1-bedroom and 2-bedroom apartments followed a similar pattern, with vacancy rates rising sharply in 2020-2021 before dropping back in 2023.

North York Population Growth

The North York population grew from 1,109,909 to 1,173,334 between 2016 and 2021, a 5.71% increase in five years.

What Is Not Included in a Typical North York Renters Insurance Policy?

Even if you’ve opted for a highly comprehensive tenant insurance policy, there are some risks that insurers explicitly don’t include as a covered peril. These are called “exclusions” by North York insurance companies.

Here are the most common tenant insurance exclusions:

Note that a tenant insurance policy doesn’t cover loss or damage to items that aren’t yours, so it won’t cover a roommate’s belongings or your landlord’s possessions. Also, the list above is by no means an exclusive enumeration of risks typically excluded from a tenant insurance policy in North York. Talk to your tenant insurance provider to see what’s covered by your policy in case of loss or damage.

How You Can Get Cheap Tenant Insurance in North York?

Trying to save money on your preferred tenant insurance coverage? Visit our Ontario page for practical tips.