Quote data from MyChoice.ca, March 2025

Mississauga Tenant Insurance Overview

Over a quarter of Mississauga residents choose to rent their homes. Some people like to rent because their landlords take care of building maintenance and repairs.

But your landlord’s home insurance policy won’t protect your personal belongings. This poses a problem because rent in Mississauga is already one of the highest in the country, so you might stretch your finances too thin to cover repair costs if something happens to your home.This is where tenant insurance comes in. Tenant insurance helps pay for replacement and repairs when accidents or natural disasters happen. Learn more about tenant insurance for Mississauga renters, what affects your rates, what it covers, and more.

How Much Does Tenant Insurance in Mississauga Usually Cost?

On average, tenant insurance in Mississauga costs $202/year. This is around $72 cheaper than Ontario’s average renters insurance rate, which is around $272 annually. At roughly $17/month, you can get a policy protecting your personal belongings in Mississauga.

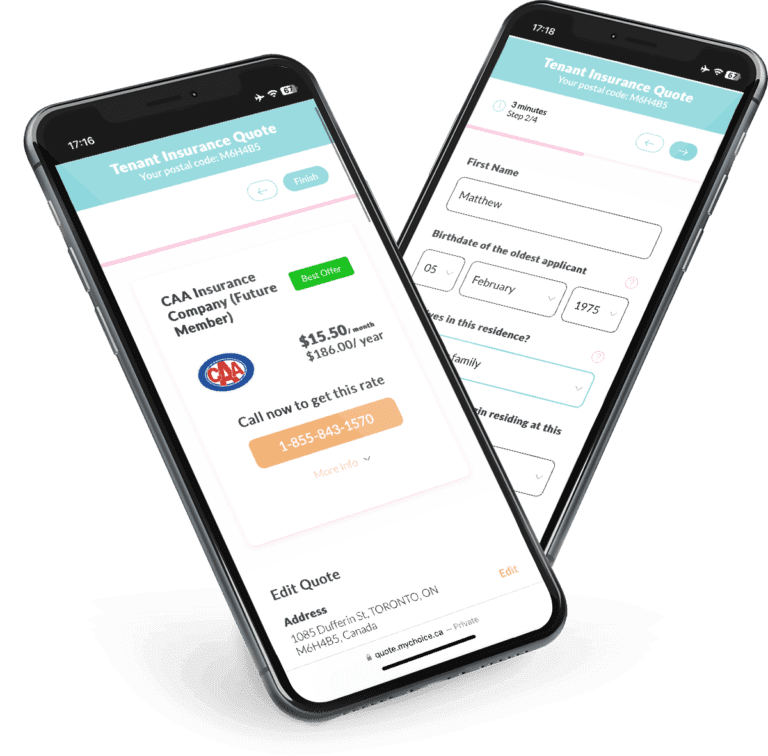

One thing to note is the $202/year mentioned is just the average tenant insurance rate in Mississauga, and your individual quotes may differ depending on many factors. Use MyChoice to compare policy deals from multiple insurers to find the best option.

Quote data from MyChoice.ca, March 2025

A Snapshot of Mississauga Renters

Based on the 25% sample data gathered during the 2021 Census of Population, 72,355 out of 244,575 Mississaugans live in rented properties. Condominiums are also relatively popular in the city, making up 28.2% of Mississauga’s total dwellings.

As of May 2023, rent in Mississauga is considerably more expensive than in other cities. With an average of $2,260/month for a one-bedroom apartment, the city boasts the fourth-highest average rent in the country, around $250 higher than the Canadian average of $2,002/month.

Average Monthly Rent in Mississauga

The average monthly rent for a detached house in Mississauga is around $3,500.

| Apartment Type | Average Monthly Rent |

|---|---|

| Detached | $3,500 |

| Semi-Detached | $3,400 |

| Townhouse | $3,500 |

| Apartment | $2,650 |

Mississauga Rent Price Over The Years

Renting in Mississauga has been getting pricier over the years, with the median rent now sitting at $2,700 in 2024. The market saw a bit of a dip in 2021, likely thanks to the pandemic, but prices have bounced back. Demand is strong, and with fewer available rentals, it’s no surprise that rent keeps climbing. If you’re looking to move to Mississauga, it’s a good idea to budget carefully.

Mississauga Vacancy Rate Over the Years

Below are the vacancy rates in Mississauga since 2018, categorized by apartment type.

Mississauga Population Growth

Mississauga’s population decreased slightly from 721,599 to 717,961 between 2016 and 2021, corresponding to a negative growth rate of roughly -0.5% over the five years.

What Is Not Included in a Typical Mississauga Renters Insurance Policy?

Even if you’ve opted for a highly comprehensive tenant insurance policy, there are some risks that insurers explicitly don’t include as a covered peril. These are called “exclusions” by Mississauga insurance companies.

Here are the most common tenant insurance exclusions:

Note that a tenant insurance policy doesn’t cover loss or damage to items that aren’t yours, so it won’t cover a roommate’s belongings or your landlord’s possessions. Also, the list above is by no means an exclusive enumeration of risks typically excluded from a tenant insurance policy in Mississauga. Talk to your tenant insurance provider to see what’s covered by your policy in case of loss or damage.

How You Can Get Cheap Tenant Insurance in Mississauga?

If you’re trying to save money on tenant insurance in Mississauga, visit our Ontario tenant insurance page for practical tips.