Quote data from MyChoice.ca, March 2025

Kitchener Tenant Insurance Overview

Kitchener, Ontario has a highly competitive rental market, with only a 1.2% vacancy rate for purpose-built rentals and 1.1% vacancies for condominium apartments. This low vacancy rate is due to the popularity of renting in the city, with over 40% of all Kitchenerites choosing to rent their homes instead of owning them.

One of the biggest reasons for doing so is convenience, as renting a property means your landlord is responsible for maintenance and repairs instead of you. However, your landlord’s insurance covers their property and liability in the event of an accident or natural disaster – not your belongings.

Tenant insurance protects your finances, providing renters with a much-needed source of funds to repair or replace damaged or lost belongings. Learn how tenant insurance works, what perils are covered, and how to get the best deals for Kitchener tenant insurance.

How Much Does Tenant Insurance in Kitchener Usually Cost?

The average cost of tenant insurance in Kitchener is $201/year, making it cheaper than the average Ontario rate of $272 annually. Costing just a little over $17 a month, this is a fairly inexpensive way to protect your belongings from loss or damage due to risks like fires, flooding, or earthquakes.

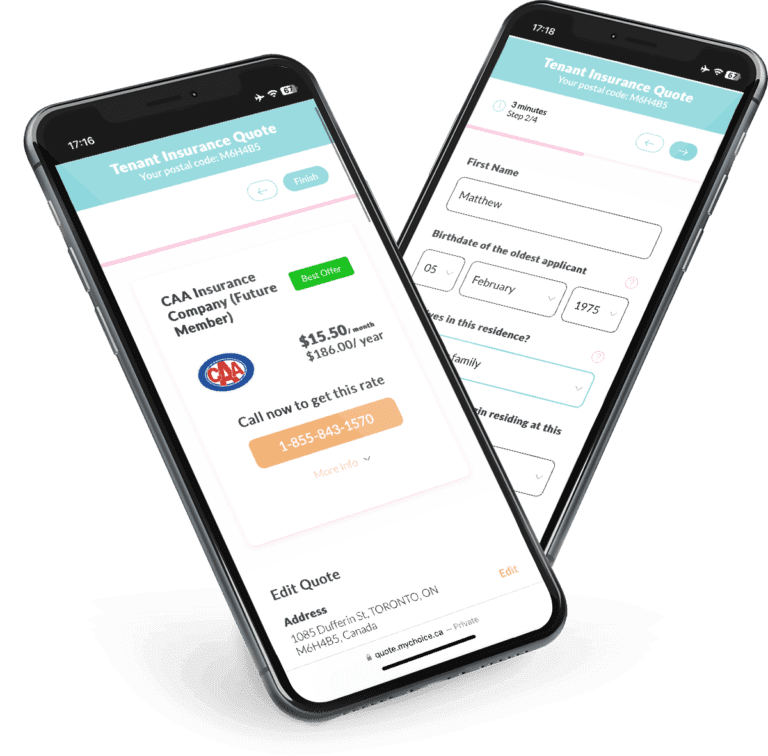

Note that $201/year is just the city’s average tenant insurance rate. Your own quotes may be higher or lower depending on several factors such as the assessed value of your belongings, your preferred coverage limits, and your neighbourhood’s postal code. Use MyChoice to compare premiums from different trusted providers to make the best choice for your needs and budget.

Quote data from MyChoice.ca, March 2025

A Snapshot of Kitchener Renters

Based on the 25% sample data taken by the 2021 Census of Population, most Kitchenerites live in rented homes. From a sample pool of 99,815 residents, 40,235 people (40.3%) were renting property. 14.3% of those surveyed were living in condominiums, compared to 85.7% occupying non-condominium private homes.

The Canada Mortgage and Housing Corporation’s January 2023 rental report showed a highly competitive rental market, with the average cost of renting a two-bedroom home in Kitchener up by 7% to $1,469. However, the report didn’t show the average rent for a two-bedroom condo. The increase in average rent in Kitchener and tighter budgets have resulted in turnover falling from 16.3% to 14.3%.

Kitchener also saw its lowest vacancy rates in 20 years, with a 1.2% vacancy rate on purpose-built rentals and a 1.1% rate on condos.

The low vacancy rates, low turnover, and higher rent can be attributed to the return of students, a resurgence in international migration, and the discouragingly high cost of homeownership. Because of these factors, it’s expected that Kitchener rental prices will continue to rise in the coming years.

Average Monthly Rent in Kitchener

Below is the average monthly rent in Kitchener, categorized by apartment type. The rent price for a one-bedroom apartment in Kitchener is $1,342, a little under the provincial average of $1,480.

| Apartment Type | Average Monthly Rent |

|---|---|

| Bachelor | $1,157 |

| 1 Bedroom | $1,342 |

| 2 Bedroom | $1,637 |

| 3 Bedroom + | $1,935 |

Kitchener Rent Price Over The Years

The rent for 3-bedroom apartments saw the highest increase, from $1,250 in 2018 to $1,935 in 2023, a 54.8% increase.

Kitchener Vacancy Rate Over the Years

The vacancy rates for bachelor apartments fluctuated over the past 6 years, starting at 2.4% in 2018, peaking at 3.5% in 2021, and ending at 2.9% in 2023.

Kitchener Population Growth

Kitchener’s population grew from 232,222 to 256,885 in 5 years since 2016, a whopping 10.62% increase. This is a high growth rate relative to other Ontario cities.

What Is Not Included in a Typical Kitchener Renters Insurance Policy?

Even if you’ve opted for a highly comprehensive tenant insurance policy, there are some risks that insurers explicitly don’t include as a covered peril. These are called “exclusions” by Kitchener insurance companies.

Here are the most common tenant insurance exclusions:

Note that a tenant insurance policy doesn’t cover loss or damage to items that aren’t yours, so it won’t cover a roommate’s belongings or your landlord’s possessions. Also, the list above is by no means an exclusive enumeration of risks typically excluded from a tenant insurance policy in Kitchener. Talk to your tenant insurance provider to see what’s covered by your policy in case of loss or damage.

How You Can Get Cheap Tenant Insurance in Kitchener?

If you’re trying to save money on tenant insurance coverage, compare insurance rates with MyChoice, or visit our Ontario page for practical tips.