Quote data from MyChoice.ca, January 2026

Kingston Tenant Insurance Overview

Kingston had the second-lowest rental vacancy rate in Ontario in 2021 and 2022. This shows that rental properties are highly popular in the city and that many of Kingston’s residents choose to rent instead of buying a home. There are many reasons to rent a home, from relative affordability to the flexibility to move out whenever you want.

Another major perk of renting your home is that the landlord is responsible for repairs and maintenance. However, they’re not responsible for damage to your belongings, which is where tenant insurance comes in. A tenant insurance policy can foot the bill if perils like fire and earthquakes damage your things.

Tenant insurance can give you peace of mind, but choosing the right policy can be confusing due to all the choices. Learn the ins and outs of tenant insurance for Kingston renters to ensure you make informed decisions and pick the policy that best suits your needs.

How Much Does Tenant Insurance in Kingston Usually Cost?

Kingston tenant insurance can cost as low as $10/month, which translates to $124/year. At its lowest, Kingston tenant insurance is much cheaper than the Ontario average renters insurance rate, which is around $273/year. $10 a month is an incredibly low price for the peace of mind you get knowing your belongings are protected.

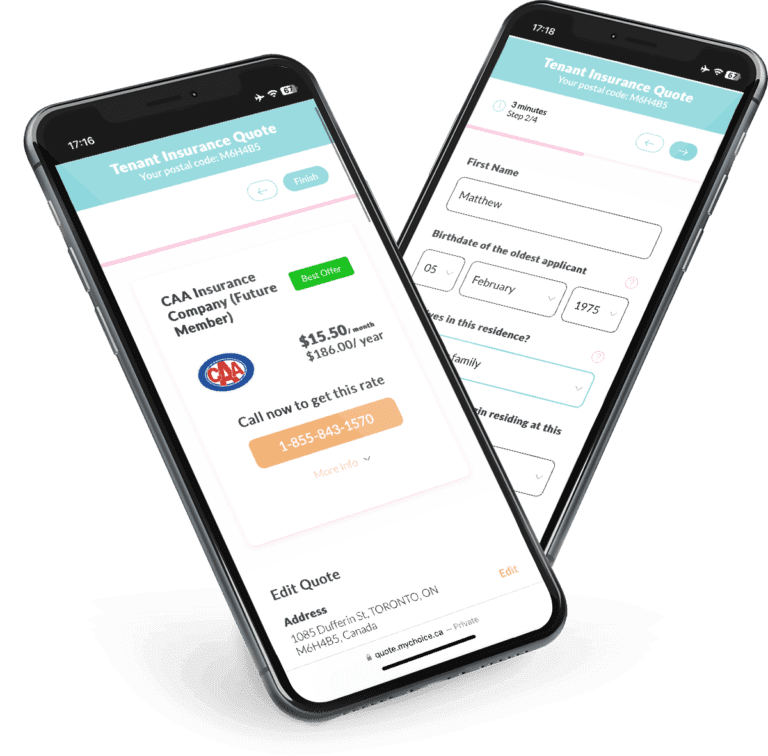

Your tenant insurance can be higher depending on the insurer and many other factors. Use My Choice to compare tenant insurance policy deals and find the one that best fits your insurance needs at a reasonable cost.

Quote data from MyChoice.ca, January 2026

A Snapshot of Kingston Renters

What’s Kingston like for renters? Let’s take a look at the 2021 Census of Population for a snapshot of the rental landscape in Kingston.

Apartments are relatively popular in Kingston, with 37.1% of the 57,840 people surveyed occupying apartments in duplexes, low-rises, and high-rises. There’s also a relative balance between homeowners and renters at 55.8% and 44.2%, respectively.

According to the Canada Mortgage and Housing Corporation’s January 2023 rental report, Kingston had the second-lowest vacancy rate in Ontario for two consecutive years in 2021 and 2022. As of 2022, the vacancy rate for purpose-built rentals in Kingston is 1.2% with a $1,471 average rent for two-bedroom properties.

While the supply of rental properties experienced strong growth with a 2.8% increase in apartment units, affordable rentals are still somewhat limited. A good example of this is the 21.6% rent increase for two-bedroom apartments available for new tenants.

Average Monthly Rent in Kingston

Below are the average rent prices in Kingston, categorized by apartment type.

| Apartment Type | Average Monthly Rent |

|---|---|

| Bachelor | $1,035 |

| 1 Bedroom | $1,331 |

| 2 Bedroom | $1,606 |

| 3 Bedroom + | $2,121 |

Kingston Rent Price Over The Years

The rent for 2-bedroom apartments increased from $1,199 in 2018 to $1,606 in 2023, a 33.9% increase.

Kingston Vacancy Rate Over the Years

The overall decrease in vacancy rates for 1-bedroom apartments in the last few years suggests an increased demand for these types of units.

Kingston Population Growth

The population in Kingston grew from 123,798 to 132,485 in 5 years since 2016, a 7.01% increase.

What Is Not Included in a Typical Kingston Renters Insurance Policy?

Even if you’ve opted for a highly comprehensive tenant insurance policy, there are some risks that insurers explicitly don’t include as a covered peril. These are called “exclusions” by Kingston insurance companies.

Here are the most common tenant insurance exclusions:

Note that a tenant insurance policy doesn’t cover loss or damage to items that aren’t yours, so it won’t cover a roommate’s belongings or your landlord’s possessions. Also, the list above is by no means an exclusive enumeration of risks typically excluded from a tenant insurance policy in Kingston. Talk to your tenant insurance provider to see what’s covered by your policy in case of loss or damage.

How You Can Get Cheap Tenant Insurance in Kingston?

Are you looking to save money on your tenant insurance coverage in Kingston? Visit our provincial page for practical tips on how to get cheap tenant insurance.