Quote data from MyChoice.ca, January 2026

Hamilton Tenant Insurance Overview

Primarily due to the high cost of homeownership, almost half of those who live in Hamilton rent their homes. The rental market is competitive, with a low vacancy rate of 1.7% for purpose-built buildings and just 1.1% for apartments.

Despite the challenges of renting in Hamilton, plenty do. And the main reason for this is that renting can be convenient and affordable. Also, since you don’t own the property, you don’t have to worry about maintenance and repairs, even in the worst-case scenario.

With that said, your landlord’s insurance only extends so far. If your belongings are damaged (or if you damage someone else’s) you’ll be out of pocket.

Fortunately, tenant insurance can help you cover the cost of replacing or repairing your assets and shield you from the financial blow of an insured peril. Learn more about how renters insurance in Hamilton works, what it can do for you, and how you can get the best policy for your budget.

How Much Does Tenant Insurance in Hamilton Usually Cost?

Tenant insurance in Hamilton usually costs $207/year, which translates to monthly premiums of $18. This is lower than the average Ontario rate of $273/year or $23/month. For a pretty affordable rate, you can get a Hamilton tenant policy that protects your personal belongings.

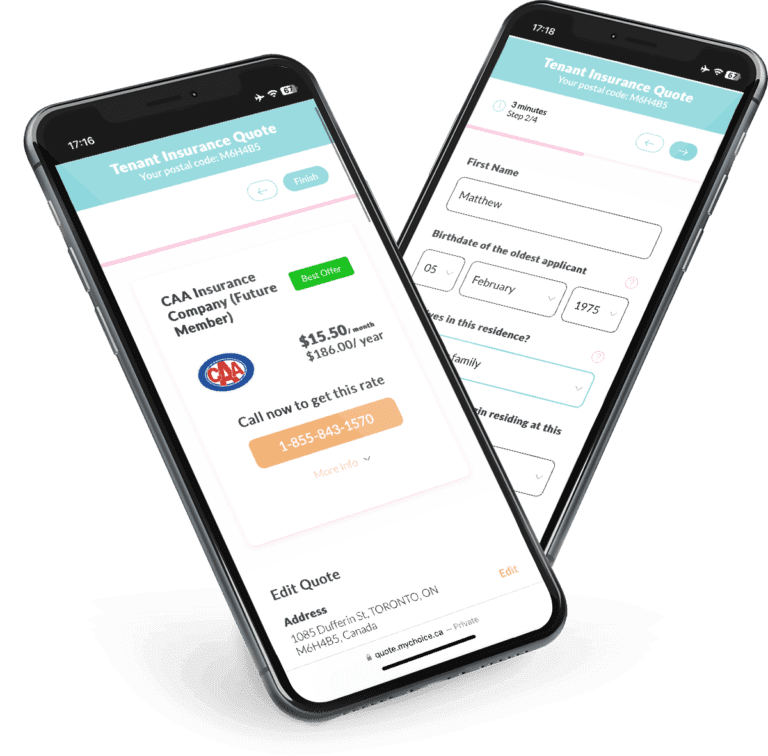

With that said, it’s important to remember that these are just average figures. How much insurers will actually charge you depends on a variety of factors, such as where in Hamilton you live, what kind of dwelling you rent, and what kind of items you need to insure. Get personalized quotes and compare offers with MyChoice to find the best tenant policy in Hamilton for your needs.

Quote data from MyChoice.ca, January 2026

A Snapshot of Hamilton Renters

According to the 2021 Census of Population, almost half (48.1%) of Hamilton residents, translating to 557,970 households, are renters. High-rise apartments are the second-most popular housing structure, comprising a massive 46.7% of all dwellings. The 2023 rental report by the Canada Mortgage and Housing Corporation found that the ratio of completions to rentals for apartments has maintained at around 36%.

The vacancy rate of both purpose-built buildings and apartments both fell in 2023 to 1.7% and 1.1% respectively, despite a record number of apartments being added to the market. Meanwhile, the average rent for two-bedroom homes rose 6.5% to $1,765 while two-bedroom condos cost $2,671.

The CMHC attributes this to an increase in interprovincial migration, post-pandemic rental demand (especially as students return to school), and employment recovery for the youth – a group that accounts for most of the rental households in the GTA.

A lack of supply combined with rising mortgage costs are turning many away from homeownership. As more people rent for longer, we’ll likely see more pressure on the rental market in Hamilton.

Average Monthly Rent in Hamilton

According to CMHC, the average monthly rent in Hamilton varies by apartment type, with bachelor apartments at $1,022 one-bedroom at $1,366 two-bedroom at $1,619 and three-bedroom or larger at $1,698.

| Apartment Type | Average Monthly Rent |

|---|---|

| Bachelor | $1,022 |

| 1 Bedroom | $1,366 |

| 2 Bedroom | $1,619 |

| 3 Bedroom + | $1,698 |

Hamilton Rent Price Over The Years

Hamilton’s rental market has seen a steady increase in prices across all apartment types from 2018 to 2023, with the most significant jumps observed in the one-bedroom and two-bedroom categories, reflecting the growing demand for rental accommodations in the city.

Hamilton Vacancy Rate Over the Years

The Hamilton vacancy rate data from 2018 to 2023 presents an intriguing pattern across various apartment types, with a general trend of decreasing vacancy rates over the given period. This trend is particularly pronounced in the bachelor apartments, where vacancy rates dropped significantly from 7.8% in 2018 to a mere 1.3% in 2023, indicating a tightening market. Similarly, the vacancy rates for one-, two-, and three-bedroom apartments also show a decline, albeit with slight fluctuations.

The consistent decrease across all apartment types suggests a growing demand for rental accommodations in Hamilton, outpacing the available supply. This scenario likely reflects Hamilton’s increasing attractiveness as a residential option, possibly driven by factors such as affordability relative to nearby Toronto and demographic shifts, including the influx of students and young professionals.

Hamilton Population Growth

Hamilton’s population has consistently grown from 624,360 in 1996 to 785,184 in 2021, showcasing a robust and steady demographic expansion over the 25-year period, which has implications for the city’s housing, infrastructure, and services.

What Is Not Included in a Typical Hamilton Renters Insurance Policy?

Even if you’ve opted for a highly comprehensive tenant insurance policy, there are some risks that insurers explicitly don’t include as a covered peril. These are called “exclusions” by Hamilton insurance companies.

Here are the most common tenant insurance exclusions:

Note that a tenant insurance policy doesn’t cover loss or damage to items that aren’t yours, so it won’t cover a roommate’s belongings or your landlord’s possessions. Also, the list above is by no means an exclusive enumeration of risks typically excluded from a tenant insurance policy in Hamilton. Talk to your tenant insurance provider to see what’s covered by your policy in case of loss or damage.

How You Can Get Cheap Tenant Insurance in Hamilton?

Compare Hamilton tenant insurance rates with MyChoice, or simply go to our Ontario tenant insurance page to learn strategies for getting cheap tenant insurance.