Quote data from MyChoice.ca, March 2025

Etobicoke Tenant Insurance Overview

Renting in Etobicoke isn’t cheap. In fact, it’s the fifth most expensive city in the country for rental properties. But the rental vacancy rate for the City of Toronto is still very low, meaning many people prefer to rent instead of buying a home.

Common reasons to rent include expensive homeownership, increased flexibility, and ease of property maintenance. Rental properties are easy to maintain because the landlord is responsible for keeping the home in good shape.

You don’t have to worry if your home catches fire or is hit by a storm, either. The landlord’s home insurance will pay the repair costs. However, you can’t say the same about your belongings since they don’t fall under the policy’s protection.

Fortunately, tenant insurance is here to help. It covers the costs of fixing your things if various hazards damage them. Etobicoke’s rent is already expensive, and you don’t need the extra headache of shelling out money to repair your things.

While it isn’t required, purchasing tenant insurance is a good idea. But there are so many choices on the market, which one is the best? Learn more about tenant insurance in Etobicoke to make educated insurance decisions.

How Much Does Tenant Insurance in Etobicoke Usually Cost?

On average, tenant insurance in Etobicoke costs $371/year, making it about $103 more expensive than the average tenant insurance rate in Ontario which is around $272/year.

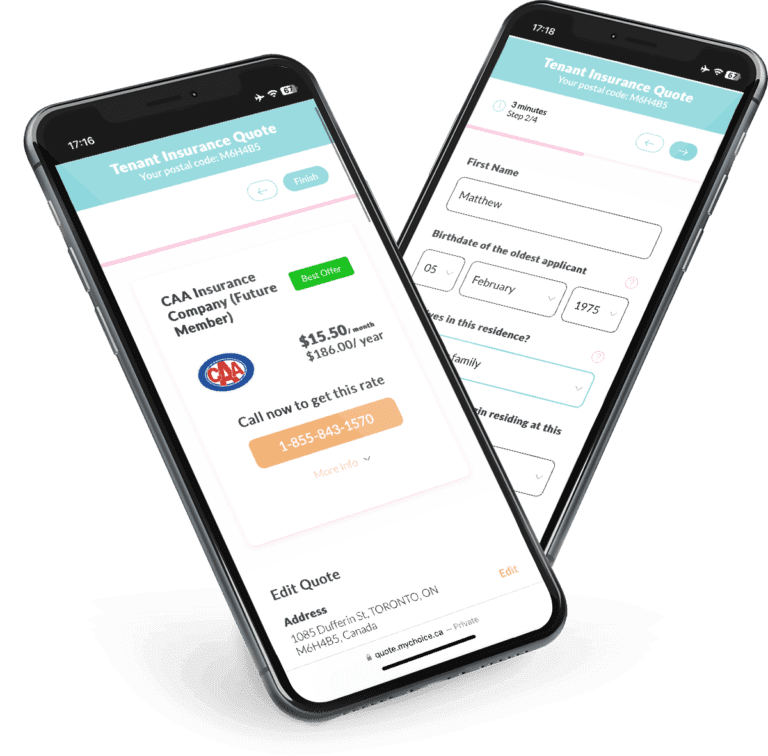

Depending on various factors, your rates can be lower or higher. Common factors influencing rates include your insurer, your belongings, and your rental home’s location. Compare deals from multiple insurance companies with MyChoice to find the best policy that fits your needs and budget.

Quote data from MyChoice.ca, March 2025

A Snapshot of Etobicoke Renters

You can get a good feel of a city’s rental landscape by checking its rent-related statistics. Cities with competitive rental markets usually have a lot of renters and apartment buildings.

Etobicoke is part of the City of Toronto, so there isn’t a dedicated part of the 2021 Census of Population for it. However, we can look at the 2013 data for federal electoral districts, which includes:

The data we present here is a combination of these three districts.

Apartments are the most popular type of dwelling in Etobicoke. Apartment units in duplexes, low-rises, and high-rises together comprise a 57.5% share of total dwellings. In fact, apartments have a roughly 23% larger share than single-detached houses, which have a 34.7% share.

There’s a nearly 60-40 split between homeowners and renters in Etobicoke, with 59.5% of the city’s households being homeowners and 40.5% being renters.

Rent in Etobicoke has been on the rise for the past year. A July 2023 report showed a 12.4% increase in rent for one-bedroom apartments between July 2022 and July 2023, while two-bedroom apartments had a 15.7% rent increase.

With rising rent prices, you may find higher rates for tenant insurance in Etobicoke.

Average Monthly Rent in Etobicoke

Below are the average rent prices in Etobicoke categorized by dwelling type:

| Apartment Type | Average Monthly Rent |

|---|---|

| Detached | $2,825 |

| Semi-Detached | $3,000 |

| Townhouse | $4,100 |

| Apartment | $2,700 |

Etobicoke Rent Price Over The Years

Etobicoke’s rental market has consistently grown since 2015, with the median rent price climbing to $2,700 by 2024. Despite a slight dip in 2021 due to the pandemic, rent prices have largely increased, reflecting strong demand in the area.

Etobicoke Vacancy Rate Over the Years

Vacancy rates in Etobicoke fluctuated significantly over the years. Bachelor apartments saw the sharpest increase, reaching a peak of 4.3% in 2021 before dropping to 2.0% in 2023.

Etobicoke Population Growth

The Etobicoke population has grown a whopping 12.35% in five years since 2016. This is one of the fastest population growth rates in Ontario.

What Is Not Included in a Typical Etobicoke Renters Insurance Policy?

Even if you’ve opted for a highly comprehensive tenant insurance policy, there are some risks that insurers explicitly don’t include as a covered peril. These are called “exclusions” by Etobicoke insurance companies.

Here are the most common tenant insurance exclusions:

Note that a tenant insurance policy doesn’t cover loss or damage to items that aren’t yours, so it won’t cover a roommate’s belongings or your landlord’s possessions. Also, the list above is by no means an exclusive enumeration of risks typically excluded from a tenant insurance policy in Etobicoke. Talk to your tenant insurance provider to see what’s covered by your policy in case of loss or damage.

How You Can Get Cheap Tenant Insurance in Etobicoke?

Compare Etobicoke tenant insurance rates with MyChoice, or visit our Ontario page for practical tips on how to get cheap tenant insurance.