Quote data from MyChoice.ca, March 2025

Burlington Tenant Insurance Overview

Burlington is the fourth-most expensive place to rent a home in Canada, but a quarter of its residents still live in rental properties.

When you rent a home, the landlord is responsible for maintaining the property. That means they’ll pay for repairs if the home is damaged in a fire, earthquake, or other perils. However, there’s a caveat – your landlord’s home insurance only protects the rental property itself and not its contents. If your belongings are damaged in a disaster, you need to repair or replace them yourself.

Fortunately, you can get tenant insurance. A tenant insurance policy foots the repair bill for any of your belongings damaged by covered perils. Rent in Burlington is already expensive, so tenant insurance can prevent you from spending too much in case of disaster.

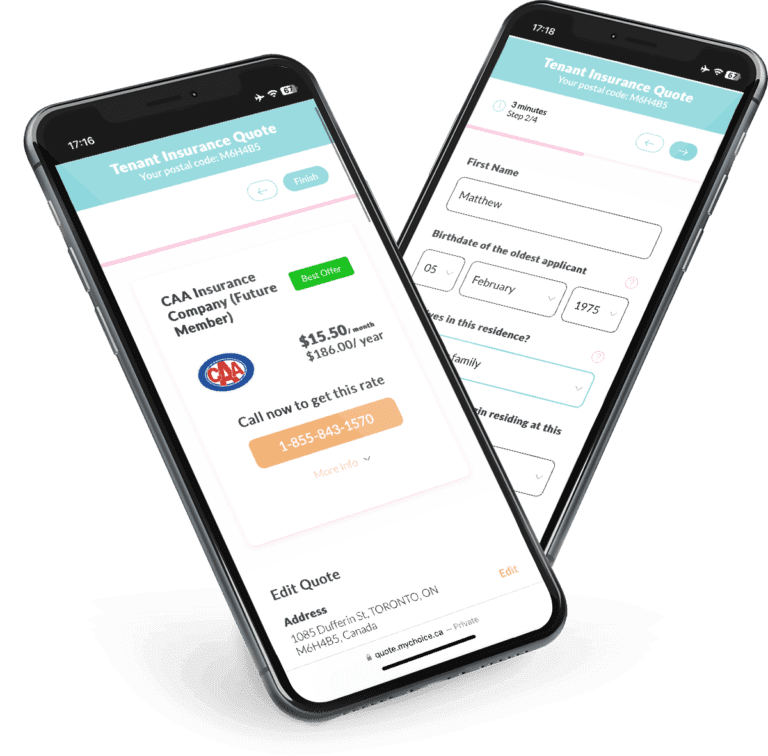

At My Choice, we highly recommend getting tenant insurance, but we also understand choosing the right policy is challenging due to the many options. Here, learn more about tenant insurance for Burlington renters to ensure you make informed decisions regarding your policy.

How Much Does Tenant Insurance in Burlington Usually Cost?

On average, Burlington tenant insurance costs $211/year, if you land the average rate, you only need to pay $18/month to get tenant insurance protection.

However, you should remember that $211/year is the average tenant insurance rate. It can rise or fall depending on the insurer you choose, the items in your house, and where your rental property is located. Compare offers from multiple insurance companies with My Choice to find the best tenant insurance policy that fits your needs and budget.

Quote data from MyChoice.ca, March 2025

A Snapshot of Burlington Renters

What is Burlington’s rental landscape like? Researching the city’s rental landscape gives us insight into the market’s competitiveness. Here’s a look at Burlington renters from the 2021 Census of Population.

Burlington’s renters make up 24.9% of the populace, according to the 25% sample data from the census. The remaining 75.1% are homeowners. These figures are also reflected in Burlington’s dwelling types, with 24.1% of dwellings being condos and 75.9% being non-condos.

About a quarter of dwellings in Burlington are apartments. Duplexes, low-rises, and high-rises together make up 26.6% of the city’s total dwellings, making them the second-most popular dwelling type after single-detached houses.

As of September 2022, Burlington is the fourth-most expensive city for rental properties in Canada. On average, rent for a single-bedroom apartment is $2,133/month, while two-bedroom apartments cost $2,559/month. The price hike was relatively high, with rent prices rising around 16% from September 2021.

Average Monthly Rent in Burlington

Below are the average rent prices in Burlington categorized by dwelling type:

| Apartment Type | Average Monthly Rent |

|---|---|

| Detached | $3,800 |

| Semi-Detached | $3,500 |

| Townhouse | $3,350 |

| Apartment | $2,573 |

Burlington Rent Price Over The Years

Burlington’s rental market has seen a steady rise in median rent prices since 2015. This upward trend reflects growing demand, driven by the city’s desirability and limited housing supply. With the rent price increasing consistently, renters are advised to plan their budgets carefully and explore tenant insurance to protect their belongings.

Burlington Vacancy Rate Over the Years

Vacancy rates in Burlington have experienced a gradual decline since 2018. Bachelor units saw the most significant drop, from a high of 5.6% in 2018 to just 2.5% in 2023. This tightening rental market is a key factor in the rising rent prices across the city.

Burlington Population Growth

The population in Burlington grew from 183,314 people to 186,948 in six years since 2016, a 1.98% overall increase.

What Is Not Included in a Typical Burlington Renters Insurance Policy?

Even if you’ve opted for a highly comprehensive tenant insurance policy, there are some risks that insurers explicitly don’t include as a covered peril. These are called “exclusions” by Burlington insurance companies.

Here are the most common tenant insurance exclusions:

Note that a tenant insurance policy doesn’t cover loss or damage to items that aren’t yours, so it won’t cover a roommate’s belongings or your landlord’s possessions. Also, the list above is by no means an exclusive enumeration of risks typically excluded from a tenant insurance policy in Burlington. Talk to your tenant insurance provider to see what’s covered by your policy in case of loss or damage.

How You Can Get Cheap Tenant Insurance in Burlington?

If you’re trying to save money on tenant insurance in Burlington, visit our provincial page for practical tips.