Quote data from MyChoice.ca, March 2025

Brantford Tenant Insurance Overview

In 2022, Brantford’s rental vacancy rate was lower than the provincial rate. This usually signifies a competitive rental market with high demand and low supply.

Many people prefer renting over buying homes for many reasons. For example, renting is more flexible since you can move out whenever you want. Another common benefit of renting is that the landlord is responsible for property maintenance. When you’re renting, you don’t need to worry about keeping your rented home in good shape since the landlord does that for you.

A landlord’s home insurance policy will even cover damages, so you won’t be charged anything if a fire, earthquake, or other disaster strikes your home. Unfortunately, this protection doesn’t extend to your belongings. You need to purchase tenant insurance to safeguard your items in case of various perils.

Tenant insurance protects you by covering your belongings’ repair or replacement bills when disaster strikes. That way, you don’t need to spend lots of money to fix your things.

Buying tenant insurance can be tough because there are so many options. To ensure you make the right insurance decisions, you need to first learn more about tenant insurance in Brantford. Once you understand the city’s insurance landscape, you’ll be ready to make informed decisions.

How Much Does Tenant Insurance in Brantford Usually Cost?

On average, Brantford tenant insurance is $384/year, which is about $103 more than the average rent for tenant insurance in Ontario. When you break it down, this means you’re paying about $32/month for tenant insurance protection.

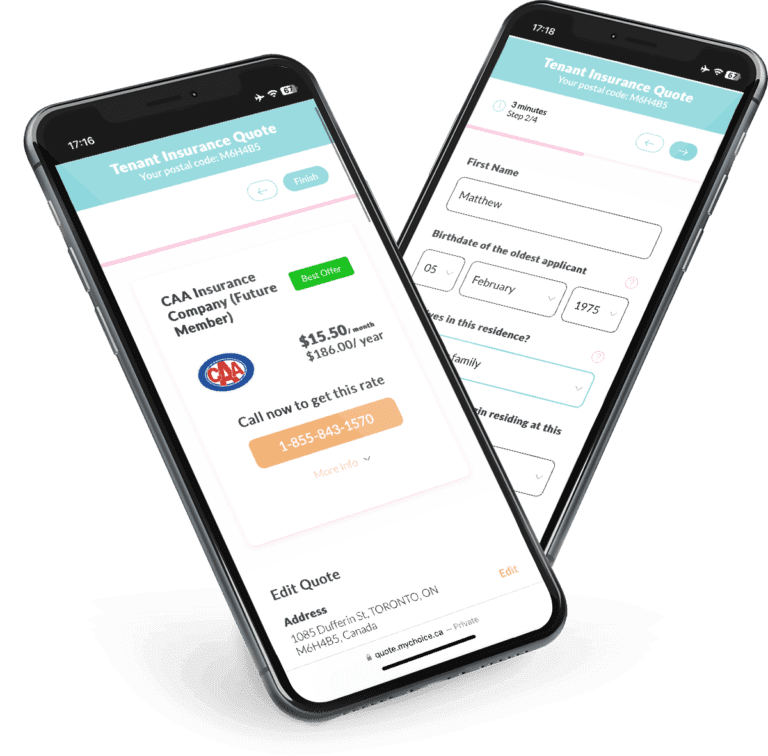

Depending on the insurer you work with, you can land more affordable rates. Many factors influence your tenant insurance quotes, like where you live and what items you have in the house. Use MyChoice to find the best tenant insurance prices and satisfy your insurance needs without going over budget.

Quote data from MyChoice.ca, March 2025

A Snapshot of Brantford Renters

Examining a city’s rental landscape is a good way to understand its market. Cities with higher renter populations tend to be more competitive, with low vacancy rates and high rent. Here’s a look at Brantford renters from the 2021 Census of Population.

Renters make up roughly one-third of Brantford’s residents. Of the 41,675 households surveyed, 34% rent their homes.

Apartments are relatively popular in the city, with 25% of Brantford’s households living in duplexes, low-rises, and high-rises. These three types of apartments combined make them the second-most popular dwelling type in the city.

According to the Canada Mortgage and Housing Corporation’s 2022 report, Brantford has a 1.5% rental vacancy rate. This is slightly lower than Ontario’s provincial vacancy rate of 1.8%. If you’re looking to rent a home in Brantford, you should be prepared for relatively stiff competition.

Average Monthly Rent in Brantford

Below are the average rent prices in Brantford, categorized by apartment type.

| Apartment Type | Average Monthly Rent |

|---|---|

| Bachelor | $984 |

| 1 Bedroom | $1,215 |

| 2 Bedroom | $1,422 |

| 3 Bedroom + | $1,401 |

Brantford Rent Price Over The Years

Bachelor apartments seem to be the hottest cake on the Brantford rental market. The average price for renting a bachelor apartment rose from $677 in 2018 to $984 in 2023, an increase of approximately 45.3%.

Brantford Vacancy Rate Over the Years

Bachelor apartments had a 0.0% vacancy rate in 2021 and 2023. This might be one reason why this apartment experienced one of the highest rent price surges in the last six years.

Brantford Population Growth

The population growth in Brantford was at 6.21% in 5 years since 2016.

What Is Not Included in a Typical Brantford Renters Insurance Policy?

Even if you’ve opted for a highly comprehensive tenant insurance policy, there are some risks that insurers explicitly don’t include as a covered peril. These are called “exclusions” by Brantford insurance companies.

Here are the most common tenant insurance exclusions:

Note that a tenant insurance policy doesn’t cover loss or damage to items that aren’t yours, so it won’t cover a roommate’s belongings or your landlord’s possessions. Also, the list above is by no means an exclusive enumeration of risks typically excluded from a tenant insurance policy in Brantford. Talk to your tenant insurance provider to see what’s covered by your policy in case of loss or damage.

How You Can Get Cheap Tenant Insurance in Brantford?

Compare Brantford tenant insurance rates with MyChoice, or visit our Ontario page for practical tips on how to get cheap tenant insurance.