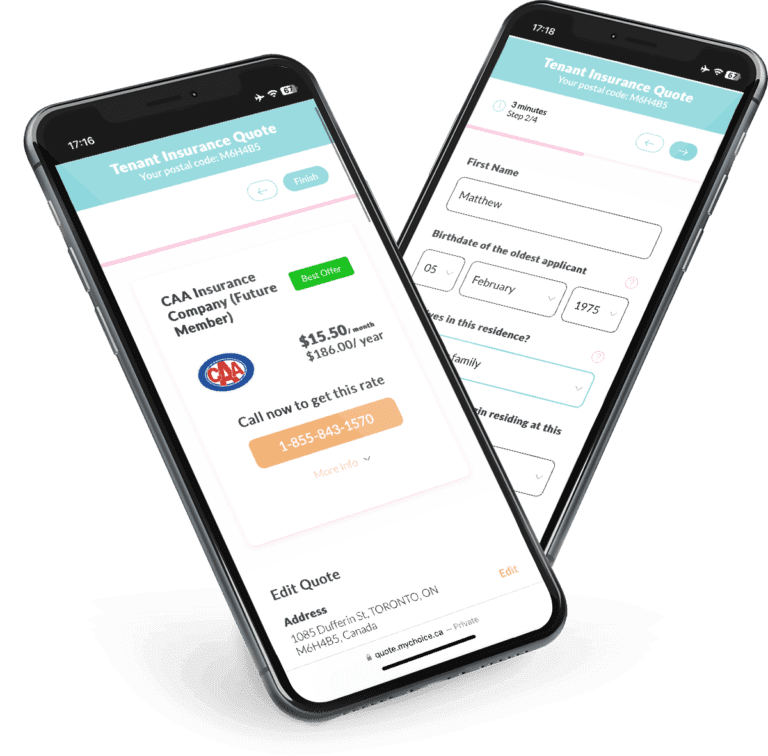

Quote data from MyChoice.ca, March 2025

Belleville Tenant Insurance Overview

The vacancy rate for low-cost apartments in Belleville is very low, at just 0.8%. Unfortunately, that means lower-income households have limited rental property choices due to the high demand and low supply.

Rental properties are generally in high demand due to rising homeownership costs and convenience. Renting a home is convenient because the landlord is responsible for maintenance and repairs. If the home is damaged in a fire, earthquake, or other disaster, their home insurance covers any damages to the building.

One caveat about renting, though – your possessions aren’t included in the landlord’s home insurance policy. So, you’re not compensated for anything if they get damaged in the same incident. That is unless you have tenant insurance.

Tenant insurance provides peace of mind by covering your belongings from damages due to unforeseen incidents. This means you don’t have to shell out money to repair your things when disaster strikes.

Learn how Belleville tenant insurance works, what’s covered in a policy, and more to ensure you make the best insurance decision.

How Much Does Tenant Insurance in Belleville Usually Cost?

On average, the cost of tenant insurance in Belleville is $149/year. Belleville’s average tenant insurance rate is about $124 cheaper than tenant insurance in Ontario, which is around $272/year. At just $12/month, tenant insurance in Belleville is very affordable.

Quote data from MyChoice.ca, March 2025

A Snapshot of Belleville Renters

We can learn more about a city’s rental landscape by looking at census data. In this case, we’re looking at a 25% sample pool taken for the 2021 Census of Population.

Out of the 23,535 households surveyed, 37.5% of them are renters, while 62.5% of them are homeowners. A very small minority of them (7.4%) live in condominiums, while the rest live in non-condo properties.

Single-detached homes are Belleville’s most popular dwelling type, with a 59.4% share of total households. Meanwhile, apartments in buildings under five storeys take second place at 17.6%, followed by apartments in buildings more than five storeys at 9%.

The Canada Mortgage and Housing Corporation’s 2023 report showed that Belleville has a 2.4% vacancy rate and an average rent of $1,295 for purpose-built rentals. The city’s overall vacancy rate rose 0.7% from 2021 due to lower demand.

Despite the relatively high overall vacancy rate, the supply of affordable apartment units can’t keep up with the demand. Apartments costing under $1,000 have a vacancy rate of 0.8%, meaning lower-income households have a harder time finding affordable housing.

Average Monthly Rent in Belleville

Below are the average rent prices in Belleville categorized by apartment types:

| Apartment Type | Average Monthly Rent |

|---|---|

| Bachelor | $953 |

| 1 Bedroom | $1,197 |

| 2 Bedroom | $1,317 |

| 3 Bedroom + | $1,640 |

Belleville Rent Price Over The Years

Since 2018, the average rent has consistently increased across all apartment types (Bachelor, one-bedroom, two-bedroom, and three-bedroom). The 3-bedroom apartments have seen the highest price inflation of 38% in 6 years.

Belleville Vacancy Rate Over the Years

Bachelor apartments in Belleville had a significant spike in vacancy in 2019 (4.8%) but dropped to 0% in 2021. On the contrary, 1-bedroom apartments have had relatively stable vacancy rates since 2018, averaging at around 2-3%. This stability suggests a consistent demand for these units. Tenants should ensure their insurance policies are up-to-date to reflect any minor changes in the rental market.

Belleville Population Growth

The population of Belleville has increased by 8.58% since 2016. That’s relatively high population growth compared to other Ontario cities.

What Is Not Included in a Typical Belleville Renters Insurance Policy?

Even if you’ve opted for a highly comprehensive tenant insurance policy, there are some risks that insurers explicitly don’t include as a covered peril. These are called “exclusions” by Belleville insurance companies.

Here are the most common tenant insurance exclusions:

Note that a tenant insurance policy doesn’t cover loss or damage to items that aren’t yours, so it won’t cover a roommate’s belongings or your landlord’s possessions. Also, the list above is by no means an exclusive enumeration of risks typically excluded from a tenant insurance policy in Belleville. Talk to your tenant insurance provider to see what’s covered by your policy in case of loss or damage.

How You Can Get Cheap Tenant Insurance in Belleville?

If you’re trying to save money on tenant insurance, visit our Ontario page for a list of practical tips.