Quote data from MyChoice.ca, March 2025

Barrie Tenant Insurance Overview

Barrie’s rental market is amongst the 10 most expensive Canadian cities for renting a home. The city only has a 1.9% vacancy rate for two-bedroom purpose-built rentals despite the uptick in immigration and return-to-work plans, resulting in a tighter rental market.

A big reason why Barrie rentals are so popular is convenience. Instead of worrying about maintaining and repairing a home, renters leave these worries in the hands of their landlords. But while landlords take care of property maintenance, they aren’t responsible if your belongings are damaged or destroyed by unforeseen events.

Get tenant insurance to protect your possessions from risks like flooding or theft, as well as cover your liability. Learn why you need tenant insurance, how it works, and what standard inclusions and add-ons you can have in a Barrie tenant insurance policy.

How Much Does Tenant Insurance in Barrie Usually Cost?

The average cost of tenant insurance in Barrie is $206/year. This average rate is much lower than the average cost of Ontario tenant insurance, which is $272 At an estimated $18/month, this is an affordable price for covering your personal possessions in case of unexpected events that result in damage or destruction.

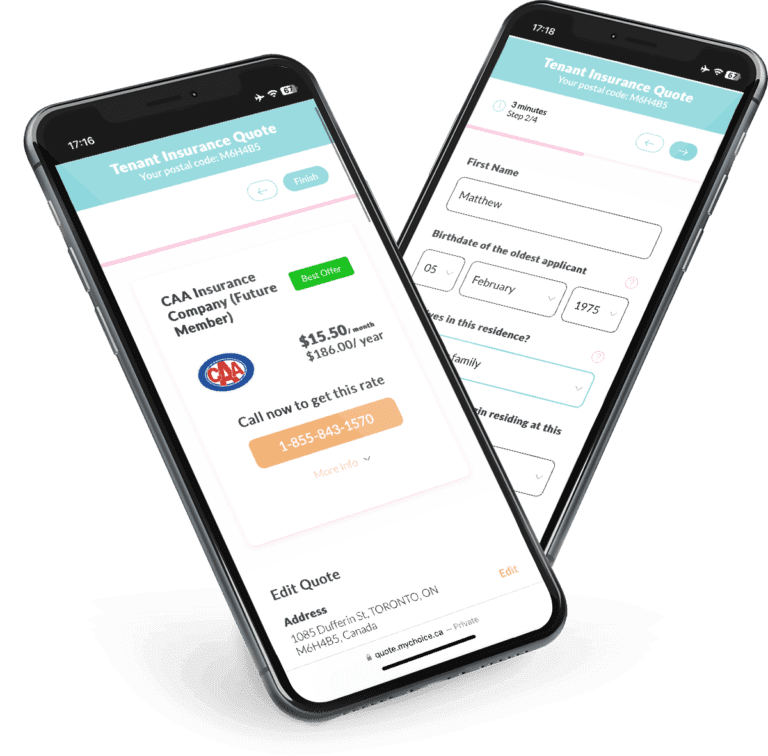

While $206/year is Barrie’s average tenant insurance rate, keep in mind that your own premiums may be cheaper or more expensive due to several considerations. Factors like your credit score, your chosen coverage limits, and your rented property type all affect the cost of your insurance policy. Compare policies and benefits with My Choice to find affordable coverage for your needs.

Quote data from MyChoice.ca, March 2025

A Snapshot of Barrie Renters

According to a 25% sample data pool taken by the 2021 Census of Population, over a third of Barrieites (32.3%) rent their homes instead of owning them. Out of 55,315 households sampled in the city, 17,880 of those surveyed were living in rented homes. However, only 11.6% were living in condominiums, with 88.4% of residents living in non-condominium homes.

In a 2023 Zumper report, Barrie was the seventh most-expensive rental market in Canada, ranked against 23 other Canadian cities. The average price for renting a two-bedroom home in Barrie was estimated to be slightly over $2,000, showing a 14.8% year-on-year increase. Vacancy rates for apartment units went down to 1.6% in 2021 as the average rent for a two-bedroom apartment in Barrie went up by 5.6 %.

The steep cost of homeownership, the low turnover rate for apartments, and the increase in rent in the past two years are all challenges faced by Barrie renters in the past three years. Though the Housing Affordability Task Force has been working on providing more affordable rentals, Barrie rental prices are still expected to go up in the next year.

Average Monthly Rent in Barrie

According to CMHC, the average monthly rent in Barrie for a bachelor apartment is $1,145, for a one-bedroom apartment at $1,427, for a two-bedroom apartment at $1,611, and for a three-bedroom or larger apartment at $1,756.

| Apartment Type | Average Monthly Rent |

|---|---|

| Bachelor | $1,145 |

| 1 Bedroom | $1,427 |

| 2 Bedroom | $1,611 |

| 3 Bedroom + | $1,756 |

Barrie Rent Price Over The Years

Rent prices in Barrie have consistently increased over the past six years indicating a higher demand for renting. The biggest price increase is noticed among the bachelor apartments at a whopping 35% over the last 6 years.

Barrie Vacancy Rate Over the Years

Below are vacant rates in Barrie over the past 6 years, categorized by apartment types. The data highlights trends in apartment availability and potential shifts in rental demand.

Barrie Population Growth

Barrie’s population grew by 4.5% between the years of 2016 and 2021.

What Is Not Included in a Typical Barrie Renters Insurance Policy?

Even if you’ve opted for a highly comprehensive tenant insurance policy, there are some risks that insurers explicitly don’t include as a covered peril. These are called “exclusions” by Barrie insurance companies.

Here are the most common tenant insurance exclusions:

Note that a tenant insurance policy doesn’t cover loss or damage to items that aren’t yours, so it won’t cover a roommate’s belongings or your landlord’s possessions. Also, the list above is by no means an exclusive enumeration of risks typically excluded from a tenant insurance policy in Barrie. Talk to your tenant insurance provider to see what’s covered by your policy in case of loss or damage.

If you’re trying to save money on your preferred tenant insurance coverage, here are some important steps to take:

How You Can Get Cheap Tenant Insurance in Barrie?

Compare Barrie tenant insurance rates with MyChoice, or visit our provincial page for practical tips on getting cheap tenant insurance.