Canada is becoming a nation of renters, with a third of Canadian households renting their primary residence instead of owning it. If you’re one of these households or are planning to rent a home, your landlord may have required you to get tenant insurance as part of your lease agreement. But what does tenant insurance cover, and how can you get the best rates for your property and needs?

Read on to learn about what impacts your quotes, the average tenant insurance premium in different provinces, and how to get cheap renters insurance in Canada.

How Tenant Insurance Works in Canada

Tenant insurance, a.k.a. renters insurance, protects you and your belongings from different risks and covers your liability for accidental property damage or injury. It’s not a legal requirement to rent a home in Canada, but some landlords may include it as a condition in a lease agreement for liability protection.

Renters insurance in Canada covers the following:

It usually doesn’t cover these:

Choose from These Types of Tenant Insurance

There are three types of tenant insurance you can purchase in Canada. Here’s an overview of each:

Average Tenant Insurance Price in Canada by Province

British Columbia and Ontario have some of the highest tenant insurance rates in Canada. Below is the full breakdown of average tenant insurance rates across the country.

| Province | Average Monthly Insurance Premium |

|---|---|

| Ontario | $12-30 |

| Quebec | $12-25 |

| British Columbia | $12-35 |

| Alberta | $12-25 |

| Manitoba | $12-25 |

| Saskatchewan | $12-25 |

| Nova Scotia | $12-25 |

| Newfoundland | $12-25 |

| New Brunswick | $12-25 |

Average Tenant Insurance Price in Canada by City

Below is the average price of tenant insurance for a 1 bedroom condo across major Canadian cities:

| City | Average Monthly Insurance Premium (1-bedroom condo) |

|---|---|

| Toronto | $19 |

| Montreal | $18 |

| Vancouver | $21 |

| Calgary | $20 |

| Winnipeg | $18 |

| Regina | $19 |

| Halifax | $17 |

| St Johns | $18 |

| Moncton | $18 |

What Impacts Your Tenant Insurance Rate

Several considerations can lower or increase your renters insurance quotes, such as property size and type. Keep these in mind when looking for cheap renters insurance, as they can make your premiums much higher or lower:

How to Save Money on Tenant Insurance in Canada

Saving money on tenant insurance requires understanding your coverage needs and personal circumstances, as well as savvy shopping. Here’s what you can do to get cheap tenant insurance in Canada:

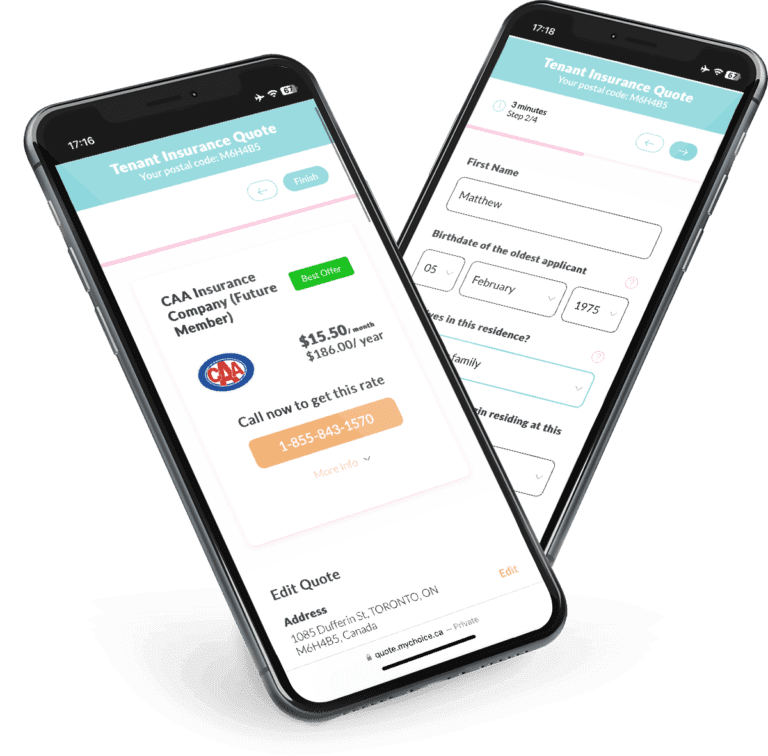

How to Shop for Tenant Insurance with MyChoice

Shopping for tenant insurance from different providers can take up a lot of time and effort. Instead of calling up insurance companies one at a time or browsing different sites, try our easy-to-use tenant insurer quoter.

Just share some basic information like the property type, any past claims in the last few years, and your address to get personalized, free tennant insurance is that it will protect you from liability if your pet hurts another person, animal, or if it damages property.

Tenant Insurance FAQs

Can you transfer tenant insurance between properties?

Yes, you can transfer your tenant insurance in Canada from your old property to another property by updating your insurer about the address change. Note that your rates may change slightly depending on the new property’s risk for natural disasters, crime rate, and other key considerations, so talk to your insurer about any changes to your quotes if you’re planning to move.

Are pets covered by renters insurance?

Pets are partially covered by renters insurance. Renters insurance doesn’t cover pet health insurance or damage caused to your own property by your pets. However, it may cover pet-related liabilities if your pet injures or bites someone or damages their property. Talk to your insurer to learn more about the extent of their coverage for pets.

Does renters insurance cover theft?

es, renters insurance covers theft but has limitations and exclusions. Here are some limits to keep in mind:

– Personal property coverage: This covers property inside and outside your home and may exclude some items like jewelry, electronics, and other high-value items.

– Replacement cost or actual cash value: Insurers will specify if they cover replacement cost value or actual cost value of stolen items. Check your policy’s declarations page to see which applies.

– Roommate theft: Renters insurance doesn’t cover items stolen by a roommate if you share a policy.

Check your policy’s terms and conditions to learn which items are covered and what value will be considered.

Do insurance companies check credit scores for tenant insurance?

Yes, insurance companies will check credit scores for tenant insurance in Canada. This is to assess the risk of insuring you. The better your credit score, the lower your renters insurance quotes.

Does renters insurance cover holes in the wall?

No, renters insurance doesn’t cover holes in the wall. It covers your personal property and your liability if someone accidentally gets hurt in your rented home, or if you accidentally hurt someone or damage their property. Damage to your rented home isn’t included, as this is covered by your landlord’s own insurance policy.

Does renters insurance cover bedbugs?

Renters insurance doesn’t cover bedbugs because they’re considered a maintenance issue that your landlord or property management company should address.

Does renters insurance cover car theft?

No, renters insurance doesn’t cover car theft in Canada. You need auto insurance to cover your car in case of theft or damage. The belongings inside your car, however, may be covered by your tenant insurance – talk to your auto insurer and car insurer to check what each policy covers.

Is renters insurance mandatory?

Renters insurance isn’t mandatory in Canada, but many landlords may opt to include a clause in the lease requiring a tenant to get it.