What Is Whole Life Insurance?

Whole life insurance is a type of life insurance that protects a person until they pass away. Sometimes called permanent life insurance, this type of policy has a guaranteed payout as long as the policyholder stays current on their premiums.

The key difference between whole life insurance and term life insurance is its coverage period. Term life insurance has an expiry date, which can be anywhere between 5 and 30 years. Meanwhile, whole life insurance has no expiry date since it protects you for the rest of your life.

Another feature of whole life insurance is its investment component. Part of your insurance premiums goes to your policy’s cash value, which you can then withdraw or borrow from during your lifetime. If you let your cash value grow, you may be able to add it to your death benefit to give extra money to your loved ones.

How Does Whole Life Insurance Work?

Whole life insurance works by providing coverage from the day protection kicks in up until your passing. When you pass, your beneficiaries can collect the tax-free death benefit to pay for your funeral expenses, settle debts, and replace the income you would’ve provided, among other purposes.

As with other insurance products, you need to pay a premium to keep a whole life policy’s protection active. Since whole life insurance is guaranteed to provide death benefits, its premiums are typically higher than term life insurance. Fortunately, whole life insurance has fixed premiums, which means you won’t see price increases as you age.

Different from term life insurance, premiums in a whole life policy don’t just keep your policy active. Your insurer reinvests part of your premiums to build the policy’s cash value. Once there’s enough money in your cash value component, you can withdraw or borrow against it if you ever need extra cash.

Understanding Cash Value

A whole life policy’s cash value or investment component makes it different from term life insurance. Your policy builds up cash value over time, and eventually, you can use it for multiple purposes.

How do you build your cash value and access the money stored inside? Let’s take a look. We’ll also go over common uses of your whole life policy’s cash value.

Is Whole Life Insurance Worth It?

Whole life insurance is worth it if you’re looking for lifelong insurance protection and don’t mind spending more money to get it. Whole life insurance is especially worth it if you:

What Are the Pros & Cons of Whole Life Insurance?

Each type of insurance product has its unique benefits and drawbacks. To help you determine whether whole life insurance is right for you, here’s a look at its pros and cons:

Pros of Whole Life Insurance

Cons of Whole Life Insurance

Who Can Benefit From Whole Life Insurance?

Naturally, people who need lifelong insurance protection can benefit from whole life insurance. You’ll benefit the most from whole life insurance if you fall into one or more of these categories:

Types of Whole Life Insurance

There are several types of whole life insurance in Canada, each with different features and stipulations. Here’s a look at the types of whole life insurance you can get from Canadian insurers:

What Factors Affect The Cost Of Whole Life Insurance?

Insurance companies determine your premiums by assessing how much risk they’re taking to insure you. The riskier you are to insure, the higher your rates.

Here are several factors that insurers often use to determine your Canadian whole life insurance cost:

Whole Life vs Term Life Insurance

Whole life insurance and term life insurance have their purposes. People who take whole life policies do so to get lifelong insurance protection and invest their money. Meanwhile, people who get term life insurance only require coverage for a limited time and want to save money.

Check out our comparison between whole life insurance and term life insurance to learn which one is best for you.

Whole Life vs Universal Life Insurance

Whole life insurance and universal life insurance provide lifelong coverage, but there are some key differences between them. Universal life insurance policyholders have more control over their cash value investments, which means they can earn or lose more money, depending on market conditions. You can also adjust the death benefit on a universal policy to modify your premiums.

Learn more about the differences between whole life insurance and universal life insurance to help you pick the right policy type.

How Much Does Whole Life Insurance Cost in Canada?

Whole life insurance costs in Canada differ depending on your personal risk factors. That means insurance premiums are tailored to every person, and you’ll get different quotes from every life insurance company.

Since getting generic quotes for whole life insurance isn’t viable, here are some sample insurance quotes taken in July 2023:

| Policyholder profile | Coverage amount | Annual price |

|---|---|---|

| 40-year-old non-smoking female | $150,000 | $1,133 |

| 50-year-old non-smoking male | $300,000 | $4,063 |

| 35-year-old non-smoking male | $500,000 | $3,291 |

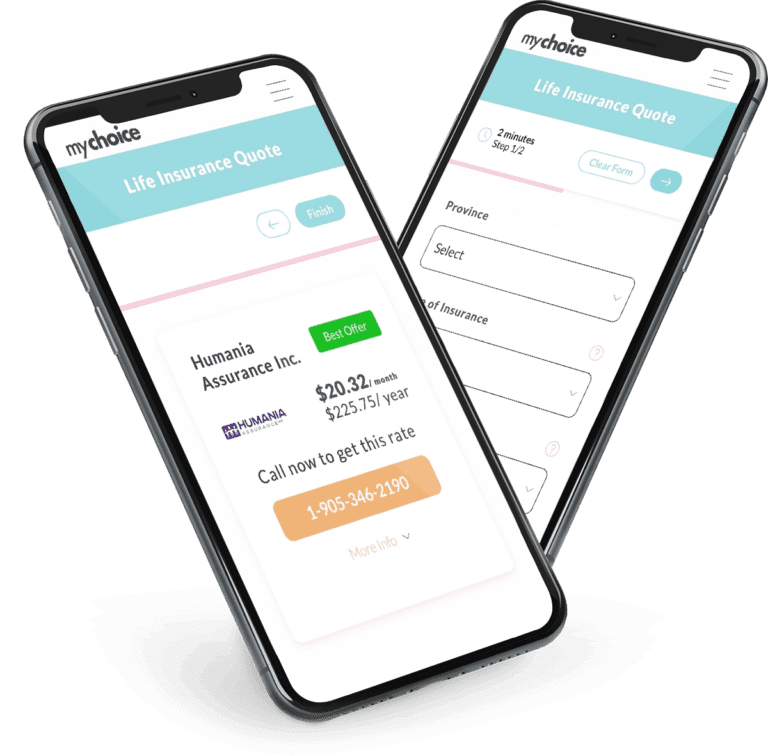

Use MyChoice to compare whole life insurance quotes between insurers and find the best deal for you.

FAQs

Can you convert term life insurance to whole life?

You can convert term life insurance to whole life insurance in Canada. Converting your policy usually means you don’t have to go through a medical exam or re-qualify for a new insurance policy.

How long does it take for whole life insurance to build cash value?

A whole life insurance policy usually takes around 10 to 15 years to accumulate substantial cash value. However, limited pay life insurance policies can build cash value faster because you’re accelerating the payment schedule.

Is whole life insurance tax deductible?

Whole life insurance premium payments aren’t tax-deductible. Your beneficiaries don’t need to pay taxes on your death benefit, either. However, you may need to pay taxes on the money you withdraw from your policy’s cash value.

Check out our guide to the tax implications of life insurance to learn more.

Does whole life insurance expire?

Whole life insurance doesn’t expire as long as you pay your premiums. Whenever you pass away while your policy coverage is active, your beneficiaries will receive the death benefit.

Can I cash in my whole life insurance policy?

You can cash in your whole life insurance policy by surrendering it. You’ll get your entire cash value minus surrender fees, but you’re also relinquishing your death benefit.

If you don’t want to cash in the entire policy, you can instead withdraw money from your cash value or borrow against it.

Is a whole life insurance policy a good investment?

A whole life insurance policy is a good investment if you’re looking for a low-risk, conservative investment vehicle to go along with your insurance coverage. Generally, whole life insurance is a good investment if you’ve maxed out all your other retirement accounts or want to ensure a lifelong dependent will be taken care of in your absence.

Read our article about whether whole life insurance is a good investment to see if it’s right for you.

What is final expense whole life insurance?

Final expense whole life insurance is a whole life policy with smaller death benefits and lower premiums. It’s usually bought by older people to ensure they have enough money to pay final expenses like funeral costs and medical bills.

Can I borrow against a whole life insurance policy?

You can borrow against a whole life insurance policy. Life insurance policy loans are tax-free and have low interest, but you still need to repay the loan. If you don’t repay the loan before passing away, your beneficiaries will receive a smaller death benefit.

Can I cancel my whole life insurance?

You can cancel your whole life insurance if needed. Your options when you want to cancel your whole life insurance policy are:

• Stop paying premiums and use the cash value to cover premium payments until it runs out.

• Convert your policy into a reduced paid-up life insurance policy with a smaller death benefit.

• Surrender the policy and receive its cash value minus surrender fees.

What is a 20-pay whole life policy?

A 20-pay whole life policy is whole life insurance where you pay premiums over 20 years. Once you’ve successfully made 20 years’ worth of payment, you don’t have to pay premiums for the rest of your life. Note that your premium payments are likely higher than regular whole life insurance since you’re compressing decades of payments into a shorter period.

What is a 10-pay whole life policy?

Similar to a 20-pay policy, a 10-pay whole life policy lets you pay off the entire policy in 10 years. 10 years is a relatively short time, so your premium payments may be even higher than 20 pay policies.

How do I find cheap whole life insurance?

Finding cheap whole life insurance is tough, but you can find affordable policies by comparing quotes between insurers. Use MyChoice to browse insurance companies and find the insurance deals that fit your budget and protection needs.