What Is Term Life Insurance?

Term life insurance is a type of life insurance that only provides death benefits if the policyholder dies during its specified term. When the term expires, the policyholder loses insurance coverage. They can either let the policy expire or renew its coverage. Term life insurance is popular among Canadians because it’s one of the most cost-effective life insurance types available.

Here, we dive deeper into what term life insurance is, who needs it, and compare it with other types of life insurance policies. You can also check our pages about universal life insurance and whole life insurance.

How Does Term Life Insurance Work?

Term life insurance works by providing a death benefit if the policyholder dies during its coverage period. A life insurance death benefit is a sum of money paid out to the policyholder’s beneficiaries after they pass away. Death benefits are typically used to replace the income of a lost loved one, settle their debts, and for other purposes.

In most cases, a term policy’s duration is set for a certain period like 20 or 30 years. You can also set your insurance coverage to end when you reach a certain age. Term life insurance coverage is limited to its duration, so your beneficiaries will only receive death benefits if you pass away while still covered.

You choose the policy’s duration and death benefit when you purchase a policy. The insurers will also set your premiums, or insurance costs, based on your health, statistics, and other factors. Generally, premiums are locked in when you finish the insurance purchase and won’t change for the entire term policy duration.

When your coverage term is over, you can simply let the policy expire or renew it with another term policy. Some insurers may allow you to convert your term policy into whole life insurance or universal life insurance.

The Different Types of Term Life Insurance

Coverage duration isn’t the only thing that can vary in a term policy. Each type of term life insurance caters to different needs and has different conditions.

Here’s a rundown of the most common types of term life insurance for Canadians you may find:

Common Term Life Insurance Additions

In addition to your main term life insurance coverage, you can buy extra coverage or riders to round out your insurance protection. Some of these additions can be bought as add-ons to your existing policy, or as separate insurance policies. Check with your insurer to learn which additions fit your risk profile and coverage needs.

Here are examples of common riders you can add to a term life insurance policy in Canada:

How to Choose Your Term Insurance Length

One of the main challenges of getting term life insurance is determining your term length. Getting the most value out of your insurance coverage means finding the right amount of coverage without paying too much on premiums.

To help you decide, here are four elements to consider when determining your term insurance length:

What Are the Pros & Cons of Term Life Insurance?

Every kind of insurance product has its benefits and drawbacks. Here’s a look at the pros and cons of term life insurance:

Pros of Term Life Insurance

Cons of Term Life Insurance

Who Should Consider Term Life Insurance?

People who need insurance protection should consider term life insurance. Generally, you should think about getting term life insurance if you have dependents that rely on you to stay financially stable, or you have debts to repay.

Here are several examples of people who can greatly benefit from a term life insurance policy:

If you’re doubting whether life insurance is right for you, read our article on why life insurance is important.

Do You Need Term or Whole Life Insurance?

You need term life insurance if you want simple, affordable insurance coverage that lasts a limited amount of time. Meanwhile, you need whole life insurance if you’re looking for insurance coverage with an investment component and don’t mind paying extra for it.

Check out our deep dive into the differences between term and whole life insurance to learn more.

What Is Term Life vs Whole Life Insurance?

| Features | Term life insurance | Whole life insurance |

|---|---|---|

| Coverage period | Term life insurance provides a limited coverage period, depending on your chosen term. | Whole life insurance has lifetime coverage, from the start of your policy until you pass away. |

| Coverage needs | Best for limited-time coverage needs, like paying a mortgage or ensuring your family’s financial stability until your children grow up. | Best for lifelong insurance coverage and wealth building. |

| Cash value | No cash value. | Comes with a growing cash value that you can withdraw from or use to increase your death benefit. |

| Death benefit | Fixed death benefit, determined when you purchase the policy. | Variable death benefit that may grow over time if your policy’s cash value grows. A payout is also guaranteed when you pass away. |

| Withdrawals | No withdrawals. | You can withdraw or borrow against the cash value during your lifetime. |

| Cost | Term life insurance is affordable since there’s no cash value component and it isn’t guaranteed to pay out. | Generally more expensive due to the cash value component and guaranteed payout. |

How Much Is Term Life Insurance in Canada?

The cost of term life insurance is influenced by various personalized factors such as the term length, coverage amount and medical status meaning prices will vary.

We have compiled some example term life insurance rates collected in the first half of 2024 here at MyChoice which are listed in the table below. The dollar amounts mentioned are estimated monthly premium costs, with the following policy details:

- A coverage amount of $500,000

- Policyholder is based in Ontario and is a non-smoker.

As you can see the price of term life insurance increases substantially as the policyholder gets older and longer term options will cost more than shorter ones.

| Age | Gender | 10-Year-Term | 20-Year-Term | 30-Year-Term | Avg. Savings w/ MyChoice |

|---|---|---|---|---|---|

| 20-year-old | Male | $20.46 | $26.98 | $31.57 | $2.15 |

| Female | $14.72 | $19.41 | $23.47 | $1.00 | |

| 30-year-old | Male | $21.03 | $27.60 | $40.67 | $2.43 |

| Female | $15.41 | $20.86 | $31.06 | $0.99 | |

| 40-year-old | Male | $26.29 | $42.15 | $79.58 | $4.19 |

| Female | $20.10 | $32.56 | $61.57 | $1.11 | |

| 50-year-old | Male | $55.97 | $107.40 | $211.20 | $13.58 |

| Female | $39.55 | $77.45 | $154.22 | $6.48 | |

| 60-year-old | Male | $156.22 | $320.82 | N/A | $14.23 |

| Female | $108.62 | $241.73 | N/A | $41.77 |

What If Your Term Life Insurance Policy Has Expired and You’re Still Alive?

If you’re still alive when your term life insurance policy expires, your coverage ends. You won’t receive any death benefits, either. You may receive a refund on your premiums if you choose a return of premium policy.

What can you do when you outlive your term life insurance? Generally, you have four options:

- Let your insurance coverage lapse and live without insurance coverage.

- Let your current policy lapse and purchase a new term or whole life insurance policy. This might be more expensive since you’re older and likely have more health issues, making you a bigger risk to insurers.

- If you have renewable term life insurance, renew your policy with your current insurer without any medical exams. However, you may be charged higher premiums after renewal.

- If you have a convertible term life policy, convert your term life coverage into permanent life coverage.

FAQs

What happens when term life insurance expires?

When term life insurance expires, your coverage lapses. You can either let the coverage lapse and go uninsured or renew your protection through multiple means.

Depending on your insurer and the clauses available on your policy, you can renew insurance coverage or turn your term policy into a whole life policy. You can also re-qualify for a new term or whole life insurance policy.

Do you get your money back at the end of a term life policy?

In most cases, you don’t get your money back at the end of a term life policy. However, you can get your premiums back if you have a return of premium clause on your term life insurance policy.

What happens if you outlive your term life policy?

If you outlive your term life policy, your insurance coverage ends. If you have a return of premium clause, you’ll get a refund on your premiums.

Once your term life policy expires, you can either go without insurance or renew your coverage by re-qualifying for a new policy or renewing your existing one.

How to make a claim for term life insurance?

You can make a claim for term life insurance in Canada by contacting the deceased’s insurer and submitting proof of death. From there, the insurer will guide you through the steps until you receive the insurance payout.

Can a senior obtain term life insurance?

Seniors in Canada can still get term life insurance. However, the maximum age for you to purchase term life insurance is 75. If you’re over 75, you can only purchase permanent policies. Term policies also expire when you turn 85.

What is the most popular term life insurance?

The most popular term life insurance in Canada is the 20-year term policy. It’s popular because most parents want to protect their children until they’re self-sufficient, which generally happens once they turn 18. It also helps people with debts to settle them in case they pass away.

Is term life insurance better than whole life?

Term life insurance isn’t necessarily better than whole life insurance. However, term life insurance in Canada is more affordable for people who only need insurance protection for a certain amount of time and don’t need the wealth-building component offered by whole life insurance.

Can I sell my term life insurance policy in Canada?

Depending on where you are and what insurers you use, you can sell your term life insurance policy in Canada. However, it’s harder to sell term life insurance policies since there’s no guarantee that the death benefit gets paid out. It’s generally easier to convert your term policy into a permanent one before selling it to somebody else.

As an alternative to selling your term policy, you can ask the insurer to reduce its coverage amount or just cancel the policy altogether.

How much term life insurance should I buy?

There’s no definitive answer for how much term life insurance you should buy. Everybody has different insurance protection needs, so you should consider all the factors and find the ideal coverage amount and term length for you.

Can I cash in my term life insurance policy?

You can’t cash in your term life insurance policy since there’s no cash value component. In most cases, the only way somebody earns money from a term policy is if the policyholder passes away during its coverage period.

If you want to invest in life insurance, consider buying whole life or universal policies.

Does term life insurance cover accidental death?

Term life insurance in Canada covers accidental death. If needed, you can take an accidental death rider to increase your life insurance payout if you pass away due to an accident.

Does term life insurance cover disability?

Term life insurance doesn’t cover disability. However, you can take disability riders to receive income replacement or premium waivers if you become disabled.

Can I cancel my term life insurance policy?

You can cancel your term life insurance policy by submitting a cancellation form, contacting your insurance provider, or stopping premium payments. Cancelling a term policy is easier because there’s no cash value involved.

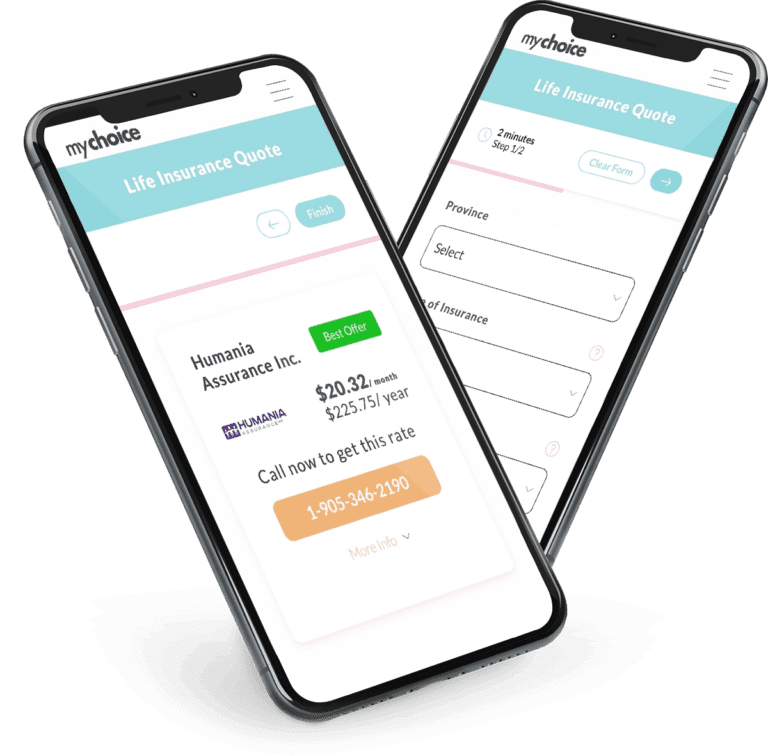

How do I buy term life insurance online?

You can buy term life insurance in Canada online by visiting an insurer’s site. From there, you can navigate to its term life insurance page and follow the listed instructions to get an insurance quote and apply for a policy online.

When do term life insurance policies payout?

Term life insurance policies in Canada payout after the deceased’s beneficiaries file an insurance claim. In most cases, death benefits can be paid out within 30 to 60 days.

Is term life insurance tax-deductible?

Term life insurance premiums aren’t tax-deductible, since they’re classified as personal expenses. Life insurance payouts are similarly tax-free, which means your beneficiaries won’t lose a chunk of the money to taxes. Read our deep dive into the tax implications of life insurance to learn more.