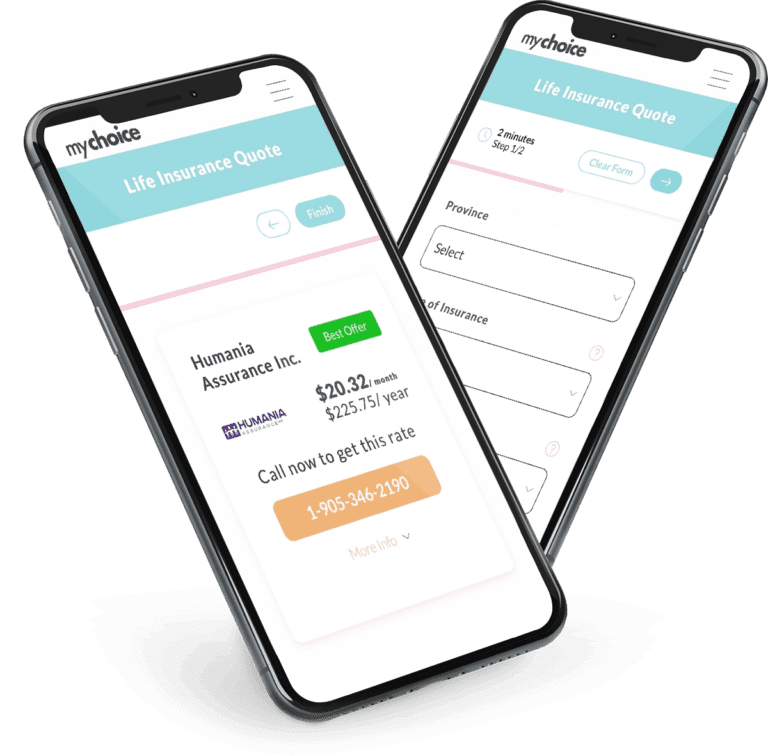

Life insurance can be a safety net for you and your family, helping you provide for their financial security when you’re gone. One of the most significant factors influencing life insurance premiums is age, and understanding how age affects rates for different policy types can help you make informed decisions about your coverage options.

Are there age limits for life insurance? Learn more about life insurance rates by age and what type of life insurance policy you should get, depending on how old you are.

Term 10 Life Insurance Rates by Age

Below are the average monthly life insurance premiums in Canada for 10-year term policies by age and gender.

| Age | Male | Female |

|---|---|---|

| 25-year-old | $20.70 | $12.60 |

| 35-year-old | $20.25 | $14.40 |

| 45-year-old | $33.75 | $23.40 |

| 55-year-old | $81.00 | $61.65 |

| 65-year-old | $253.80 | $181.35 |

As seen in this 10-year term life insurance rates by age chart, premiums increase significantly as individuals age. Notably, males typically pay higher rates than females due to differences in life expectancy.

If you’re in your 20s or 30s, locking in a term 10 policy can be an affordable way to secure coverage while you’re young and healthy. For those approaching their 50s or older, consider evaluating your financial responsibilities and whether a longer-term policy may be more beneficial.

Term 20 Life Insurance Rates by Age

Below are the average monthly life insurance premiums in Canada for 20-year term policies by age and gender.

| Age | Male | Female |

|---|---|---|

| 25-year-old | $27.00 | $19.80 |

| 35-year-old | $28.80 | $22.05 |

| 45-year-old | $63.45 | $48.60 |

| 55-year-old | $161.10 | $115.20 |

| 65-year-old | $505.35 | $349.20 |

As seen in this comparison of 20-year term life insurance rates by age chart in Canada, the trend continues: premiums rise sharply as age increases. Interestingly, the gap between premiums for male and female applicants widens in older age groups.

For those in their late 30s or early 40s, this type of policy could provide a good balance of coverage duration and affordability. If you’re nearing retirement age, consider how your financial obligations will change and whether you still need extensive coverage for your beneficiaries.

Term 30 Life Insurance Rates by Age

Below are the average monthly life insurance premiums in Canada for 30-year term policies by age and gender.

| Age | Male | Female |

|---|---|---|

| 25-year-old | $34.20 | $24.30 |

| 35-year-old | $49.50 | $36.90 |

| 45-year-old | $122.85 | $91.80 |

| 55-year-old | $288.50 | $201.15 |

| 65-year-old | n/a | n/a |

For applicants over the age of 60, securing this type of term life insurance policy can be challenging because of the increased risk factors associated with aging.

If you’re under 40 and have long-term financial commitments like a mortgage or your children’s education, a 30-year term policy can offer extensive protection at a relatively low cost. However, older applicants may need to explore shorter-term options or permanent policies.

Whole Life Insurance Rates by Age

Whole life insurance premiums increase sharply with age but remain fixed once the policy is issued. Below are the average monthly whole life insurance premiums in Canada by age, gender, and payment type.

| Age | Gender | Guaranteed Pay | Guaranteed Pay to 65 | Guaranteed 20 Pay |

|---|---|---|---|---|

| 25-year-old | Male | $209.25 | $264.15 | $366.30 |

| | Female | $176.40 | $217.80 | $319.95 |

| 35-year-old | Male | $322.20 | $442.80 | $540.90 |

| | Female | $276.30 | $385.20 | $475.20 |

| 45-year-old | Male | $522.00 | $825.30 | $812.25 |

| | Female | $436.05 | $734.85 | $677.70 |

| 55-year-old | Male | $830.70 | n/a | $1,232.10 |

| | Female | $663.75 | n/a | $1,031.40 |

| 65-year-old | Male | $1,462.95 | n/a | $1,774.80 |

| | Female | $1,282.95 | n/a | $1,574.10 |

Whole life premiums are significantly higher than term options because of the lifelong coverage and cash value component. It can be a good investment for younger individuals who want to build cash value and have lifelong security, but older applicants should consider whether the high rates align with their financial goals.

Universal Insurance Rates by Age

Universal life insurance offers lifelong protection with flexible payments and a built-in investment component that grows on a tax-deferred basis.

Below are the average monthly whole life insurance premiums in Canada by age, gender, and payment type.

| Age | Gender | Universal Life | Universal Life – 20 Pay | Universal Life – 10 Pay |

|---|---|---|---|---|

| 25-year-old | Male | $181.33 | $369.80 | $685.63 |

| | Female | $155.50 | $289.18 | $528.66 |

| 35-year-old | Male | $278.00 | $496.57 | $936.68 |

| | Female | $241.75 | $415.84 | $776.47 |

| 45-year-old | Male | $452.17 | $808.13 | $1,417.09 |

| | Female | $385.92 | $680.78 | $1,210.06 |

| 55-year-old | Male | $730.08 | $1,150.59 | $1,946.09 |

| | Female | $608.41 | $955.43 | $1,736.90 |

| 65-year-old | Male | $1282.32 | $1,694.81 | $2,725.00 |

| | Female | $1136.05 | $1,519.64 | $2,453.86 |

Universal life insurance can be appealing to younger individuals who want more flexible coverage options. However, as you approach retirement age, consider reassessing your needs and choosing simpler term options, as this policy type gets costly as you age.

How Life Insurance Companies Calculate Your Premiums

Understanding how life insurance companies calculate premiums is essential for anyone considering a policy. Premiums are not a one-size-fits-all cost – they are determined based on various factors that assess the risk associated with insuring an individual.

Insurers use statistical models and actuarial data to evaluate those risks and determine premiums for each applicant accordingly. Here’s a closer look at the key factors that influence life insurance premiums:

What Can You Do to Save Money on Life Insurance?

If you’re reluctant to get coverage because of the cost of life insurance premiums, fret not. Here are some strategies you can try to save money on life insurance:

FAQs

What is the average monthly cost of life insurance in Canada?

The average monthly cost of life insurance will vary greatly depending on the type of policy chosen and other factors such as age, gender, and family history of illnesses. While it typically ranges from $10 to $300, your own quote may differ depending on those factors.

What’s the best age to get life insurance?

The best age to get life insurance is generally around your late twenties or early thirties. This is because at this age, you are likely to have stable employment to help you cover the cost of life insurance. Life insurance premiums also tend to be lower for this age group, as they tend to have better health prospects.

How long should you get life insurance for?

Generally, the length of your life insurance policy should align with covering your financial obligations, such as a mortgage or future college tuition. If you don’t opt for permanent life insurance, you can choose from common term lengths like 10, 20, or 30 years, depending on your individual needs.

Should a 75-year-old have life insurance?

Yes, a 75-year-old should have life insurance. Senior citizens still benefit from life insurance by having a safety net to cover final expenses or provide financial support for loved ones.

Is 60 too old to get life insurance?

No, 60 is not too old to get life insurance. However, options may be limited and may come at higher premiums compared to younger applicants.