Keeping loved ones safe and financially stable is a priority for most people who take out life insurance policies. However, knowing how much life insurance you’ll need in your policy depends on many factors and variables that are unique to each person.

How much life insurance do I need? Do calculators for life insurance make choosing your life insurance policy easier? Read on to find out what factors in your life affect the amount of life insurance you’ll need to take out, and try out our handy life insurance calculator to easily determine the best life insurance amount for you.

How Much Life Insurance Do You Need in Canada?

The average life insurance coverage in Canada per insured household is around $474,000. However, the recommended coverage amount depends on your age, location and financial situation. View our analysis of the life insurance coverage across Canada to see what the recommended coverage for your province is.

Taking out a life insurance policy is a huge factor in keeping your loved ones financially secure in the event of your passing. When you’re thinking about how much life insurance to take out, you need to consider a lot of factors based on your lifestyle and your family’s yearly expenses.

Your life insurance payout is meant to take care of your family’s living expenses by being a replacement for your income. A good target to aim for is a payout that equals 10 times your annual income. This ensures that your family can live comfortably off of your death benefit for the next decade.

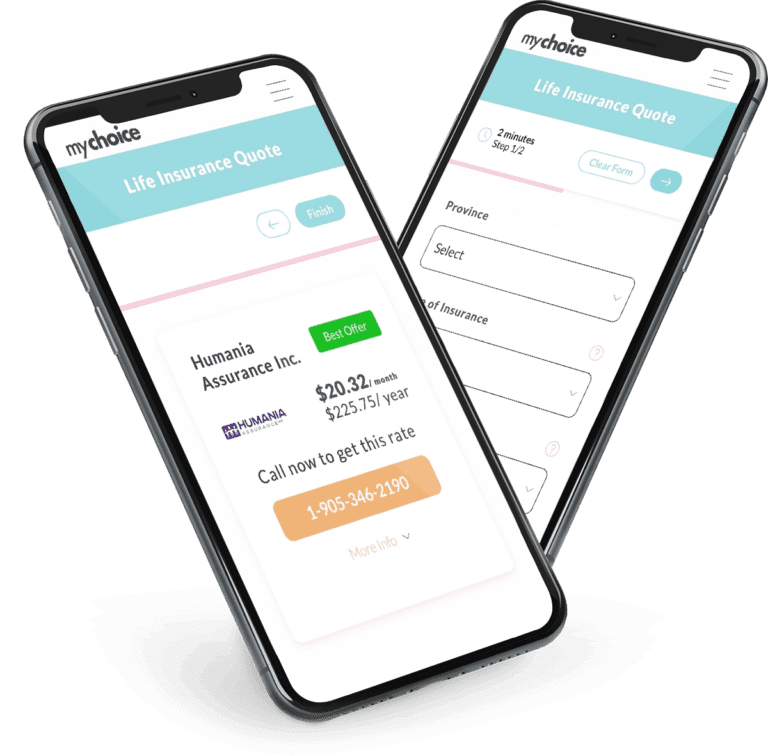

Use MyChoice Life Insurance Calculator

When it comes to computing the amount of life insurance you need, a life insurance calculator for Canada-specific policies and circumstances makes this arduous task easy. We’ve made a life insurance calculator for you to use here that will allow you to quickly and easily compute the amount of life insurance you’ll need, taking into account your specific circumstances and goals.

How to Calculate Your Life Insurance Needs Manually

There are a few key factors to consider when determining how much life insurance coverage you need in Canada:

Taking all of these factors into account, you can calculate the amount of life insurance you’ll need to take out to ensure your loved ones’ comfort and financial security.

Whole Life Insurance vs Term Life Insurance

There are two main types of life insurance policies to choose from: term life insurance and whole life insurance. These have significant differences that will affect which one is right for you.

Term life insurance provides coverage for a set period of time, usually ranging from 10 to 30 years. If the policyholder dies during this term, the insurance company pays out a death benefit to the beneficiaries. Term life is generally the most affordable type of life insurance, with lower premiums compared to whole life. However, term life insurance policies do not accumulate any cash value.

When taking out term life insurance, a policy of between $250,000 and $500,000 might be sufficient, especially if you’re concerned about your budget. With a term policy that lasts 10 years, this amount may be sufficient for the needs of your family, with the option to renew or change your policy after the term expires.

Whole life insurance provides lifelong coverage as long as premiums are paid. In addition to the death benefit, whole life insurance policies also have a savings component that builds cash value over time. This cash value can be accessed through loans or withdrawals during the policyholder’s lifetime. Whole life premiums are significantly higher than term life due to the lifetime coverage and cash value feature.

For whole life insurance, you may want to get a policy that pays out between $750,000 and $1,000,000, since you’re aiming to keep this policy for the rest of your life. This amount will give you peace of mind, knowing that your loved ones will be well taken care of after you pass on, whenever that may be.

Choosing term life insurance is great for when you need affordable coverage for a limited time, such as until your children are financially independent. However, if you want to be covered for life and don’t mind higher premiums, whole life insurance may be the better option.

How to Pick the Right Coverage Amount: Different Scenarios

The amount of life insurance coverage you need depends on your unique financial situation and goals. Let’s look at two different scenarios to illustrate how to calculate the appropriate coverage amount:

Life Insurance Needs by Age

As you progress through the stage of your life, your need for life insurance coverage changes. The more responsibilities and dependents you have, the more life insurance you’ll need to be able to cover them in the event of your passing.

Young adults in their 20s often have fewer financial obligations, making term life insurance an affordable option. Coverage can focus on income replacement for future dependents or student loan debt. A policy of around $250,000 to $500,000 may be sufficient.

When individuals reach their 30s, marriage and children often come into the mix, increasing the need for coverage. Parents should consider policies that cover income replacement, mortgage debt, and future education costs for children. Coverage amounts typically range from $500,000 to $1 million.

As responsibilities rise in a person’s 40s, so does the need for a sizable life insurance policy. Individuals at this stage of their lives may want to ensure their family’s financial stability, covering debts, college expenses, and potential retirement savings. Policies of $1 million or more may be appropriate.

When people reach their 50s, many may have paid off significant debts and their children may be financially independent. Coverage can focus on providing for a spouse or covering final expenses. Policies typically range from $500,000 to $1 million.

In their 60s and beyond, most people will be considering retirement and the planning of their estates. At this stage, many opt for smaller policies, often around $100,000 to $500,000, depending on their financial situation. However, some individuals may choose to take out bigger policies to transfer wealth to their loved ones upon their passing.

What’s the Minimum Amount of Life Insurance You Need?

While the ideal life insurance coverage amount varies based on individual circumstances, there is a minimum level of protection that most experts recommend. At a minimum, you should have enough coverage to cover your final expenses, pay off outstanding debts, and provide short-term income replacement for your loved ones.

For most individuals, a minimum policy of $250,000 to $500,000 should be sufficient to cover these basic needs. However, it’s important to note that this is a bare minimum, and your actual coverage needs may be higher depending on your specific circumstances.

Key Advice from MyChoice

- Most financial experts recommend taking out a life insurance policy that totals 10 years of your income plus enough money to pay off existing debts and cover funeral costs and final expenses.

- Using a whole life insurance calculator or term life insurance calculator can greatly ease the burden of computing the amount you need for your ideal life insurance policy.

- Term life insurance policies are generally cheaper but are only valid for a set amount of time. Whole life insurance policies will cover you for your lifetime, but come with a higher premium.

- Your life insurance needs will change as you progress through the stages of life. Regularly review your life insurance policy as you age and experience changes in your life situation.

Frequently Asked Questions

What Percentage of Your Income Should You Spend on Life Insurance?

Most experts recommend allocating around 10% of your monthly income towards life insurance premiums. This allows for adequate coverage while keeping the financial burden manageable. Those with lower expenses and fewer dependents may be able to allocate more, up to 15-20% of their income.

How Much Life Insurance Does an Average Person in Canada Have?

The average life insurance protection per household in Canada is approximately $474,000 according to the Canadian Life and Health Insurance Association. This amount varies significantly based on individual circumstances, including income, dependents, and financial obligations.

What is the Lowest Amount of Insurance You Can Buy?

The lowest amount of life insurance coverage you can typically purchase in Canada is around $25,000 to $50,000 for term life insurance policies. For whole life insurance policies, this figure is typically around $100,000.