Buying a condo in Toronto, whether it’s for your residence or as an investment property is a good idea. Most condos in Toronto have excellent accessibility to modern amenities for comfortable living, which means it’s more comfortable to live in and more enticing for potential renters. Toronto also has a strong job market, so many people flock to live in the city in hopes of landing promising careers.

In addition to the condo unit itself, condo buildings also offer facilities like swimming pools, gyms, terraces, and other things that make your stay more comfortable. Plus, condos are much easier to maintain than landed homes due to their relatively compact size.

Thanks to healthy economic and population growth, the price of condos in Toronto keeps growing. However, owning a condo means you’re potentially exposed to risks like injuries and property damage. That’s where condo insurance comes in. It can provide you peace of mind and fill the gaps in your condo corporation’s commercial insurance to ensure you’re well-protected.

There’s no one “best” condo insurance policy for everyone. Learning more about condo insurance in Toronto helps you make informed decisions that can maximize your protection.

How Much Does Toronto Condo Insurance Usually Cost?

On average, condo insurance in Toronto costs $324 annually, or about $27 monthly. That said, this average may vary depending on local crime statistics, severe weather events, and many other factors.

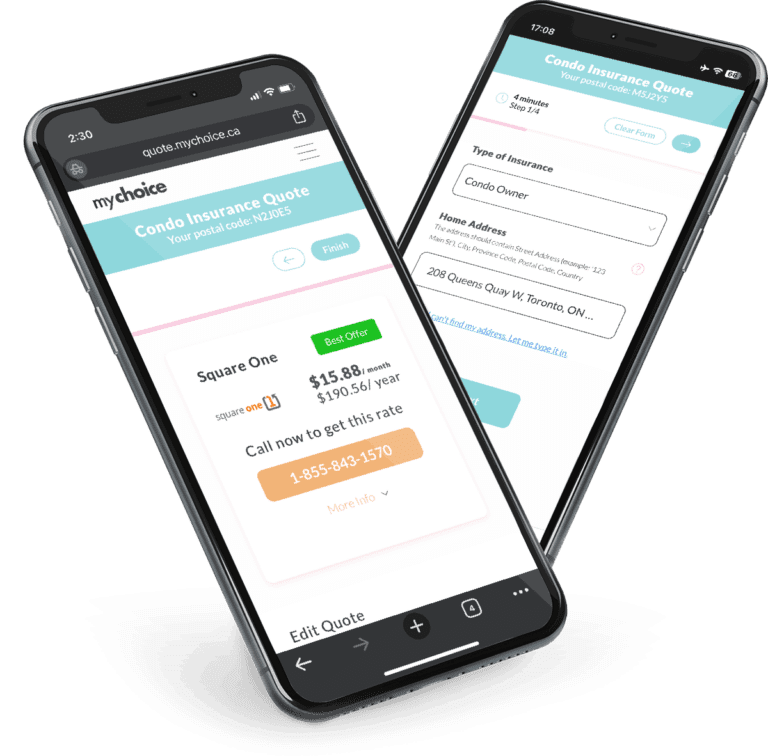

Visit My Choice to compare the costs of condo insurance between insurers in your area. This way, you’ll get a better feel of how much condo insurance will cost you and help you find the best policy for your needs.

What Do Condos Cost to Buy in Toronto?

On average, a condo apartment in Toronto costs $705,572 as of August 2023. A Toronto condo market report from the same month showed that condo apartment prices dropped 0.8% from August 2022, but condo transactions rose by 7%, potentially reflecting another demand surge.

Condo Data in Toronto

According to the 25% sample data taken from the 2021 Census of Population, nearly one-third of Toronto’s 1,160,890 households live in condominiums. 353,215 households or 30.4% of the city’s total households are condo residents, while Toronto’s 807,670 non-condominium residents make up the remaining 69.6%.

557,970 households in Toronto, or about 48.1% – nearly half of the city are renters. This means buying a condo in Toronto to rent out may be a good idea.

Why Do I Need Condo Insurance in Toronto?

You don’t technically “need” condominium insurance in Toronto as it isn’t mandatory. Further, your condo corporation already has commercial condo insurance for the entire building and its common areas. However, it’s a good idea to get it anyway for the following reasons:

How Does Condo Insurance in Toronto Work?

Like home insurance and tenant insurance, Toronto personal condo insurance provides financial coverage in the event of damage or loss to your condo unit, personal possessions, any improvements you’ve made to your condo, and your personal liability.

Note that this type of condo insurance is different from your condo corporation’s insurance, which is also known as a commercial condo insurance policy. Here’s a simple overview of the standard coverages included in personal condo insurance, as well as additional coverage options.

Who Provides Condo Insurance Quotes In Toronto?

There are different ways that you can get a condo insurance quote in Toronto. Here are the four providers that you can use or contact for condo insurance rates:

Who Regulates Condo Matters in Toronto?

Condominium matters in Toronto are regulated by the Condominium Authority of Ontario (CAO). This organization provides services, resources, and training to improve condo living in the province. It also helps resolve disputes in condos to ensure peaceful living.

Additionally, the Condominium Management Regulatory Authority of Ontario (CMRAO) regulates condo managers. This organization licences condo managers to ensure they have the skills needed to oversee daily condominium operations.

What Determines the Cost of Condo Insurance in Toronto?

The cost of condo insurance in Toronto varies depending on several considerations, such as your zip code, your property type, and even your credit score. Here are some of the different cost factors for condo insurance in Toronto:

What Is Not Included in a Typical Toronto Condo Insurance Policy?

The following are typically excluded from Toronto condo insurance policies:

How You Can Get Cheap Condo Insurance in Toronto

If you’re trying to save money on your preferred condo insurance coverage, here are some important steps to take:

FAQs About Condo Insurance in Toronto

Is condo insurance mandatory in Toronto?

Condo insurance isn’t mandatory in Toronto, because it’s not a legal requirement from the government. However, your condo association or lender may still require you to purchase condo insurance. Additionally, protecting your investment through insurance is a good idea regardless.

How much condo insurance do I need in Toronto?

The amount of condo insurance you need in Toronto depends on your living situations. However, a good rule of thumb is that you should at least have enough condo insurance coverage to replace the contents of your unit.

How expensive is condo insurance in Toronto?

On average, condo insurance in Toronto is $234/year or $27/month. That means it’s affordable, especially compared to home insurance.

Does my Toronto condo insurance cover fire damage?

Your Toronto condo insurance does cover fire damage. You need a personal policy to get fire damage protection, since the condo board’s insurance policy only covers the building and its common areas, not individual units.

What does condo insurance in Toronto cover?

A standard condo insurance policy in Toronto covers the following items:

– Additional living expenses

– Contingency protection

– Improvements and betterments to your unit

– Loss assessments

– Personal belongings protection

– Personal liability protection

In addition to the standard coverage, you can buy extra protection like:

– Overland water coverage

– Sewer backup coverage

What does condo insurance in Toronto not cover?

Your Toronto condo insurance won’t cover damages and expenses caused by the following:

– Business activities

– Criminal activities

– Earthquakes

– Failure to maintain the condo unit

– Floods

– Mortgage or property taxes

– Tenant activities

– War and other military hostilities

Note that you can get insurance add-ons to get coverage from things like floods, earthquakes, and damage caused by tenants.