Whether you’re a long-time condo owner or about to purchase one for the first time in Ontario, understanding condo insurance is important to protect your investment. Your condo insurance quotes may be affected by different factors such as your location and common properties, making it challenging to decide the best policy type for you.

Here, we explain the ins and outs of condo insurance in Ontario, from how it works to its standard and additional coverages for your peace of mind. Discover how much Ontario condo insurance typically costs, how to lower your quotes, and how to shop for affordable policies.

Why Do I Need Condo Insurance in Ontario?

You don’t technically “need” condominium insurance in Ontario as it isn’t mandatory. Further, your condo corporation already has commercial condo insurance for the entire building and its common areas. However, it’s a good idea to get it anyway for the following reasons:

How Does Condo Insurance in Ontario Work?

Like home insurance and tenant insurance, Ontario personal condo insurance provides financial coverage in the event of damage or loss to your condo unit, personal possessions, any improvements you’ve made to your condo, and your personal liability.

Note that this type of condo insurance is different from your condo corporation’s insurance, which is also known as a commercial condo insurance policy. Here’s a simple overview of the standard coverages included in personal condo insurance, as well as additional coverage options.

Who Provides Condo Insurance Quotes In Ontario?

There are different ways that you can get a condo insurance quote in Ontario. Here are the four providers that you can use or contact for condo insurance rates:

What Is Not Included in a Typical Ontario Condo Insurance Policy?

The following are typically excluded from Ontario condo insurance policies:

What Determines the Cost of Condo Insurance in Ontario?

The cost of condo insurance in Ontario varies depending on several considerations, such as your zip code, your property type, and even your credit score. Here are some of the different cost factors for condo insurance in Ontario:

How You Can Get Cheap Condo Insurance in Ontario

If you’re trying to save money on your preferred home insurance coverage, here are some important steps to take:

What Do Condos Cost to Buy in Ontario?

Condo purchase prices in Ontario differ from city to city, but you can expect to pay anywhere from $440,000 to $892,000 on average. A June 2023 Ontario housing market report showed that overall home prices in the province went up 3% from the past year.

Here’s a look at condo purchase prices in several major areas of Ontario:

| City | Property type | Average price |

|---|---|---|

| Greater Toronto Area | Condo apartment | $739,395 |

| Toronto | Condo | $770,423 |

| Condo townhouse | $892,843 | |

| Ottawa | Condo apartment | $448,380 |

| Hamilton | Condo apartment | $504,339 |

| Mississauga | Condo townhouse | $855,074 |

| Condo | $636,012 | |

| Brampton | Condo townhouse | $756,195 |

| Condo | $610,473 | |

| London | Condo apartment | $430,002 |

Census Data – Condo Data in Ontario

According to the 2021 Census of Population, the majority of occupied private dwellings in Ontario are not condominiums based on a 25% sample size. Only 15% of 822,780 Ontario private dwellings are condos, compared to 4,668,425 private dwellings (85%) that are not condos.

Who Regulates Condo Matters in Ontario?

Condominium matters in Ontario are regulated by the Condominium Authority of Ontario (CAO). This organization provides services, resources, and training to improve condo living in the province. It also helps resolve disputes in condos to ensure peaceful living.

Additionally, the Condominium Management Regulatory Authority of Ontario (CMRAO) regulates condo managers. This organization licences condo managers to ensure they have the skills needed to oversee daily condominium operations.

FAQs About Home Insurance in Ontario

Does Ontario condo insurance cover the possessions in my unit?

Yes, Ontario condo insurance typically covers the possessions in your unit. Personal belongings coverage is a standard inclusion in personal condo insurance policies. This protects your personal possessions such as electronics, clothing, and appliances from covered perils like fire or theft.

Note that every condo insurance provider differs in the amount of coverage offered for personal belongings, depending on the limits of your chosen policy. There may be certain exclusions for special or high-value items such as art, jewelry, and collectibles. If your belongings exceed your standard policy’s limits or you have items that are excluded, you may need to get additional coverage.

Is Ontario condo insurance purchased by the condominium corporation enough?

While the Ontario condo insurance purchased by the condominium corporation may be enough for the building and its common areas, it may not be enough to protect your personal investment.

The corporation’s insurance typically doesn’t cover your personal unit’s belongings, nor does it cover your personal liability in the event of damage or injury in your unit. This is why it’s highly recommended that unit owners get a personal condo insurance policy as well to cover these risks.

Is condo insurance mandatory in Ontario?

No, condo insurance is not mandatory in Ontario. However, you should still consider getting a personal condo insurance policy to protect your unit, its improvements, and your belongings from loss or damage due to covered risks.

What’s the difference between commercial condo insurance and personal condo insurance in Ontario?

Commercial condo insurance is the “master policy” of your condo corporation. This insurance policy typically covers the entire condo building, inclusive of its common properties like a gym or walkways and any required renovations and upkeep. Depending on your condo corporation’s agreement, you may have to pay a deductible to the corporation in the event of an accident involving your unit.

Personal condo insurance, on the other hand, is the condo insurance that you can personally purchase as a unit owner. This typically covers your unit, belongings, improvements, and any personal liability in the event of loss or damage due to covered risks like property theft or fire.

How much condo insurance do I need in Ontario?

Determining the amount of condo insurance coverage you need in Ontario will depend on several factors. Here are some key considerations that will affect how much coverage you need:

– The value of your personal belongings

– The risk of personal liability

– The need for additional coverages such as overland water or sewer backup coverage

– Any upgrades or improvements done to your unit

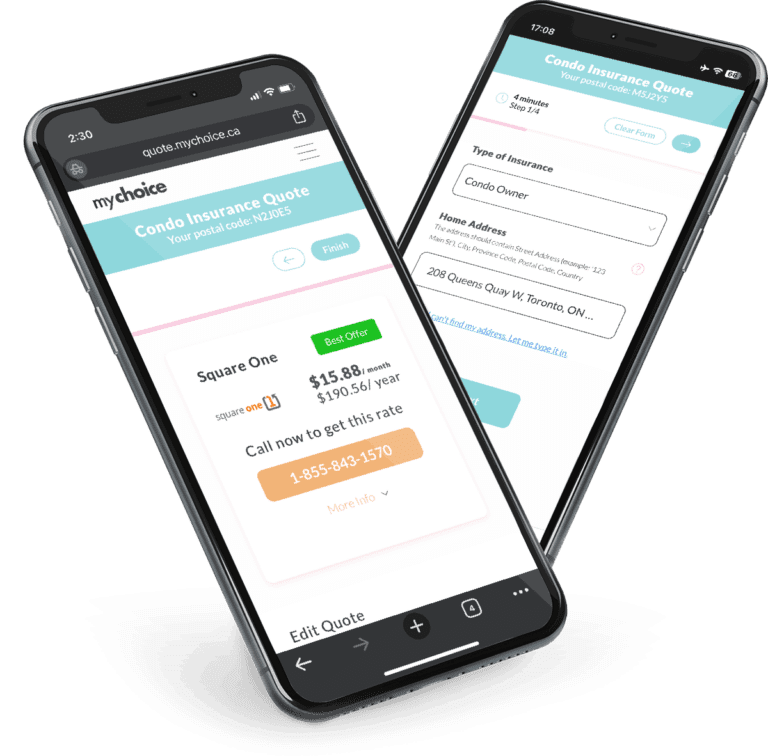

Review your condo’s master policy to learn more about its provided coverage, so your personal condo insurance can address any gaps in the event of loss or damage. Compare quotes on MyChoice to see how much coverage is provided by different trustworthy providers at varying price points.