Whether you’re a first-time buyer or own multiple properties, navigating the intricacies of condo insurance and finding the best rates can be daunting. Learn the basics of condo insurance in Canada, what factors can affect your premium rates, and how you can get the most affordable condo insurance quotes with MyChoice.

How Condo Insurance Works in Canada

Condo insurance is a type of home insurance policy that protects unit owners from injuries, as well as provides coverage for damages and losses that happen to the unit itself and the owner’s personal belongings.

Condo insurance is similar to homeowner’s insurance, with one of the main differences being the price. Because condos are much smaller than homes, the cost to cover the physical structure is much lower.

What condo insurance covers:

Average Condo Insurance Prices in Canada by Province

The below table shows a comparison of the average monthly condo insurance premiums across the Canadian provinces.

| Province | Average Monthly Insurance Premium |

|---|---|

| Ontario | $35 |

| Quebec | $28 |

| British Columbia | $38 |

| Alberta | $39 |

| Manitoba | $31 |

| Saskatchewan | $31 |

| Atlantic Provinces | $28 |

Your Condo Insurance Quote at a Glance

Several factors affect your condo insurance rates. Understanding these factors and how they impact you can help you make a more informed decision when choosing a policy and provider. Some of these factors include:

Is Condo Insurance the Same as Home Insurance?

Condo insurance is relatively similar to homeowner’s insurance, with a few key differences:

How to Save Money on Condo Insurance in Canada

There are plenty of ways to save money on condo insurance. Follow these tips to find discounts and good deals on your insurance:

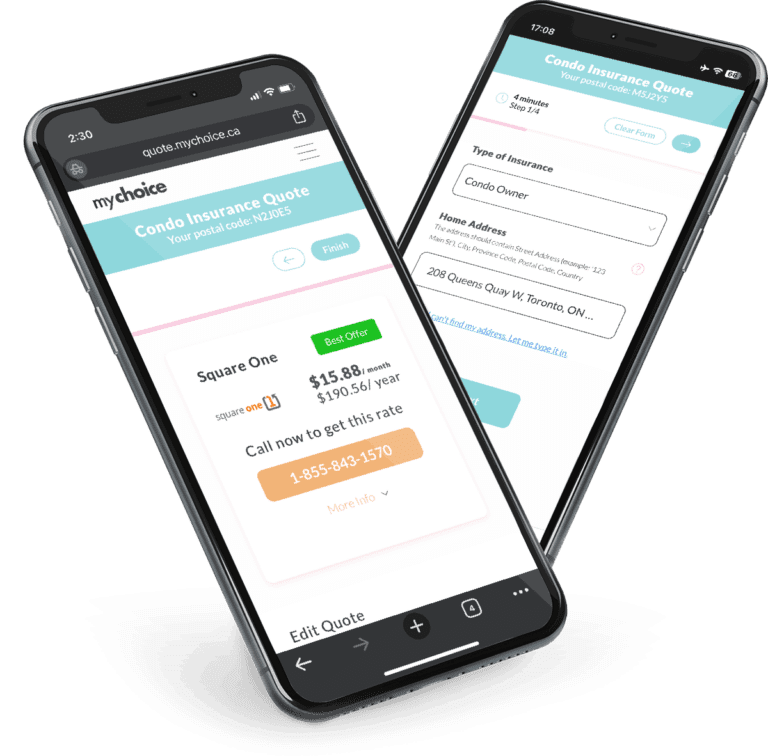

Shopping for Condo Insurance with MyChoice

Ready to find the best rates for condo owners’ insurance? Try MyChoice’s easy-to-use condo insurance quoter. Just input the type of insurance you need and your address, and provide some personal information. In minutes, you can shop around for the lowest rates for your budget and lock down the best policy for you.

Condo Insurance FAQs

What does the average condo insurance typically cost?

The cost of condo insurance depends on several factors, including:

– The condo’s location

– Its value

– The value of the property inside the condo

– The type of policy you choose

In Canada, most people pay around $25 to $40 per month for condo insurance. The rate changes depending on how much coverage is included in the pro

Is having condo insurance in Canada mandatory?

Condo insurance is not mandatory in Canada. However, some condo corporations may require unit owners to have condo insurance before signing their contracts. Many banks and lenders require their clients to have condo insurance before issuing a mortgage.

Is condo insurance the same as renters insurance?

No, condo insurance is not the same as renters insurance. Renters insurance is for people who rent, while condo insurance is offered to condo owners. Condo insurance covers the structural components of the condo itself plus personal property; renters insurance only covers personal property.

Does condo insurance cover appliances?

Most condo insurance policies cover personal property such as fixtures within the unit, appliances, plumbing, wiring, and flooring.

Do condo fees cover insurance?

Some condo fees go to an insurance fund set for paying the building’s insurance premiums. Typically called condominium corporation insurance, this covers the common areas and the furniture and equipment within the property.

Is condo insurance more expensive in big cities like Toronto or Vancouver?

Condo insurance is more expensive in big cities like Toronto and Vancouver. This is because of certain risk factors that increase when living in a big city, such as fires, theft, and vandalism.

How to submit a condo insurance claim in Canada?

To submit a condo insurance claim, call the hotline or go on your insurer’s app to start the process.

Before making a claim, it’s important to document the damage done to your condo. Take photos and write a short report so you have enough evidence for your insurance provider. Upon calling, your insurer will walk you through the process of submitting a claim, which will involve everything from submitting initial documents to finding people to make repairs.

Do I need sewer backup insurance for my condo?

Given the health risks posed by sewer waste, it’s a good idea to get sewer backup insurance for your condo. Sewer backup insurance is an optional policy add-on that covers damages caused by sewage that seeps into your unit from floor drains (this is most common in basement and ground floor apartments) and plumbing and sewage system blockages.