The Top 10 Cheapest SUVs to Insure In Canada in 2025

When picking which SUV to buy, don’t just consider its features and price. You should also consider how much the specific make and model costs to insure. This can have a significant impact on how much you spend on your vehicle each month.

In this guide, we’ll reveal the cheapest SUVs to insure in Ontario and the rest of Canada. We’ll also share some of the factors that determine your SUV insurance premiums.

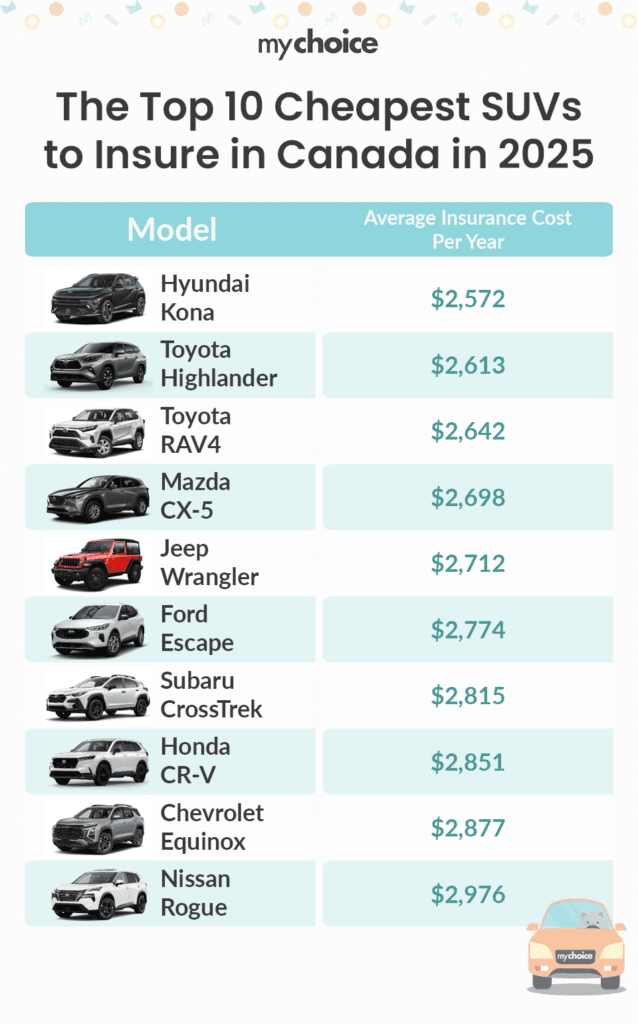

Below is a list containing our picks for the cheapest SUVs to insure in Canada in 2025.

Hyundai Kona

The Hyundai Kona is considered the cheapest SUV in Canada. It has four trim levels, with the SE and SEL levels as the cheapest ones to insure. Hyundai Kona Limited and Hyundai Kona Ultimate are more expensive trim levels to insure because they come with more features and more valuable components.

The former comes with the minimum standard specs and a few safety features, such as automatic headlights, crash-mitigating technologies, and driver-assistance systems. The latter comes with blind-spot collision warnings and lane change assistance.

Overall, the Hyundai Kona is inexpensive to insure because of low theft rates and low repair costs.

Estimated Average Insurance Cost: $2,572/year

Estimated Total Annual Driving Costs: $6,530/year*

Total Cost per Kilometre: $0.65

Fuel Cost per Year (Gas): $1,405/year

*Cost is representative of owning or leasing a vehicle for 5 years.

Toyota Highlander

The Toyota Highlander is an eight-passenger SUV that’s cheaper to insure compared to other vehicles offered by Toyota because it comes with an array of safety features, such as a pre-collision system with pedestrian detection, lane departure alert with steering alert, lane tracing assistance, and full-speed range dynamic radar cruise control. This particular model also performs well when it comes to crash test ratings.

Estimated Average Insurance Cost: $2,613/year

Estimated Total Annual Driving Costs: $8,850/year*

Total Cost per Kilometre: $0.88

Fuel Cost per Year (Gas): $1,810/year

*Cost is representative of owning or leasing a vehicle for 5 years.

Toyota RAV4

The Toyota RAV4 is often considered one of the most affordable SUVs in Canada because of its safety features. The 2025 model comes with a host of safety features, such as blind spot monitor alerts, enhanced vehicle stability control, traction control, smart stop technology, and an anti-lock brake system. It’s also inexpensive to insure because it’s cheap to repair.

However, keep in mind that you may pay more for SUV insurance if you opt for Limited or Hybrid models. These have components that are more difficult to replace, driving up insurance costs.

Estimated Average Insurance Cost: $2,642/year

Estimated Total Annual Driving Costs: $6,870/year*

Total Cost per Kilometre: $0.68

Fuel Cost per Year (Gas): $1,390/year

*Cost is representative of owning or leasing a vehicle for 5 years.

Mazda CX-5

The Mazda CX-5 2025 model is celebrated for its blend of agile handling, upscale interior, and reliable performance. It comes with standard advanced safety features like blind-spot monitoring, rear cross-traffic alert, and available all-wheel drive. This car offers solid fuel efficiency and relatively affordable parts, making it a competitively priced SUV to insure.

Estimated Average Insurance Cost: $2,698/year

Estimated Total Annual Driving Costs: $7,120/year*

Total Cost per Kilometre: $0.71

Fuel Cost per Year (Gas): $1,500/year

*Cost is representative of owning or leasing a vehicle for 5 years.

Jeep Wrangler

The Jeep Wrangler is a renowned and versatile compact SUV that always makes the list of the cheapest vehicles to insure. It is celebrated for its exceptional off-road capabilities and iconic design. Its unique blend of ruggedness and adventure-ready features stands out in the SUV market. The Wrangler offers a range of powerful engine options, including the efficient 2.0L Turbo and the robust 3.6L Pentastar VVT V6, catering to different driving preferences. It’s also one of the more reliable vehicles that usually attain the longest possible lifespan.

Not only is the Wrangler designed for off-road adventures, but it also provides a comfortable on-road experience. It has advanced safety features such as Blind Spot Monitoring and Forward Collision Warning, enhancing driver confidence in various conditions. The interior is designed for comfort and convenience, featuring user-friendly technology and ample cargo space.

The Jeep Wrangler is also recognized for its relatively low insurance costs in Canada, making it an attractive option for those seeking a balance between adventure and affordability.

Estimated Average Insurance Cost: $2,712/year

Estimated Total Annual Driving Costs: $5,300/year*

Total Cost per Kilometre: $0.36/km

Fuel Cost per Year: $2,385/year

*Cost is representative of owning or leasing a vehicle for 5 years.

Ford Escape

The Ford Escape is a compact SUV with low horsepower, making it a low-risk vehicle. Aside from that, the 2025 model comes with a suite of safety features, such as a Blind Spot Information System (BLIS) with cross-traffic alerts, pre-collision assistance, and automatic emergency braking (AEB).

Estimated Average Insurance Cost: $2,774/year

Estimated Total Annual Driving Costs: $7,740/year*

Total Cost per Kilometre: $0.77

Fuel Cost per Year (Gas): $1,490/year

*Cost is representative of owning or leasing a vehicle for 5 years.

Subaru CrossTrek

The Subaru CrossTrek is particularly known for being safe and getting top safety scores from the Insurance Institute for Highway Safety (IIHS). It comes with various safety systems, such as pre-collision braking, pre-collision throttle management, adaptive cruise control, and lane-centering assist.

Estimated Average Insurance Cost: $2,815/year

Estimated Total Annual Driving Costs: $6,530/year*

Total Cost per Kilometre: $0.65

Fuel Cost per Year (Gas): $1,660/year

*Cost is representative of owning or leasing a vehicle for 5 years.

Honda CR-V

Honda CR-V is often included in lists for the cheapest SUVs to insure because it’s quite cheap to repair and maintain. Its low horsepower also makes it less prone to collisions. Additionally, three out of the four CR-V trims come with advanced security systems, making them less prone to theft.

Estimated Average Insurance Cost: $2,851/year

Estimated Total Annual Driving Costs: $9,090/year*

Total Cost per Kilometre: $0.91

Fuel Cost per Year (Gas): $1,650/year

*Cost is representative of owning or leasing a vehicle for 5 years.

Chevrolet Equinox

The Chevrolet Equinox is a practical, family-friendly and compact SUV, with a comfortable ride and a good reliability rating. Equipped with standard safety tech like automatic emergency braking and lane-keeping assist, the 2025 model appeals to drivers seeking peace of mind. The Equinox is also known for having a relatively low theft rate, which helps keep insurance premiums in check.

Estimated Average Insurance Cost: $2,877/year

Estimated Total Annual Driving Costs: $6,200/year*

Total Cost per Kilometre: $0.62

Fuel Cost per Year (Gas): $1,390

*Cost is representative of owning or leasing a vehicle for 5 years.

Nissan Rogue

The Nissan Rogue is an inexpensive SUV that is also cheap to repair and maintain. The 2025 model is fitted with driver assistance technologies that help drivers avoid a collision. It was also awarded the 2024 Top Safety Pick+ by the IIHS for its crash safety performance. All of these make this model relatively cheap to insure.

Estimated Average Insurance Cost: $2,976/year

Estimated Total Annual Driving Costs: $9,300/year*

Total Cost per Kilometre: $0.93

Fuel Cost per Year (Gas): $1,360

*Cost is representative of owning or leasing a vehicle for 5 years.

How to Get Affordable SUV Insurance

Choosing a make and model that’s cheap to insure can help you save money on insurance each month. Check our list above to see which SUVs come with affordable premiums. You can also try increasing your deductibles and installing additional safety features to get lower premiums.

What Factors Determine SUV Insurance Premiums?

To get the cheapest SUV insurance possible, you should look into the factors that affect your premiums. These include:

Now that you know what factors make an SUV more or less to insure, you can narrow your options down further with our picks for the cheapest SUVs to insure in Canada.

How Can You Lower Your SUV Insurance Premiums?

Aside from choosing the cheapest SUV to insure, you can lower your premiums by doing the following:

Whichever SUV you end up buying, you need a good insurance policy to protect from accidents and theft. MyChoice can help you compare insurance quotes from top providers and get you the best deals. Contact us to find the right car insurance policy today!