Cheapest Vehicles to Insure in Ontario in 2025

Different cars come with different premiums, so when it comes to buying a car in Ontario, finding the cheapest cars to insure can become rather tedious. Luckily, there are plenty of excellent cars available with very reasonable average insurance quotes, that’s why we’ve put together the following list of the 10 cheapest cars to insure in Ontario in 2025.

Mitsubishi Mirage

While Mitsubishi decided to cease the production of the 2025 Mirage model, the 2024 model still remains one of the cheapest cars you can insure in Ontario. The car ticks all the boxes if you are after a small and compact, fuel-efficient, trendy hatchback that can operate like a breeze in any notorious Canadian weather situation. The Mirage boasts an extremely economical gas usage but doesn’t sacrifice power and performance, making it more capable in any conditions. With numerous features and technology coming standard on the vehicle to make your drive all the little easier, you will soon fall in love with the Mirage, and it won’t break back when it comes to your insurance.

Estimated Total Annual Driving Costs: $6,370.81/year*

Total Cost per Kilometre: $0.33

Fuel Cost per Year (Gas): $1,160.81

Estimated Average Insurance Cost: $1,534/year

*Cost is representative of owning or leasing a vehicle for 5 years.

Chevrolet Spark

The Chevrolet Spark is a nifty little hatchback that not only looks the part but won’t break the bank when it comes to insurance. The Spark model was discontinued in 2022, but it is still regarded as one of the most reliable hatchbacks within its class, boasting a great safety rating and being manufactured by a reliable brand like Chevrolet certainly helps. This little car is perfect for buzzing around the city and getting you from A to B, it doesn’t ooze luxury but you count on it to get you where you need to go.

Estimated Total Annual Driving Costs: $6,874.11/year*

Total Cost per Kilometre: $0.34

Fuel Cost per Year (Gas): $1,357.11

Estimated Average Insurance Cost: $1,565/year

*Cost is representative of owning or leasing a vehicle for 5 years.

Toyota Corolla

The Toyota Corolla is known for its reliability and practical, everyday appeal. Toyota sells over one million Corollas every year, and if you’re looking for proof of this car’s worth, there it is. The Corolla’s standard safety features are some of the best in its class. One of the best things about the Corolla is the peace of mind you get when you buy this car. It may not be the fastest or most luxurious, but it’s incredibly reliable, and it’s an excellent commuter car, so unless you’re looking for something a little more fancy, you won’t regret purchasing a Corolla.

Estimated Total Annual Driving Costs: $6,921.33/year*

Total Cost per Kilometre: $0.36

Fuel Cost per Year (Gas): $1,252.36

Estimated Average Insurance Cost: $1,624/year

*Cost is representative of owning or leasing a vehicle for 5 years.

Honda Civic

The Honda Civic is a tough one to beat. The Civic is constantly one of the best 4-door compacts on the market, it’s civilized, looks sleek with a ride that’s smooth and crisp. It genuinely gives a feeling of luxury, which is surprising considering how cheap it is to buy and insure. They’re known for being very reliable, and it’s fuel economy is top-class. And on top of that, it’s one of the cheapest cars to insure in Ontario. The Honda Civic is a great small car that’s been a consistent performer for a number of years.

Estimated Total Annual Driving Costs: $7,445.33/year*

Total Cost per Kilometre: $0.38

Fuel Cost per Year (Gas): $1,308.98

Estimated Average Insurance Cost: $1,645/year

*Cost is representative of owning or leasing a vehicle for 5 years.

Mazda 3

The Mazda 3 combines athletic styling and a refined interior, delivering an engaging driving experience that strikes a perfect balance between comfort and performance. This compact car offers impressive acceleration and fuel efficiency, topping out at 250 hp on higher trims in terms of its range of Skyactiv engine options. If you are looking for a sophisticated, fun-to-drive compact car that won’t break the bank, the Mazda 3 is a top contender.

Estimated Total Annual Driving Costs: $7,216.22/year*

Total Cost per Kilometre: $0.37

Fuel Cost per Year (Gas): $1,407.13

Estimated Average Insurance Cost: $1,669/year

*Cost is representative of owning or leasing a vehicle for 5 years.

Chevrolet Cruze

The Chevrolet Cruze is a comfortable 4-door sedan with plenty of room on the inside, and when it comes to standard features, the Cruze definitely has its fair share. The Cruze comes with an “Infotainment System, ” a touch-screen setup that will sync with your phone. Its fuel economy is excellent, making it an ideal car for all types of trips, and perhaps the most appealing aspect of the Cruze for some people could be the price. The Cruze has one of the lowest starting prices in its class, making it an excellent choice for budget buyers, and it’s also one of the cheaper cars for insurance in Ontario.

Estimated Total Annual Driving Costs: $7,423.11/year*

Total Cost per Kilometre: $0.36

Fuel Cost per Year (Gas): $1,388.26

Estimated Average Insurance Cost: $1,694/year

*Cost is representative of owning or leasing a vehicle for 5 years.

Hyundai Elantra

The Hyundai Elantra is a top-of-the-line compact car; it’s stylish, fuel-efficient, reliable, and safe. This car should absolutely be on your list of considerations of cheap cars to ensure decent engine power and a smooth ride. Usually, cars in this class don’t have a lot of high-tech, but with the Elantra, there is a wide variety of technology available, and in fact, it has a very similar price point when compared to the more expensive Sonata.

Estimated Total Annual Driving Costs: $7,423.41/year*

Total Cost per Kilometre: $0.38

Fuel Cost per Year (Gas): $1,290.11

Estimated Average Insurance Cost: $1,703/year

*Cost is representative of owning or leasing a vehicle for 5 years.

Toyota Camry

The Toyota Camry is easily considered one of the best mid-size cars on the market today, it seats the standard five people and has plenty of extra room within the interior. In addition, it also has a good-sized trunk, so you will have plenty of room for everyday errands, and Toyota has a long history of being reliable. Finally, the Camry has consistently been awarded very high safety scores, which can often be a deal breaker when it comes to a family car. In regards to cost, the Camry is a little bit more expensive to run and insure compared to other vehicles on this list, but the other aspects mentioned certainly make that up.

Estimated Total Annual Driving Costs: $7,721.93/year*

Total Cost per Kilometre: $0.39

Fuel Cost per Year (Gas): $1,553.41

Estimated Average Insurance Cost: $1,749/year

*Cost is representative of owning or leasing a vehicle for 5 years.

Kia K5

The Kia K5 elevates the midsize sedan category with a sleek design, dynamic engine options, and advanced driver-assist technologies. From its turbocharged performance variants (up to 290 hp) to its available all-wheel drive, the K5 is built to make your daily commutes more exciting. The car’s features, like a 24-inch combined Panoramic Display and generous cabin space, emphasize comfort and connectivity. If you want a stylish, spirited sedan with modern amenities and impressive safety features, the Kia K5 deserves a spot on your shortlist.

Estimated Total Annual Driving Costs: $7,821.07/year*

Total Cost per Kilometre: $0.41

Fuel Cost per Year (Gas): $1,446.77

Estimated Average Insurance Cost: $1,771/year

*Cost is representative of owning or leasing a vehicle for 5 years.

Volkswagen Golf

The Volkswagen Golf is a practical, German-made hatchback. This reliable, compact car is large enough for a family and kids but doesn’t break the bank regarding fuel consumption. One of the most interesting aspects of golf is the very diverse lineup. For the sake of this analysis, we looked at the costs of the standard model, but plenty of other models are available, such as the sporty wagon. Overall, the Volkswagen Golf is a reliable car with an affordable estimated annual driving cost that may justify the additional price.

Estimated Total Annual Driving Costs: $7,771.20/year*

Total Cost per Kilometre: $0.39

Fuel Cost per Year (Gas): $1,432.61

Estimated Average Insurance Cost: $1,783/year

*Cost is representative of owning or leasing a vehicle for 5 years.

Nissan Sentra

The Nissan Sentra is, by definition, a compact car, but it has some midsize qualities on offer with roomy interior space and a good-sized trunk. This vehicle has a high rating for fuel economy and great safety ratings, making it one of the best performers in its class. Its engine, however, tends to be a little less powerful, which may deter some people, but it isn’t necessarily a bad thing if you’re predominantly driving in a city environment. Of course, this doesn’t mean it’s a bad car, it’s very reliable, has top-notch safety scores and very high fuel economy. It’s an excellent everyday car overall, but it might be a little pricey for insurance when compared to similar cars from its class on this list.

Estimated Total Annual Driving Costs: $8,532.63/year*

Total Cost per Kilometre: $0.44

Fuel Cost per Year (Gas): $1,250.47

Estimated Average Insurance Cost: $1,795/year

*Cost is representative of owning or leasing a vehicle for 5 years.

Volkswagen Jetta

This is the second Volkswagen on the list, but unlike the Golf, the Jetta is a bit more expensive to insure, coming in at the final position on our list. That being said it’s a 4-door compact car with good power for its size, as for the interior that is said to be rather bland and boring, but despite this, it is very spacious. While the Jetta may be more expensive overall, its features, safety, and reliability will make it the perfect fit for more than a few car owners.

Estimated Total Annual Driving Costs: $9,713.43/year*

Total Cost per Kilometre: $0.47

Fuel Cost per Year (Gas): $1,304.26

Estimated Average Insurance Cost: $1,803/year

*Cost is representative of owning or leasing a vehicle for 5 years.

Kia Sorento

The Kia Sorento makes travel easy while giving you the time and space to be inspired. It features a heated steering wheel and front seats, rear cross-traffic alert with lane keeping assist. With all-wheel drive, you will have all the traction and control to carve through the elements with ease. Move confidently with the Advanced Forward Collision-Avoidance Assist with Junction Turning Function. This state-of-the-art safety feature warns you with an audible alert if it detects a vehicle approaching yours at a junction. The Blind Spot Collision Avoidance Assist monitors your blind spots for approaching vehicles. If it sees that a collision is possible, it can intervene to reduce the risk or impact.

Estimated Total Annual Driving Costs: $6,136/year*

Total Cost per Kilometre: $0.39

Fuel Cost per Year (Gas): $1,780.86

Estimated Average Insurance Cost: $1,814/year

*Cost is representative of owning or leasing a vehicle for 5 years.

Dodge Caravan

The Dodge Caravan uses space, comfort and convenience to define your driving experience. The 2025 Grand Caravan offers up to 81 comfortable seating configurations to choose from, along with the iconic Stow ‘n Go Seating, which allows easy change to cargo mode. It also offers outstanding storage versatility in its Super Console. There are several levels of available multimedia centres, each offering essential features to keep you entertained. Their UConnect system is designed to give you safety, security, information, and entertainment when you travel, and it also features hands‑free operation for safety. The 2025 Grand Caravan was designed from the wheels up to offer advanced safety technologies that give you insight into your blind spots.

Estimated Total Annual Driving Costs: $3,327.12/year*

Total Cost per Kilometre: $0.23

Fuel Cost per Year (Gas): $2,220.64

Estimated Average Insurance Cost: $1,821/year

*Cost is representative of owning or leasing a vehicle for 5 years.

What Factors Determine How Cheap It Is to Insure Your Car

Many different elements go into calculating your car insurance premiums in Canada. Some are related to the driver and the driving history, and some are related to the type of vehicle. Some examples include:

The Cheapest SUVs to Insure

SUVs are one of the most popular types of vehicles to own with a wide range to choose from. Here is our breakdown of some of the cheapest SUVs to insure.

| SUV Vehicle Model | Est. Insurance Rate P/Y |

|---|---|

| Hyundai Kona | $2,572 |

| Toyota Highlander | $2,613 |

| Toyota RAV4 | $2,642 |

| Mazda CX-5 | $2,698 |

| Jeep Wrangler | $2,712 |

| Ford Escape | $2,774 |

| Subaru CrossTrek | $2,815 |

| Honda CR-V | $2,851 |

| Chevrolet Equinox | $2,877 |

| Nissan Rogue | $2,976 |

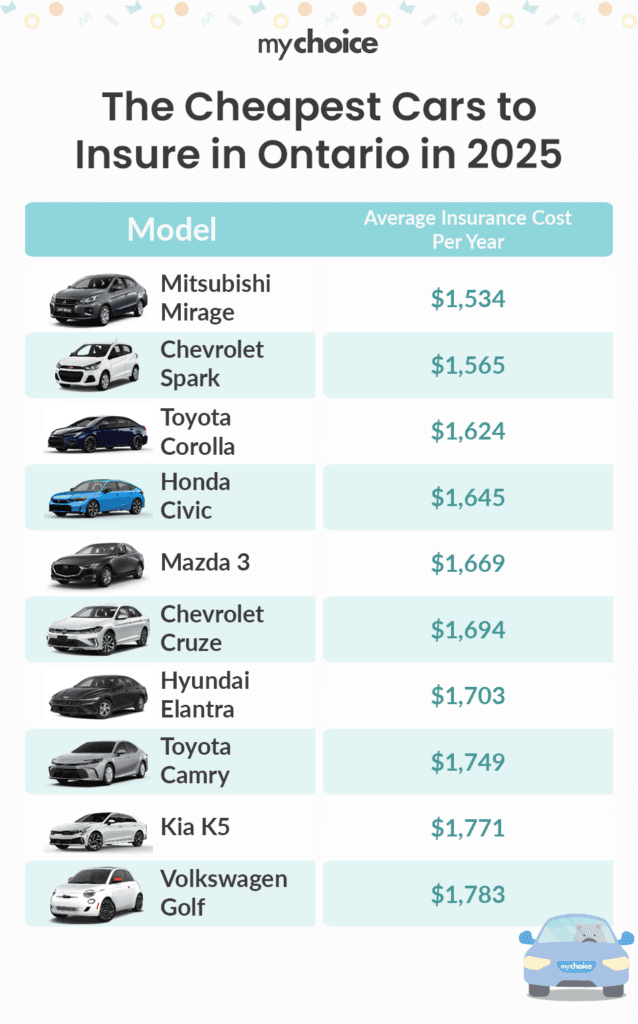

The Cheapest Small Cars to Insure

Small cars are still as popular as ever, ideal for an urban lifestyle and often one of the cheaper vehicle types to run. Here is our list of some of the cheapest small cars to insure, and while you’re here, check out our list of the top 10 small cars in Canada for 2025.

| Small Vehicle Model | Est. Insurance Rate P/Y |

|---|---|

| Mitsubishi Mirage | $1,534 |

| Chevrolet Spark | $1,565 |

| Toyota Corolla | $1,624 |

| Honda Civic | $1,645 |

| Mazda 3 | $1,669 |

| Chevrolet Cruze | $1,694 |

| Hyundai Elantra | $1,703 |

| Toyota Camry | $1,749 |

| Kia K5 | $1,771 |

| Volkswagen Golf | $1,783 |

The Cheapest Electric Vehicles to Insure

Electric vehicles are consistently growing in popularity, and they are a vehicle model you should consider when purchasing your next car. Here is our list of some of the cheapest electric vehicles to insure.

| Electric Vehicle Model | Est. Insurance Rate P/Y |

|---|---|

| Ford Focus EV | $1,821 |

| Volkswagen E Golf | $2,265 |

| Tesla Model 3 | $2,341 |

| Kia Soul | $2,612 |

| Nissan Leaf | $2,939 |

The Cheapest Trucks to Insure

Trucks are a common vehicle option when choosing your next car, they offer a range of versatility especially in all weather types. Here is our list of some of the cheapest trucks to insure.

| Truck Vehicle Model | Est. Insurance Rate P/Y |

|---|---|

| GMC Canyon | $1,880 |

| Chevrolet Silverado | $1,905 |

| Toyota Tacoma | $1,950 |

| Chevrolet Colorado | $1,970 |

| Ford F-150 | $2,020 |

| Nissan Titan | $2,065 |

| Hyundai Santa Cruz | $2,210 |

Methodology

We analyzed a range of the best automotive sites across the web to help curate these lists of cheapest vehicles to insure, as well as supplementing from our own internal data gathered from quotes collected in 2024.

We used the following criteria to help find the estimated average insurance rate: clean driving record, based in the Greater Toronto Area (cheapest postal code), male, aged 35 and using vehicle for personal use. Note, insurance estimates can vary based on your specific driving situation.