Commercial insurance is essential for protecting your growing business from losses that may occur due to unforeseen events or daily business operations, such as errors or property damage. But what type of business insurance should you get?

Read on to learn more about this and other useful information about commercial insurance, such as coverage options and how to get an affordable quote online.

Most Common Business Insurance Coverage Options in Canada

Canadian businesses can choose from a variety of insurance policies tailored to their specific needs. Here are the most common coverage options for business owners in Canada:

Who Provides Business Insurance Quotes in Canada

If you’re looking for business insurance quotes in Canada, these four providers can offer them to you based on your specific needs:

What is The Best Insurance for a Small Business?

Determining the best insurance for a small business depends on its unique needs and risks. However, essential coverages for most small to mid-sized businesses typically include:

What Information Do You Need to Get a Business Insurance Quote?

For a business insurance quote, you’ll typically have to submit the following details:

What Factors Affect Your Business Insurance Quote?

Several factors can influence the cost of commercial insurance in Canada. Here’s a quick breakdown of how each one can raise or lower your quotes:

How to Get Affordable Business Insurance

Careful planning and research are key to finding affordable insurance for your business. Here are some tips to try to get lower quotes:

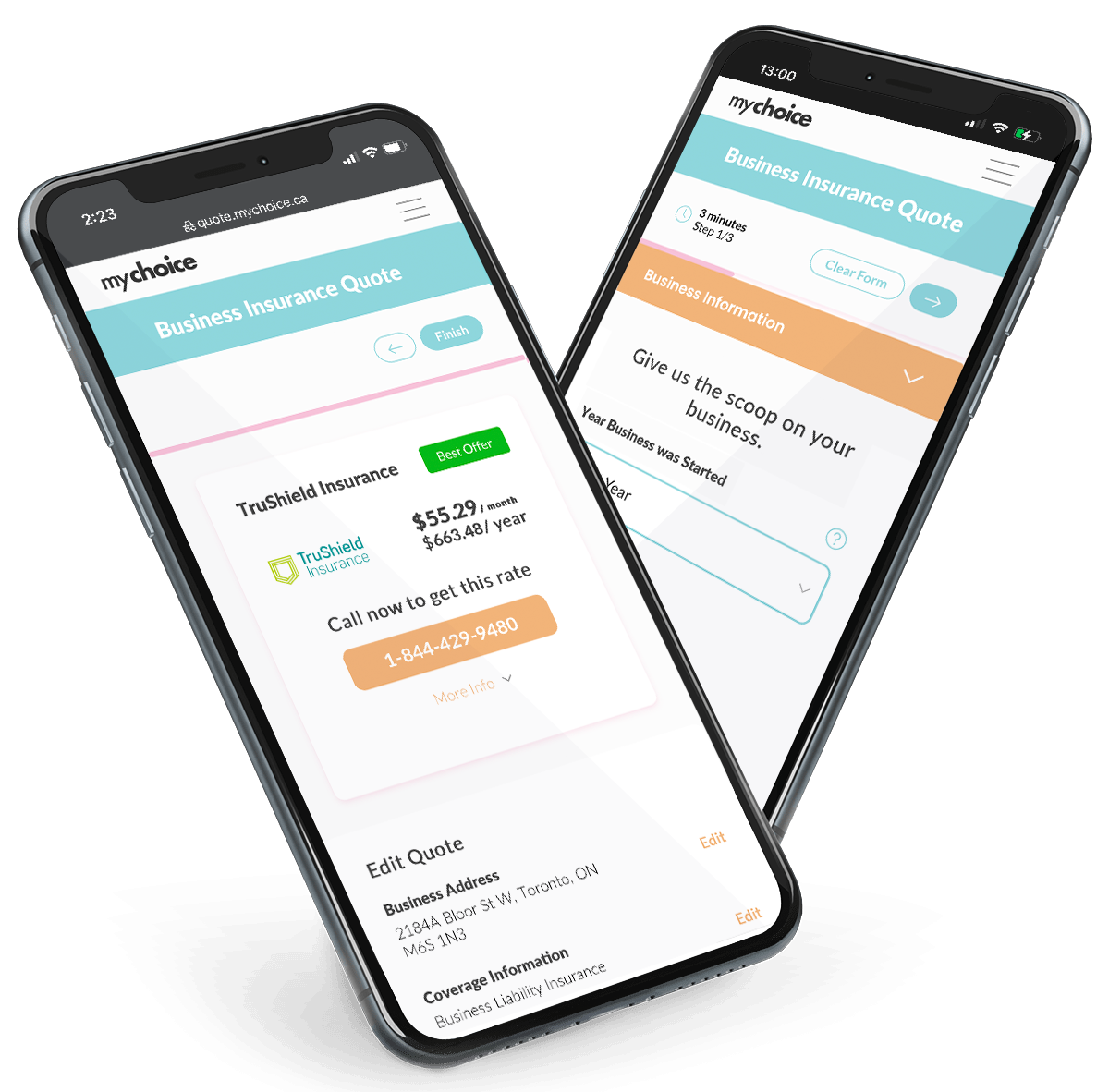

Why You Should Compare Business Insurance Rates with MyChoice

Comparing rates through MyChoice offers several advantages:

- Convenience: You can access multiple quotes from various insurers in one place without having to research too extensively. This saves time while ensuring you find competitive rates for your unique preferences and business needs.

- Cost savings: Finding the best rate quickly through MyChoice can lead to significant savings on premiums over time. These small differences in rates can add up substantially when considering long-term costs.

- Tailored options: MyChoice allows you to filter quotes based on your specific needs and budget constraints. This ensures you find the right coverage at an affordable price without sacrificing essential protections.

Commonly Asked Questions About Business Insurance

How much does business insurance cost in Canada?

The cost of business insurance in Canada varies widely based on factors like industry type, location, size of the business, and coverage needs. On average, small businesses may pay between $450 to $1,500 annually for basic coverage.

What does business insurance cover?

Business insurance typically covers risks such as liability claims, property damage, and loss of income due to business interruption. However, specific coverages will depend on the policy chosen.

How can I get business insurance?

Here’s a quick step-by-step guide to getting business insurance:

1. Evaluate your business risks (e.g. bodily injury, food spoilage) and consider different business coverage types.

2. Apply for business insurance quotes through insurance agents, brokers, direct insurers, or insurance aggregators like MyChoice. You may need to submit information such as annual revenue and industry type for an accurate quote.

3. Compare quotes and complete an application from your chosen business insurance provider.

4. Once your application is approved, purchase your policy.

How much is a $2 million dollar insurance policy for a business?

A $2 million dollar insurance policy may cost a small to mid-size business around $450 per year, but this can vary significantly based on risk factors like your insurance claims history, business size, and annual revenue.

How much does small business insurance cost per month in Canada?

Small business insurance costs can range anywhere from $19 for basic coverage options to several hundred dollars per month, depending on the size and nature of the business.

What is the most common type of business insurance?

General liability insurance is the most common type of business insurance as it protects against basic risks faced by most businesses, such as claims or lawsuits.

What is the difference between commercial and personal insurance?

Commercial insurance covers risks associated with running a business, while personal insurance protects individuals against personal liabilities and losses incurred outside a professional context.

What is the best insurance for a small business?

The best insurance for a small business varies by industry, but generally, businesses should look into getting general liability, professional liability, and property insurance tailored to their specific operational risks. Consulting with a business insurance provider can help you identify the best options for your situation.