Remote work continues to be embraced by Canadian workers thanks to shortened commute times and better work-life balance. The COVID-19 pandemic accelerated the shift to working from home (WFH), with approximately 20% of Canadians working most of their hours from home. This change in work arrangements, however, has led to murkiness about coverage for remote workers, whether through an employer’s policy or personal coverage.

Read on to find out how working from home can impact your home or tenant insurance. Learn more about the risks that remote workers should get coverage for, employer liability for WFH employees, and what additional coverage to get depending on your work situation.

Risks Faced by WFH Employees

Working from home introduces unique risks that can affect both personal property and liability coverage. Some of the primary risks include:

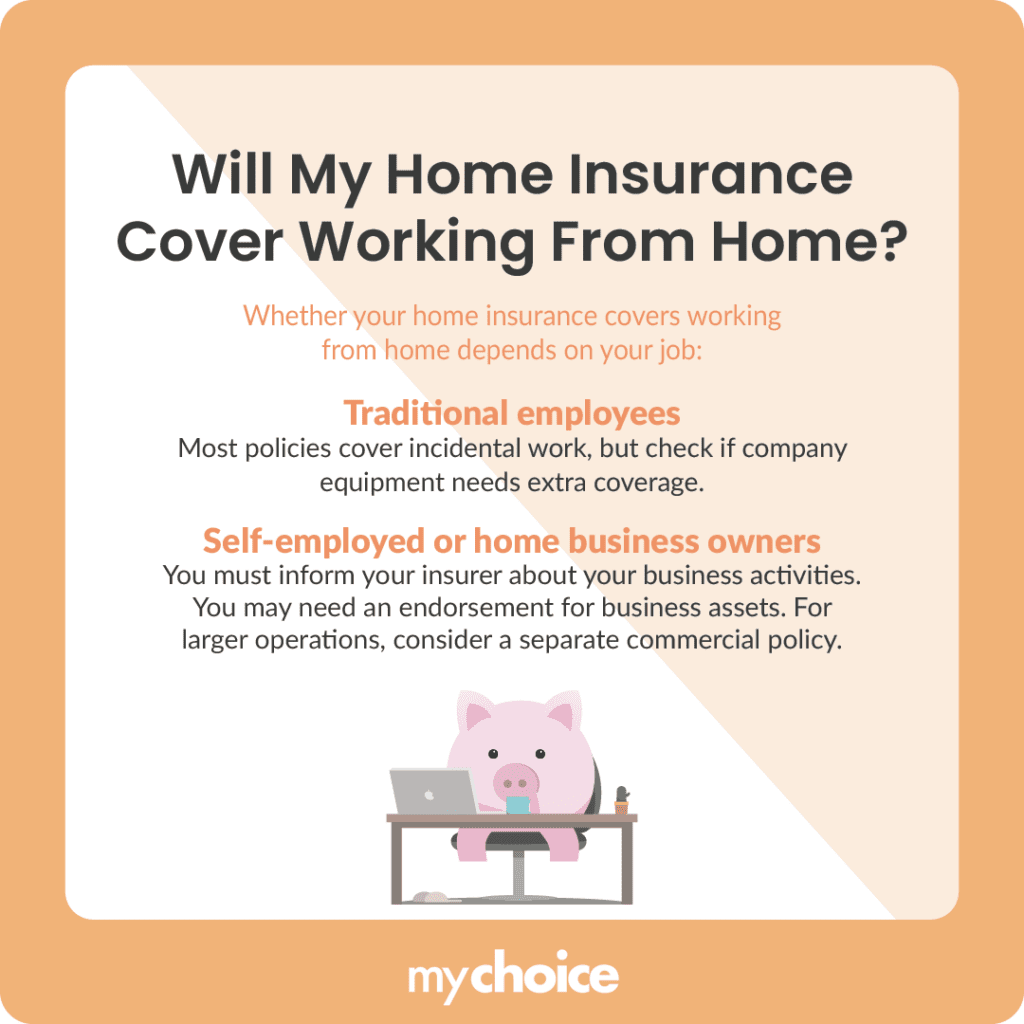

Will My Home Insurance Cover Working From Home?

The answer to whether your home insurance covers working from home largely depends on the nature of the work being done. Are you a traditional employee or self-employed? Here’s a breakdown of what your home insurance will cover depending on the work you do:

Standard home insurance has coverage limitations, even with added limits for business property. The offered amount in your policy may be insufficient for more extensive operations or valuable equipment, so consider looking into getting a separate commercial policy to keep you covered.

Will My Tenant Insurance Cover Working From Home?

Also known as renters insurance, tenant insurance typically provides coverage for personal liability, as well as loss or damage of personal belongings due to risks like fire or theft. If you are working from home and using personal equipment like a laptop, these items may be covered under your tenant insurance policy. However, this coverage often has limits and may not extend to items used primarily for business purposes.

Likewise, tenant insurance won’t cover you if you’re running a business from home or conducting significant work-related activities – you’ll need additional coverage for that. Given the limits of standard tenant insurance regarding work-related activities, remote employees should consider getting endorsements for home-based businesses to prevent out-of-pocket expenses.

What If I Don’t Tell My Insurer I’m Working from Home?

Simply put: do not do this. Always inform your insurer if you have a WFH arrangement. If insurers find out about undisclosed WFH arrangements after a claim has been made, they may adjust future premiums based on perceived risk factors associated with remote work. This could lead to increased costs for coverage down the line.

Failure to disclose that you’re running a small business or working from home won’t just result in pricier insurance – it can lead to denial of a claim or even termination of your home or tenant insurance policy. For example, if a fire damages your home office equipment and you haven’t disclosed that you work from home, the insurer may deny your claim based on the grounds of non-disclosure. This could leave you personally liable for any property damage or loss or liability claims.

Are Employers Liable For Employees Working from Home?

Employer liability concerning remote workers can be complicated. Recognizing the risks that WFH employees still face is key to ensuring that they’re protected, whether through personal insurance or company policies. Here’s a closer look at what employers are typically liable for when it comes to their WFH employees:

These are just some of the risks that employers should handle in some capacity for their remote employees. Employers should clearly communicate their policies regarding remote work and ensure that employees understand what protections are available, so they can get riders for coverage gaps.

Should I Get Additional Insurance If I Work from Home?

If you’re a freelancer or a small business owner operating from home, your standard homeowner’s insurance may fall short of providing adequate protection. Depending on your needs, you may opt for a home-based business insurance rider to your existing policy or get a separate policy for your business.

Here are some considerations and types of coverage to keep in mind:

Consult with your insurance company to determine what types of coverage are essential for your business activities. Each business has unique risks that may require tailored solutions to ensure comprehensive protection.

Key Advice from MyChoice

- Always inform your insurance provider about your remote work status and any changes in your employment situation to ensure adequate coverage.

- For self-employed individuals or those running businesses from home, consider adding endorsements or separate commercial policies tailored to your specific needs.

- Understand your coverage limits and review your policy carefully to understand what is covered when working from home – especially regarding equipment and liability related to client interactions.