Each year, blizzards, ice storms, and heavy snow events sweep through Canada, devastating thousands of Canadians. These winter storms can dump massive amounts of snow or coat entire cities in ice, knocking out power and halting transportation. The damage caused by these weather events can reach hundreds of millions of dollars when they happen, leaving insurance providers on the hook for thousands of claims.

How do winter storms affect home insurance rates in Canada? Are winter storms becoming more frequent? What can you do to prepare for winter storms? Read on to learn about why winter storms are concerning for insurance companies and what you can do to minimize the damage they could cause.

Why Canadian Insurers Are Paying Closer Attention to Winter Storms

As climate change continues to alter weather patterns, winter storms in Canada are becoming more frequent and intense. According to the Insurance Bureau of Canada (IBC), 2024 was a record-breaking year for losses related to severe-weather incidents. Out of the $8.5 billion of weather-related damages in 2024, the deep freeze event throughout Western Canada in January caused over $180 million.

Along with the winter storms in February 2025 that ravaged Ontario, Quebec, and the Atlantic provinces, experts predict that severe weather incidents will only become more common in the coming years. With Canada’s population growing and more valuable assets at risk, insurers are considering winter storms a looming liability that needs close attention and assessment.

How Much Are These Storms Really Costing?

Data from Public Safety’s Canada’s Canadian Disaster Database confirms that winter storms are becoming more frequent and costly. According to the database, Canada experienced 89 winter storm disasters between 1905 and 2020. While many older events didn’t record the cost of damages, the trend in recent decades shows an alarming increase in reported damages.

In the 1980s and early 90s, it was uncommon for winter storms to cause more than $100 million in damages. While the multi-billion dollar winter storm disaster in 1998 was an outlier for the time, the 2000s brought with it a massive uptick in winter storm occurrences and severity. By the 2010s, winter storms causing losses in the nine figures had become almost routine. From 2013 to 2019, Canada experienced at least five separate winter storms causing more than $100 million or more in damages.

In recent years, severe weather events have ramped up, with 2023 reporting $3.1 billion in damages and 2024 breaking previous records with an alarming $8.4 billion in insured damages. While this number includes wildfires, hailstorms, floods, and similar weather events, over $180 million of damages was caused by a deep freeze disaster early on in the year. As winter storms cause considerably more damage to Canadians annually, insurers face increasingly significant claims, encouraging them to adjust insurance policies in response.

How Winter Storms Impact Insurance Premiums & Coverage

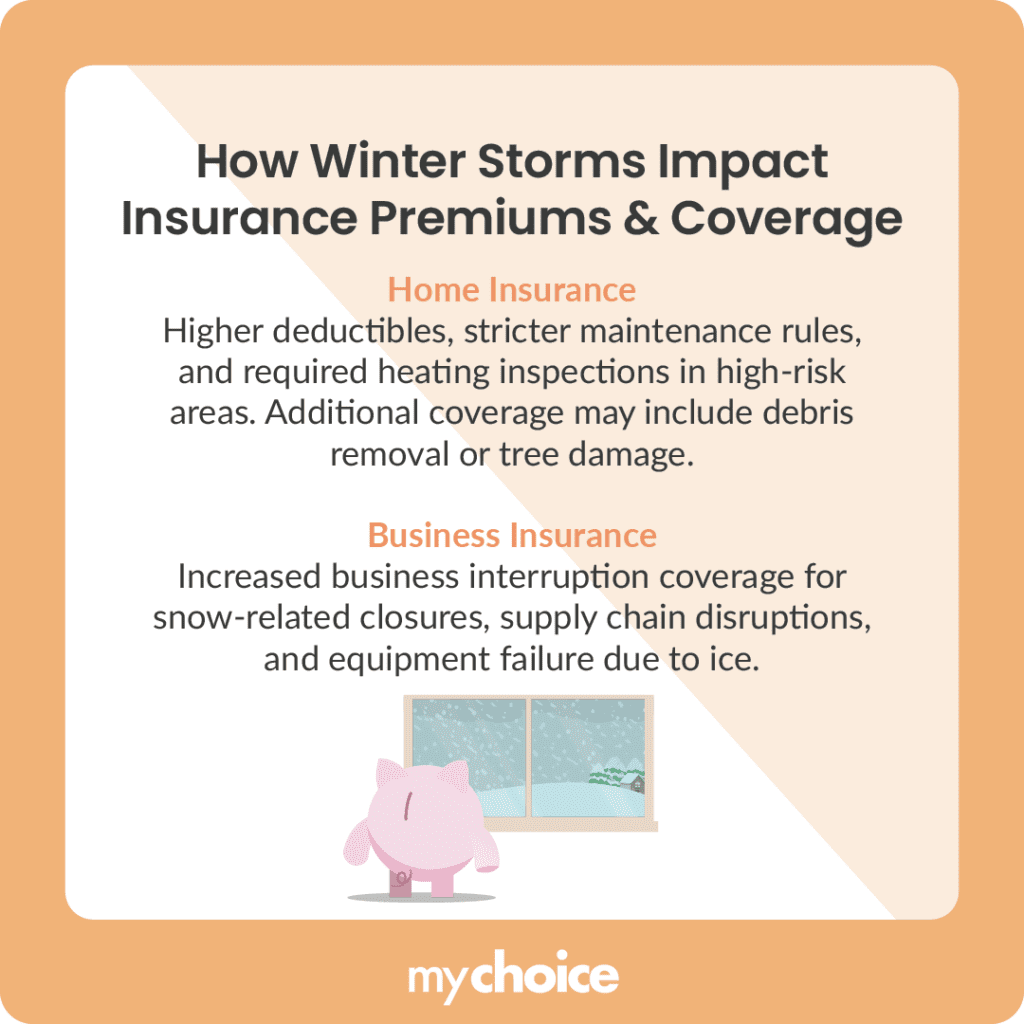

Increased winter storm risks can push insurance providers to raise premiums and adjust policy terms across different insurance types. Homeowners in high-risk areas might experience higher deductibles, strict maintenance requirements, or specific clauses to prevent winter damage. This can include mandatory heating system inspection or proof of adequate insulation. Insurance policies may include additional endorsements for debris removal or tree damage in areas prone to heavy snowfall or hailstorms.

Winter storms also heavily impact businesses, which affects commercial insurance. Severe snowfall and blizzards can disrupt supply chains and cause power interruptions. Because of the frequency of these events, commercial policies are increasingly including business interruption coverage specifically for winter-related disruptions. This can include extended coverage for lost revenue if a storefront is forced to close due to snow or if important equipment fails due to ice damage.

What Homeowners and Businesses Can Do to Prepare

As winter storms increase in frequency and intensity, preparation becomes vital to homeowners and businesses that want to protect their assets. Here are some tips that will help minimize damage from winter storms and keep you safe:

Key Advice from MyChoice

- Winter storm risks vary across provinces and regions, and insurers adjust premiums accordingly. Compare quotes from multiple insurance providers with MyChoice to determine which policy in your area provides adequate coverage for a decent price.

- Install preemptive devices like a sump pump or backup generator to protect your home from the effects of winter storms.

- Review your home insurance policy to ensure you have the right coverage against severe weather events. Some insurers will only offer this kind of coverage as additional riders or endorsements to your standard policy.