Winters in Canada can be incredibly difficult for drivers to navigate. The combination of snow, ice, and reduced visibility leads to a significant uptick in car collisions during this season. Nearly 30% of car accidents in Canada happen on snowy or icy roads. From November through January, collision-related claims skyrocket, increasing by almost 50% compared to the rest of the year.

Why is winter the most dangerous time to drive? What can you do to keep yourself safe from accidents while driving on snowy roads? How does this affect your auto insurance rates? Read on to learn about why you should be careful driving during the winter months.

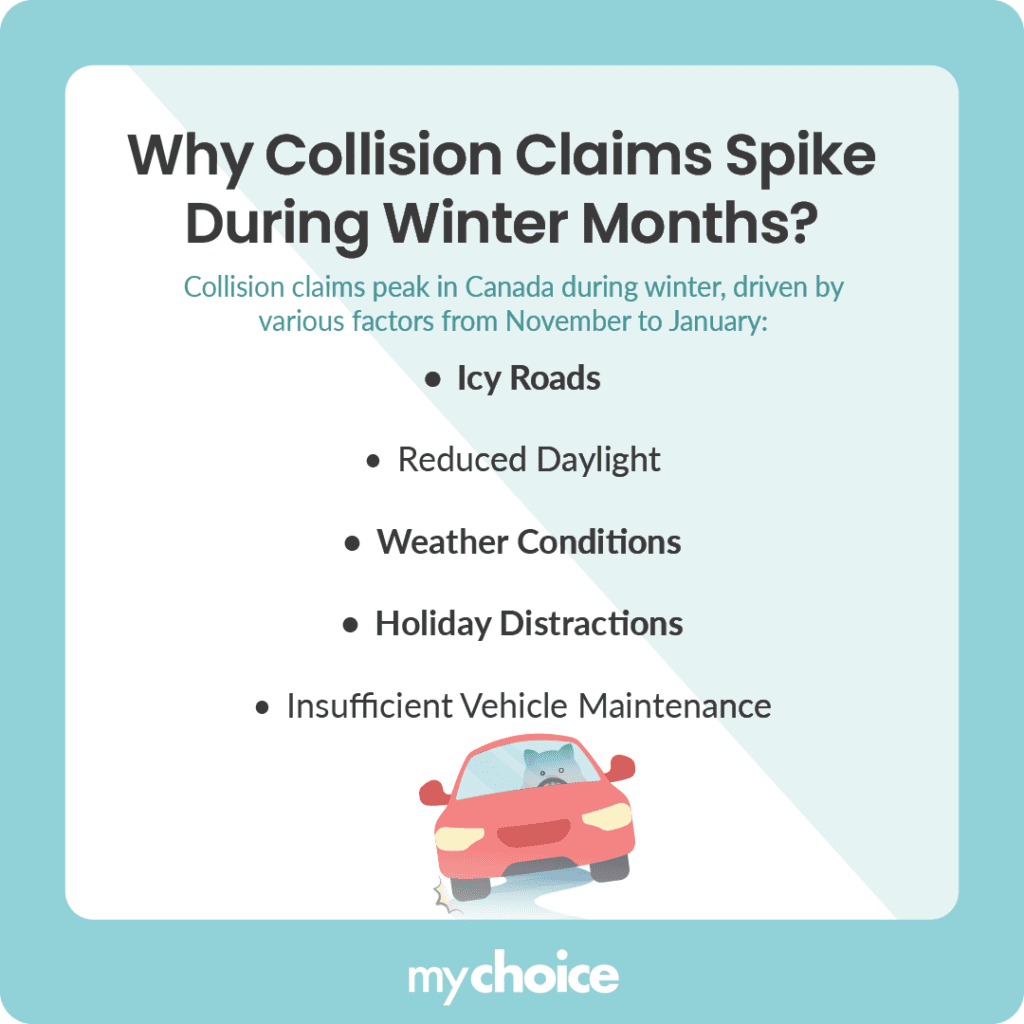

Why Winter Months See Increased Collision Claims

Canada’s winter months see the most collision claims by far throughout the year. There are several factors that contribute to the rise in accidents happening from November through January:

The Impact of Winter Accidents on Your Insurance Premiums

Collisions that occur during winter not only pose immediate dangers but also have long-term financial implications for drivers. When an accident occurs, insurance companies assess liability based on various factors, including weather conditions. However, regardless of external conditions like snow or ice, drivers are generally held responsible for operating their vehicles safely.

Getting into an accident in winter will often lead to an increase in premiums, unless you have accident forgiveness. If you are deemed at fault in a collision during winter months, your insurer will likely adjust your rates accordingly. This adjustment can be particularly steep if you have multiple claims on your record due to winter driving incidents.

Additionally, supply chain issues may exacerbate repair times for damaged vehicles. Many drivers are finding themselves without their cars for extended periods due to delays in parts availability. This not only affects their daily routines but also places additional financial strain on those needing rental vehicles while waiting for repairs.

Preventative Measures for Safe Winter Driving

Preventing an accident from happening is a lot better than relying on insurance claims after the fact. Here are some preventative measures you can take to keep you and your fellow drivers safe on the winter roads:

How Insurance Companies Respond to Seasonal Risks

Insurance companies closely monitor seasonal risks associated with winter driving and often adjust policies or premiums accordingly. The increase in claims during this period prompts insurers to evaluate their coverage options and risk assessments more rigorously.

For example, insurance companies may offer specific policies tailored for winter driving that include coverage enhancements related to weather-related incidents. If you have an accident on your driving record during the winter months, insurers will see that as an increased risk, giving them justification to raise your premiums. Following an uptick in claims due to winter accidents, insurers may also raise premiums across the board for all policyholders or specifically target those with recent claims history.

Key Advice from MyChoice

- Review your auto insurance policy to make sure that it adequately covers winter-related incidents such as collisions due to icy conditions or snow-related accidents.

- Consider adding roadside assistance coverage if it isn’t already included in your policy. This service can provide peace of mind knowing help is just a call away if you encounter vehicle trouble in winter.

- Keep your vehicle maintained for the winter months and stay away from distractions while driving to minimize the risk of getting into an accident on icy roads.