Over the past decade, global life insurance premiums have steadily increased at around only 1.5% per year. However, the Swiss Re Institute predicts that global life insurance will increase to 3% yearly starting in 2025. Because of this, Canadians should prepare for the growing demand for financial security across the country.

The recent 2.6% spike in global premiums for both life and non-life insurance in 2024 also reflects the ongoing economic changes as more people seek all types of insurance coverage. Keep reading to learn why life insurance premiums are on the rise and how to safeguard your future with the right plan.

Why Are Life Insurance Rates Still Increasing?

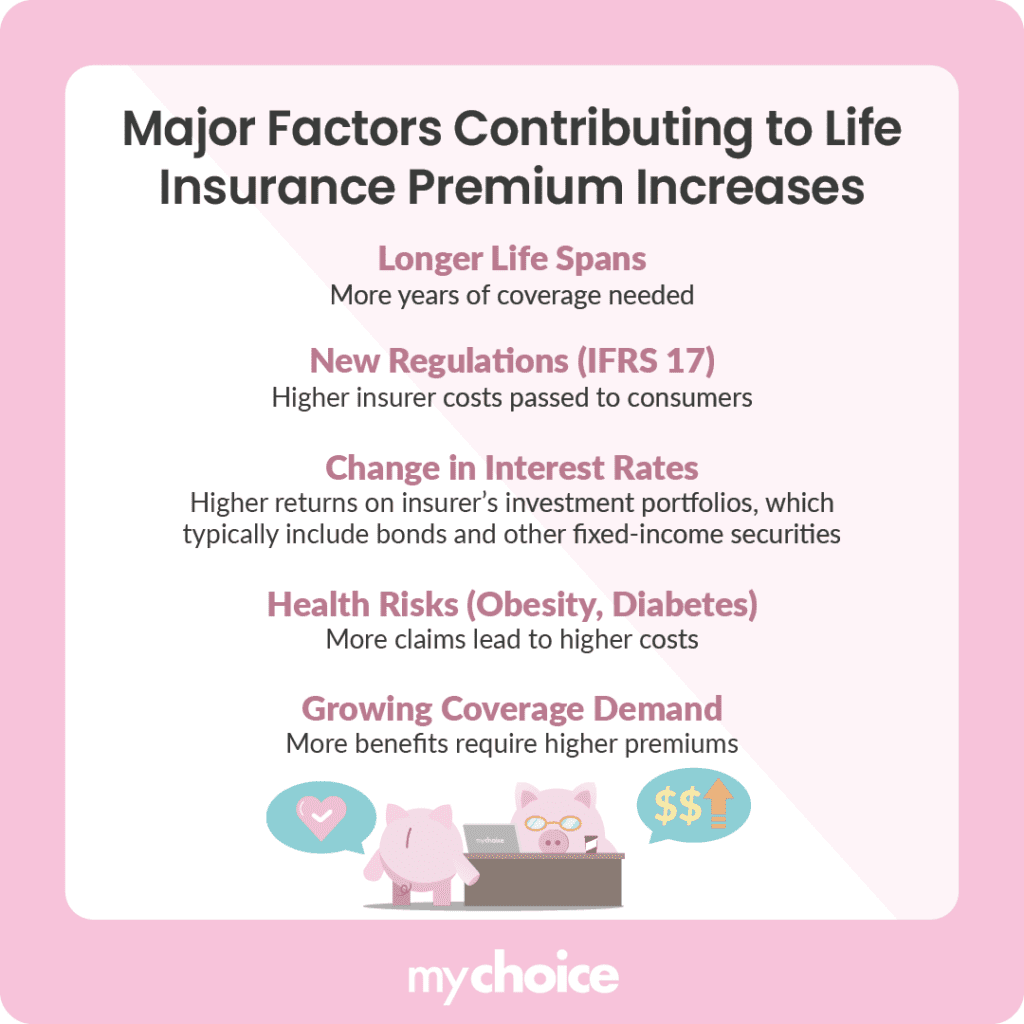

Life insurance premiums are not exempt from our changing economy. Major contributors to life insurance premium increases stem from changing interest rates, strong demand for extensive coverage plans, and lifestyle risks leading to early health complications.

As companies offer new and compelling coverage options, more people are encouraged to start securing life insurance for long-term security and potential financial benefits in the future. Here’s a deeper dive into the key factors behind these premium increases.

Major Contributors to Premium Increases

Premiums are the insurance payments you spend monthly, quarterly, or annually. For example, around ten years ago, a 60-year-old without any serious health conditions could pay a monthly premium of $50-80 for a basic plan. Fast forward to 2025 and the same 60-year-old would have to shell out $120-160 a month instead.

The primary reasons for the increases in premiums are:

How Interest Rates Impact Insurance Coverage Costs

To understand how interest rates affect coverage costs, let’s take a closer look at how life insurance companies make a profit. They make money by using their clients’ premiums to invest in assets like bonds and stocks to get a return on investment that helps them with insurance payouts and funds to operate the business.

When the interest rate on coverage costs increases, it usually means better cash flow for the company. But this isn’t always the case – sometimes, companies increase their rates to make up for bad investments. Other reasons for higher interest include a sudden spike in insurance claims, inflation, or new policies that affect insurers’ finances.

How Global Economic Trends Can Impact Your Insurance Policy

Global economic trends and changes affect both you and your insurance company. For instance, everyone has to adjust to inflation. Sometimes, this contributes to higher operational costs or insurance companies receiving poor investment returns. Meanwhile, you’re left with no choice but to pay higher premiums when you renew your plan.

There’s also a chance that insurers will modify fixed insurance policies after the 10 to 30-year term ends to limit coverage. This is why you should always keep economic trends in mind, especially for guaranteed insurance, like a fixed death benefit that might overlook inflation.

What This Means for You in 2025

In 2025, people can expect premiums to keep increasing, receive fewer coverage inclusions, and pay higher premiums. Luckily, there are ways to work around these issues. For instance, researching different types of life insurance is a good start to choosing an affordable and sustainable life insurance plan that fits your needs.

While you can’t control policy changes or spikes in interest rates, you can make it a habit to read up on inflation trends and industry developments. The more information you have about what’s going on, the better you can position yourself for any upcoming coverage renewals with your life insurance provider.

Key Advice from MyChoice

- Invest in life insurance as early as you can. Healthy, young individuals get the best deals because they aren’t prone to illness and will presumably only start filing insurance claims when they’re much older. Whole life insurance is a good choice if you want to stick to the same premium fees for life.

- Make sure your plan covers all your priorities, especially if you need specific inclusions. Check online reviews as well to assess how reliable a company is when it comes to processing payouts before you commit.

- Explore options like whole or universal life insurance and build funds in a cash-value account. This might help when you retire because you can borrow or withdraw the money in the future.