There are two main types of permanent life insurance policies: whole life and universal life. In 2024, these policies collectively represented 83% of the Canadian life insurance market, with whole life accounting for 69% and universal life for 13%.

While these two policy types may be similar at first glance, there is a world of difference between them that you should be aware of if you’re considering buying a life insurance policy.

What’s the difference between whole life vs universal life insurance policies? Which type of policy suits your personal situation and financial goals better? Read on to learn the nuances of whole life and universal life insurance, and take our simple quiz to help you figure out which one is better for you.

Whole vs Universal Life Insurance: Key Differences

Whole life and universal life policies are similar in that they are permanent life insurance policies, meaning that you keep paying premiums on them until you pass away. However, there are significant differences between them, as shown in this table:

| Feature | Whole Life Insurance | Universal Life Insurance |

|---|---|---|

| Premium Structure | Fixed, predictable premiums over the life of the policy. Once set, the premium remains constant, making budgeting easier. | Flexible premiums that allow you to adjust your payments based on current financial conditions. This flexibility can be beneficial if your income fluctuates over time. |

| Cash Value Growth | Guaranteed cash value accumulation with a set interest rate. The growth is typically slower but steady, with minimal risk. | The cash value grows on a tax-deferred basis and policy loans can be taken out tax-free under certain conditions. |

| Tax Implications | The cash value grows on a tax-deferred basis, and policy loans can be taken out tax-free under certain conditions. | Similarly, tax-deferred but the flexible nature means policyholders must monitor their account to avoid potential taxable events if the account value exceeds certain thresholds. |

| Estate Planning | Offers predictable benefits for estate planning. The guaranteed death benefit can provide a straightforward transfer of wealth, making it easier to plan for heirs and taxes. | Provides more adaptability, allowing adjustments in the death benefit and cash value, which may be helpful in more complex estate planning situations. |

| Investment Component | Typically conservative, with growth based on fixed interest rates and dividend performance. | Can incorporate investment sub-accounts, allowing for potential exposure to equity markets, though this introduces a degree of investment risk. |

| Flexibility | Less flexible once the policy is in place; changes in premium payments or death benefits are limited. | Offers high flexibility in adjusting premiums, death benefits, and investment choices, catering to those who prefer a hands-on approach to managing their policy. |

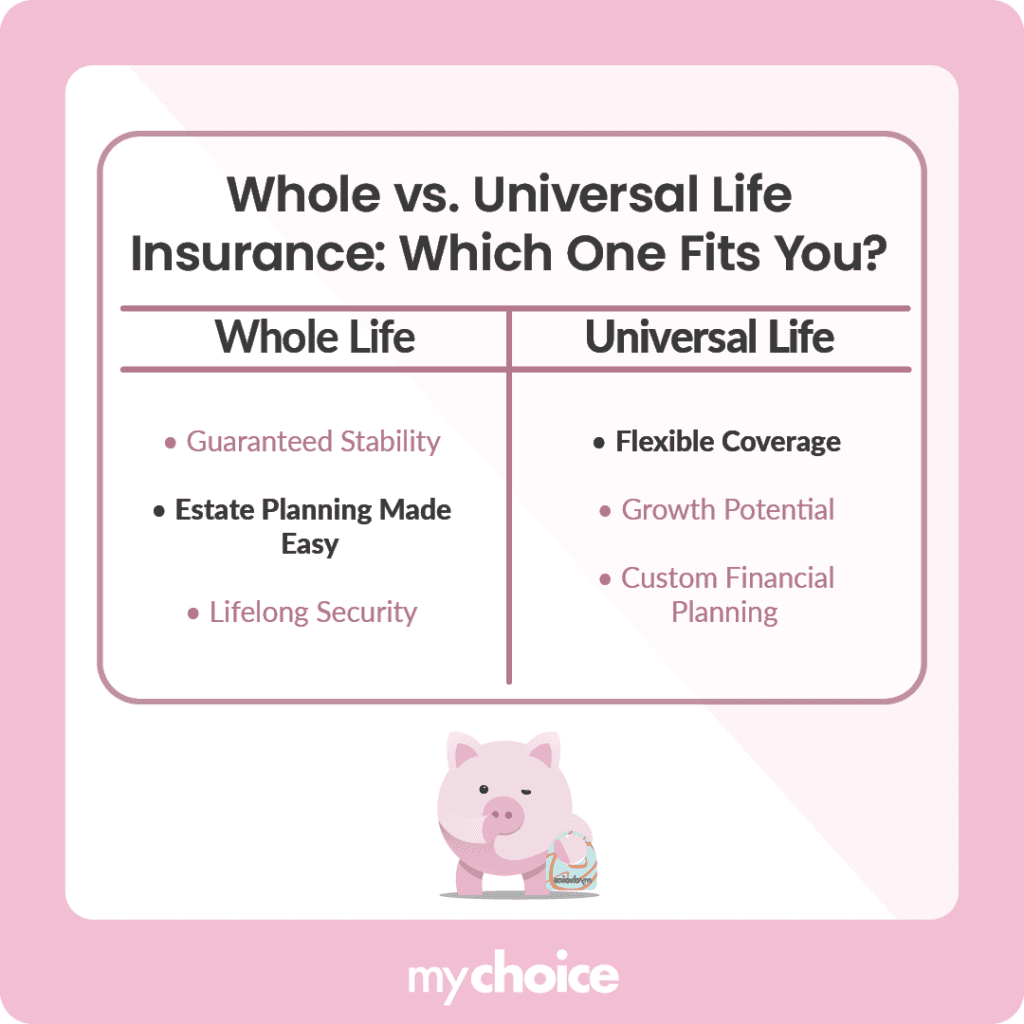

Reasons to Get Whole Life Insurance

Whole life insurance is a compelling option for many individuals because it offers long-term stability and predictable growth. Here are some of the primary reasons to consider whole life insurance:

Reasons to Get Universal Life Insurance

Universal life insurance is ideal for those who appreciate flexibility and the potential for increased returns. Consider these reasons when evaluating universal life insurance:

Which Policy Type is Better for Me? A Short Quiz

It can be a bit overwhelming trying to decide which type of life insurance policy is right for you, especially if you’re unsure about what you’re looking for in a policy. To help you decide, we’ve prepared a short quiz with yes or no questions designed to give you more insight into your risk appetite and financial goals:

- Question 1: Are you looking for a policy with fixed, predictable premiums?

- Yes: You might lean towards whole life insurance.

- No: Universal life insurance can be more flexible.

- Question 2: Do you prefer a guaranteed rate of cash value accumulation, even if it’s lower?

- Yes: Whole life insurance could be a better option for you.

- No: You may be comfortable with the variable growth offered by universal life insurance.

- Question 3: Is having the ability to adjust your premiums and death benefit important to you?

- Yes: Universal life insurance provides more flexibility.

- No: A stable whole-life policy might be the better choice.

- Question 4: Are you comfortable with some degree of market risk in exchange for potentially higher returns on your policy’s cash value?

- Yes: Universal life insurance might suit your risk appetite and desire for capital growth.

- No: You might prefer whole life insurance’s lower-risk, predictable growth.

- Question 5: Do you have a straightforward estate planning strategy that benefits from a consistent death benefit?

- Yes: Whole life insurance offers a stable death benefit for a consistent plan.

- No: Universal life can offer you better flexibility if you have more complex estate planning needs.

If your answers leaned more towards whole life, you’re probably looking for a consistent and steady financial plan and safety net for your loved ones. Conversely, if your answers leaned more towards universal life, you may appreciate a more adjustable life insurance policy with a higher cash accumulation rate.

Key Advice from MyChoice

- Whole life insurance comes with steady growth and predictable premiums, while universal life can expose you to more risk in exchange for a higher return.

- Review your life insurance policy regularly, especially after a significant life event like a marriage, divorce, or the birth of a new child. Ensure you have enough coverage to support your loved ones after you pass.

- You can compare policy terms and premium quotes from the top life insurance providers by using MyChoice’s free comparison tool.