Purchasing car insurance in Canada isn’t just about meeting provincial requirements; it’s about safeguarding your finances when the unexpected happens. For many, the term “full coverage” implies complete security, but is it always necessary? The choice can depend on factors like your vehicle’s age, how much you drive, and whether your lender demands additional coverage.

How much does full coverage insurance cost? Is full coverage different from province to province? Read on to learn about full-coverage car insurance, what it includes, and when it makes sense to have a full-coverage policy.

How Much is Full Coverage Car Insurance in Canada?

When opting for a full coverage auto insurance policy, drivers should be prepared for an increase of 10% to 30% more to their annual premiums compared to the legally mandated minimum coverage. Generally, this would add between $100 and $600 to your yearly insurance rates.

However, the cost of full coverage car insurance varies significantly based on factors such as your province, driving history, age, type of vehicle, and postal code. Some insurers will also bundle collision and comprehensive coverage together, giving drivers a discount on the package. Because of these variables, it can be difficult to know exactly how much full coverage will be for each specific driver. Thankfully, you can use MyChoice’s car insurance calculator to determine an accurate insurance premium for your circumstances.

What Does Full Coverage Car Insurance Cover?

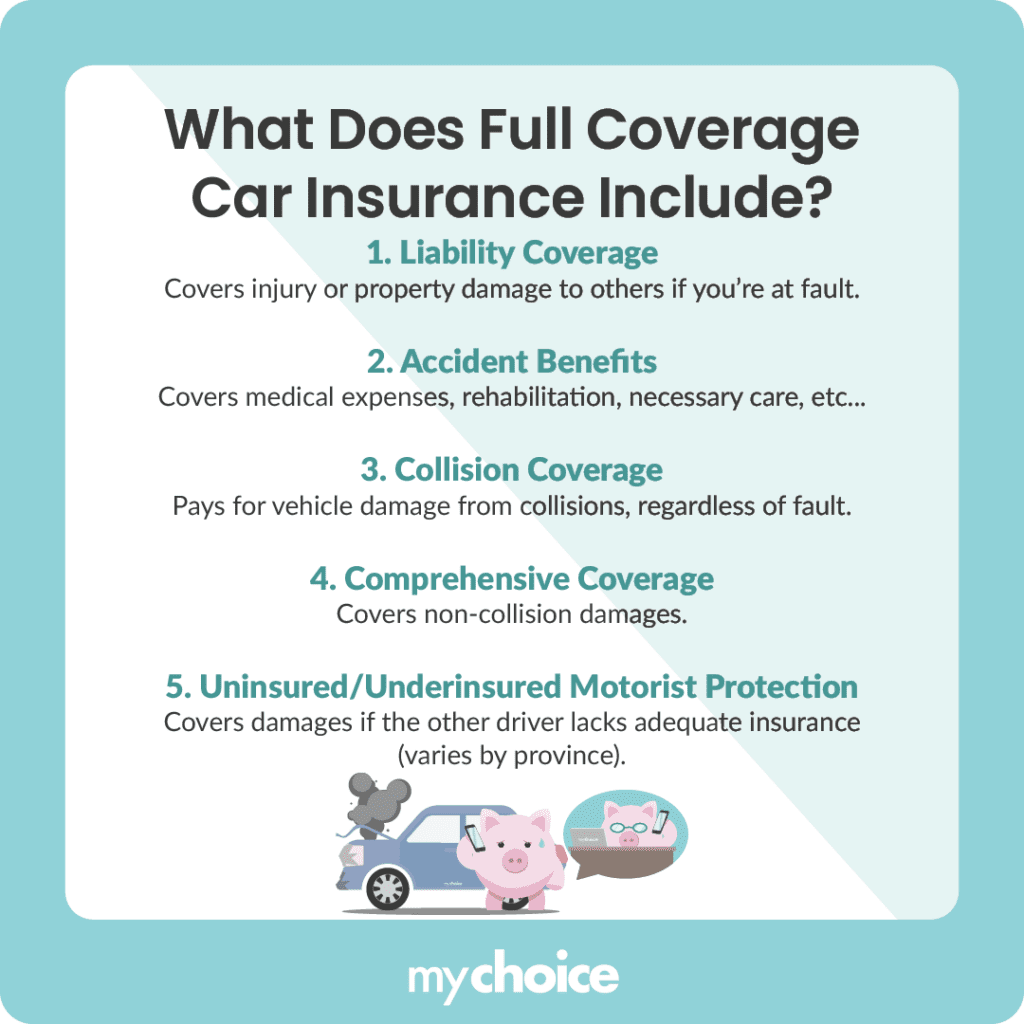

Full coverage generally covers your vehicle from collisions and most other unexpected events. This makes it a more all-inclusive policy compared to purchasing only the legally mandated minimum coverage. However, each insurance provider may have nuances in how they define “full coverage,” so it’s important to review the details of each policy carefully.

Typically, full coverage includes the following:

Provincial Differences

Canada’s provinces have different rules and insurance systems that can significantly affect both coverage and cost. When considering full coverage in any province, always keep in mind that you’ll pay more for collision and comprehensive than for a basic policy. The actual price jump will depend on factors like your location’s claims frequency, crime rates, and road conditions. Here’s how full coverage can differ between each province:

Reasons to Have Full Coverage Car Insurance

There are various reasons why you should consider having full coverage auto insurance. Here are a few reasons why you may need to get full coverage car insurance:

Reasons to Drop Full Coverage Car Insurance

There are also some situations where full coverage may not make sense for you:’

Key Advice from MyChoice

- If you’re leasing or financing your vehicle, lenders or leasing companies generally require collision and comprehensive coverage to protect their financial interest in your car.

- The cost and details of a full coverage policy can differ from province to province. Check with your insurer to determine the specifics of full coverage in your area.

- You can opt for higher deductibles to reduce premiums or choose specific endorsements (OPCF for Ontario citizens) if you’re more concerned about certain types of damage.