The average mileage driven in Canada varies from province to province. Knowing how many miles you drive, and how your mileage stacks up against other drivers, could help you save money – not just on gas and maintenance but on insurance, too.

Read on to learn more about the average distance Canadians drive per year, how much mileage a car can last, and why mileage matters to your car insurance providers.

Average Annual Mileage in Canada

According to the 2009 Canadian Vehicle Survey Summary Report, the most recently published report on Canadian vehicle use, Canadians drove an average of 15,366 km. This is lower than the 2000 average of 16,944 km by 1,578 km but higher than the 2008 average of 15,200 km.

Below is a breakdown of the average km per year travelled by light vehicles in various Canadian provinces:

| Province/Territory | Average Annual Mileage in 2000 | Average Annual Mileage in 2009 | Variation from 2000-2009 |

|---|---|---|---|

| Canada | 16,944 km | 15,366 km | -1,578 km |

| Nova Scotia | 17,005 km | 17,247 km | 242 km |

| Ontario | 16,996 km | 16,196 km | -800 km |

| Alberta | 18,940 km | 16,144 km | -2,796 km |

| New Brunswick | 19,301 km | 16,118 km | -3,183 km |

| Saskatchewan | 17,103 km | 15,338 km | -1,765 km |

| Prince Edward Island | 16,475km | 15,091km | -1,384 km |

| Newfoundland and Labrador | 19,965 km | 15,056 km | -4,909 km |

| Manitoba | 16,044 km | 14,963 km | -1,081 km |

| Quebec | 16,633 km | 14,834 km | -1,799 km |

| British Columbia | 15,077 km | 12,892 km | -2,185 km |

From 2000 to 2009, only Nova Scotia saw an increase in annual mileage. One potential explanation for this is that the province saw the smallest growth in light vehicles for the same time period, meaning that Nova Scotians relied more heavily on their primary or only vehicle. Meanwhile, drivers in other locales may have spread their mileage across multiple cars.

Additionally, Nova Scotia – particularly Halifax, which contains the majority of Nova Scotia’s population – has a large land area and low population density. This encourages higher mileage for drivers in the province.

At What Mileage Should You Replace Your Car?

It’s commonly believed that the average car can last between 200,000 and 300,000 km. However, with today’s technological advancements, more durable builds, and higher-quality materials, a well-maintained car can last an average of 322,000 km. This translates to about ten to 12 years of use.

Electric vehicles also tend to have a shorter lifespan, averaging 200,000 to 250,000 or so kilometres. Meanwhile, some higher-end and luxury vehicles can rack up even more mileage, up to 400,000 km, before needing to be replaced. Aside from mileage, how long your car will last depends on a wide range of factors, such as:

- Driving habits and usage

- Where you mainly drive (e.g., highways, city roads, etc.)

- Weather conditions in your area

- What model and make

- How well and often you maintain it

- Quality of replacement parts (e.g., car battery)

- What type of fuel you use

Ideal Mileage on Used Vehicles

The higher the mileage on a used car, the more likely it’ll have issues. This means it will also be more expensive to maintain and insure. If you’re buying secondhand, look for vehicles with mileage ranging from 80,000 to 100,000 km.

That said, mileage isn’t the only consideration. A high-mileage vehicle could be a better investment than a low-mileage car if it’s well-maintained or a newer model with the latest safety features.

Impact of Mileage on Insurance

While factors like traffic tickets and model/make likely play a bigger role, your average annual mileage can significantly impact your insurance rates. The idea is that the more you drive, the higher the risk of getting into an accident and making a claim. Cars with higher mileage are also more likely to break down and require maintenance or replacement.

If you travel more than the average Canadian, you can expect higher premiums (all other factors being equal). On the other hand, low-mileage drivers can get much cheaper insurance, especially if they opt for pay-as-you-go models. If your average mileage is less than 12,000 km/year, consider checking out CAA MyPace, which charges according to driving time.

Get a car insurance quote from MyChoice for a better understanding of how your mileage is affecting your rates.

How to Estimate Your Mileage

Insurers will ask about your driving habits and mileage when quoting you for an auto insurance policy. Here’s how to estimate your average kilometres per year:

- Calculate your average daily commute. Get the driving distance from your home to your workplace, and multiply it by two. Then, multiply that by the number of days you go to the office. Finally, multiply that by the number of weeks you work (e.g., 52 if you work year-round, 49-50 with holidays). For example:

- 15 km (one way) x 2 = 30 km

- 30 km x 4 days onsite = 120 km

- 120 km x 49 weeks = 5,880 km

- Calculate your average weekend distance. Is there a destination you regularly travel to on your days off? Factor both short and long frequent drives into your mileage. For example:

- 200 km (one way) x 2 = 400 km

- 400 km x 4 visits per year = 1,600 km

- Add your average commute distance and average weekend distance.

- 5,880 km + 1,600 km = 7,480 km

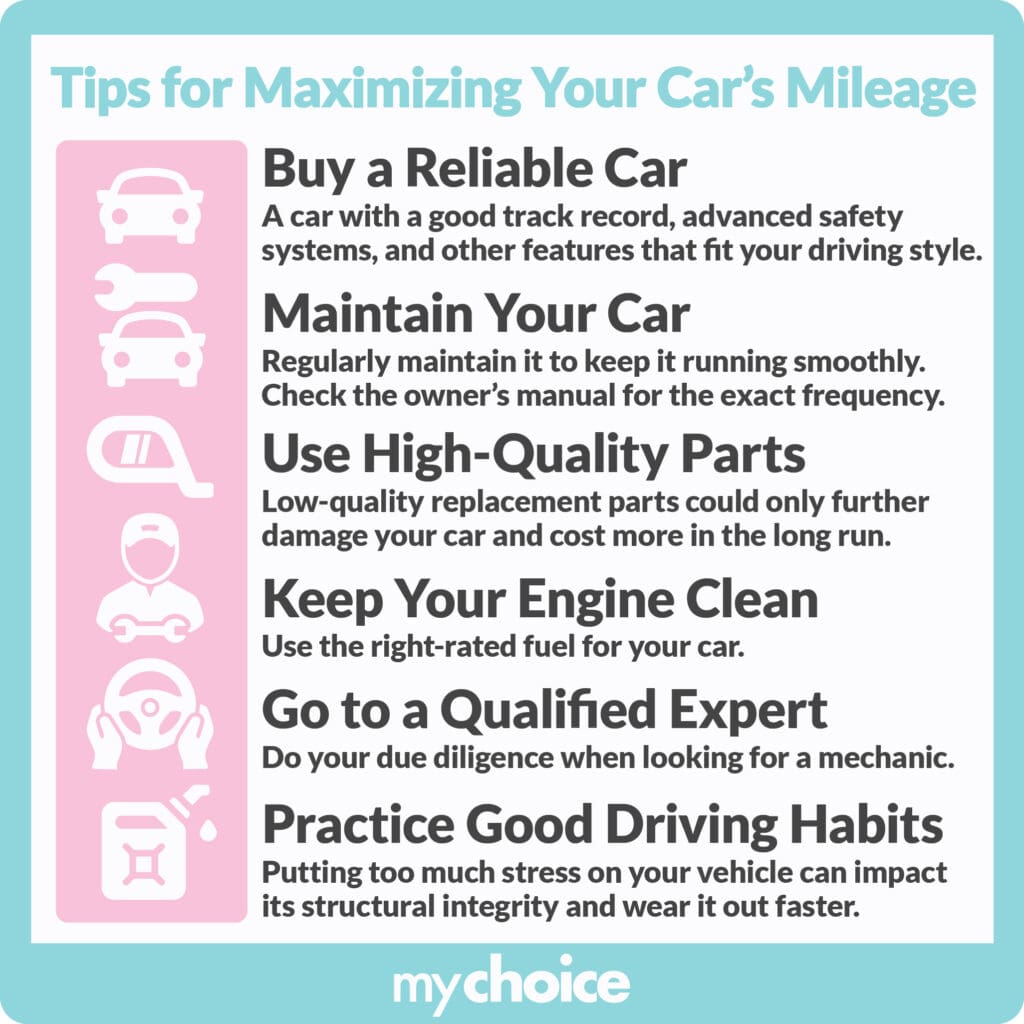

Tips for Maximizing Your Car’s Mileage

There are many ways you can make your car last longer, save on the costs of repairing or replacing your vehicle, and potentially get lower insurance rates – even with higher mileage. Here’s how:

- Buy a reliable car with a good track record, advanced safety systems, and other features that fit your driving style.

- Regularly maintain your car to keep it running smoothly. Check the owner’s manual for the recommended maintenance frequency for your make and model.

- Only use high-quality replacement parts. While you might save a few dollars by opting for cheaper alternatives, low-quality parts could further damage your car and cost more in the long run.

- Keep your engine clean by using the right-rated fuel for your car (e.g., high octane for premium vehicles).

- Do your due diligence when looking for a mechanic. A qualified expert will be able to spot issues before they snowball and make sure the repairs are done right.

- Practice good driving habits, especially during dangerous conditions like heavy snow or rain. Putting too much stress on your vehicle can impact its structural integrity and wear it out faster, even without adding to your odometer. Driving slower and smoother can also improve your fuel economy.

Key Advice From MyChoice

- Be as accurate as possible when providing your insurer with your annual mileage. If you overestimate your driving distance, you’ll overpay for insurance. If you underestimate your mileage and your insurance company finds out, you’ll have a harder time getting insured in the future.

- Consider getting a pay-as-you-go policy if you drive less than 12,000 km a year. Instead of a fixed rate, this type of insurance is priced according to your driving time.

- If your driving habits have changed since you got your policy, contact your insurer. You could get a discount on your insurance with lower mileage.