When taking out a home insurance policy, many homeowners may be confused by the coinsurance clause. Most people might be familiar with coinsurance in the context of health insurance – where a policyholder pays a percentage of medical expenses after meeting a deductible – but it functions differently in home insurance. The coinsurance clause requires policyholders to share in the cost of a claim if they have not met a predetermined level of coverage.

What does coinsurance mean for your home insurance policy? Are there big penalties for not meeting the coinsurance value? How do you calculate coinsurance penalties? Read on to learn everything you need about coinsurance in home insurance.

What Is Coinsurance in the Context of Home Insurance?

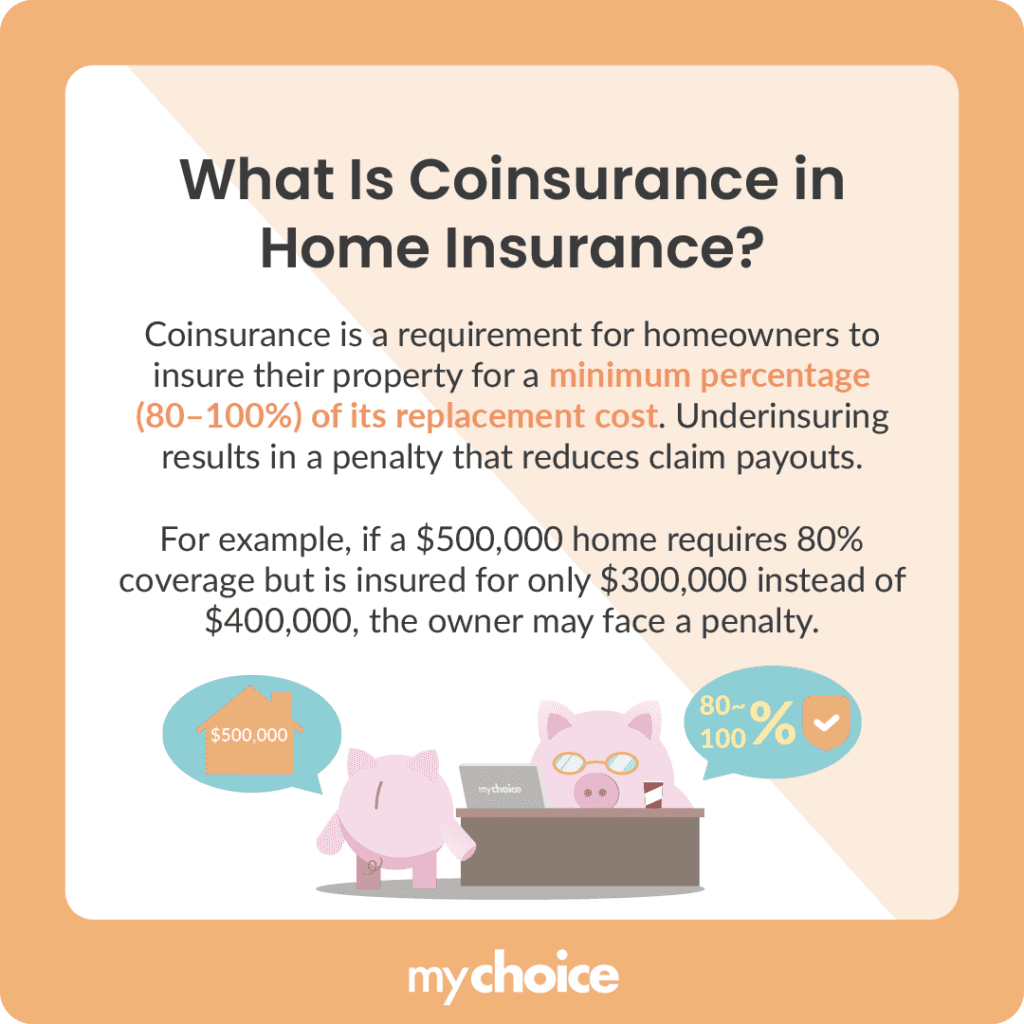

In the context of home insurance, coinsurance is a clause that requires homeowners to insure their property for a minimum total percentage of its total replacement cost. This is typically noted in percentages, usually 80%, 90% or 100%. If the home is underinsured when a homeowner files a claim, the insurance company will issue a penalty, resulting in a reduced payout. This clause discourages underinsurance and ensures that homeowners carry sufficient coverage to rebuild their property in the event of a loss.

Unlike co-pays in health insurance, which require a fixed out-of-pocket amount per visit, home insurance coinsurance checks whether a policyholder is adequately insured when a claim is filed. The penalty comes into effect only if the policyholder is underinsured, leaving the homeowner to pay for a percentage of the damages themselves.

For example, say that your home’s total replacement cost is $500,000 and your policy requires at least 80% coverage. You must insure your home for at least $400,000 to get the maximum claim value. If you choose to insure it for only $300,000, you may face a coinsurance penalty when filing a claim.

What is the Coinsurance Formula?

What happens when you file an insurance claim with coinsurance while your home is underinsured? Insurance companies follow the coinsurance formula to calculate the penalty and the payout you’ll receive. The formula is as follows:

- (Insured value of the property / Required insurance amount) * Loss amount = Payout amount

Let’s look at a practical example of the coinsurance formula in action, assuming the following factors:

- Your home has a total replacement cost of $500,000.

- Your policy includes an 80% coinsurance clause. This means you must insure your home for at least $400,000.

- You’ve chosen to insure your home for $300,000, meaning you’re underinsured.

- A covered peril causes $200,000 in damages to your home.

Here’s how the formula would be applied:

- ($300,000 / $400,000) * $200,000 = $150,000

In this example, the insurance company will only pay out $150,000, leaving you responsible for the remaining $50,000. If your policy includes a deductible, you must pay that before receiving the payout.

When Can You Face a Coinsurance Penalty?

Coinsurance penalties can be a pain to deal with, especially when you’re not aware of when you’re at risk of facing one. Here are the conditions where you can face a coinsurance penalty:

It’s a good idea to review and update your homeowner’s insurance policy whenever your home’s replacement value changes. If you fall below the required coverage level, you may expose yourself to unnecessary financial risk.

Why Underinsuring Your Home Is Risky

Many homeowners purposely underinsure their properties to save money on premiums. However, this strategy can seriously backfire if you need to file a claim. Here are some of the risks you take when you underinsure your home:

Can Coinsurance Clauses Be Removed or Waived?

While some insurance providers offer endorsements or policy options that remove coinsurance clauses, they are not always available or cost-effective. Some insurers will offer an agreed amount clause, in which the insurer agrees to waive the coinsurance requirement in exchange for insuring a house for its actual cash value (ACV). ACV is determined by calculating the replacement cost minus the depreciation value at the time of loss. This usually requires a signed statement of values and prevents the policyholder from contesting the amount of coverage in the future.

Many insurance providers will also offer guaranteed replacement cost coverage, which covers the full cost of repairing or replacing your home, even if the value exceeds the replacement cost limit stated in your policy. However, this type of insurance requires you to insure your home for 100% of the replacement cost instead of the lower percentage values in coinsurance. This type of coverage ensures that your home’s value will be fully covered in a claim, but it entails higher premiums.

Key Advice from MyChoice

- Regularly review and update your home insurance policy to ensure that you’re always insured for the right coinsurance percentage.

- Before taking out a home insurance policy, make sure to get your home appraised by a professional to estimate its total replacement cost properly.

- Inflation, home renovations, additions, and repairs can change your home’s replacement cost, which can increase the amount of coverage required for coinsurance.