A new car is a big investment that comes with plenty of expenses, such as upkeep and potential loan repayments. These expenses are all part and parcel of keeping your car well-maintained and safe to drive.

But one expense that you may not be ready for is its replacement if your car gets stolen or damaged beyond repair. Luckily, a depreciation waiver can help you cover this cost.

In this article, we’ll walk you through what a depreciation waiver is and who can buy one to protect their car. We’ll also explain what isn’t covered by a depreciation waiver, and why this optional endorsement is worth getting.

What Is a Depreciation Waiver?

A depreciation waiver is an optional endorsement that places a set value on your car for a certain period. Typically this period lasts for one to three years after you buy it. If your car is damaged beyond repair or lost during the waiver period, the company will reimburse you whichever of the following is the lowest value:

- The value you paid for your vehicle

- The manufacturer’s list price

- The cost of replacing your vehicle with similar options and equipment

Some car insurance companies also offer an additional option to this waiver, where in the event of a partial loss, you’re guaranteed that damaged parts are replaced with genuine manufacturer parts instead of generic extras.

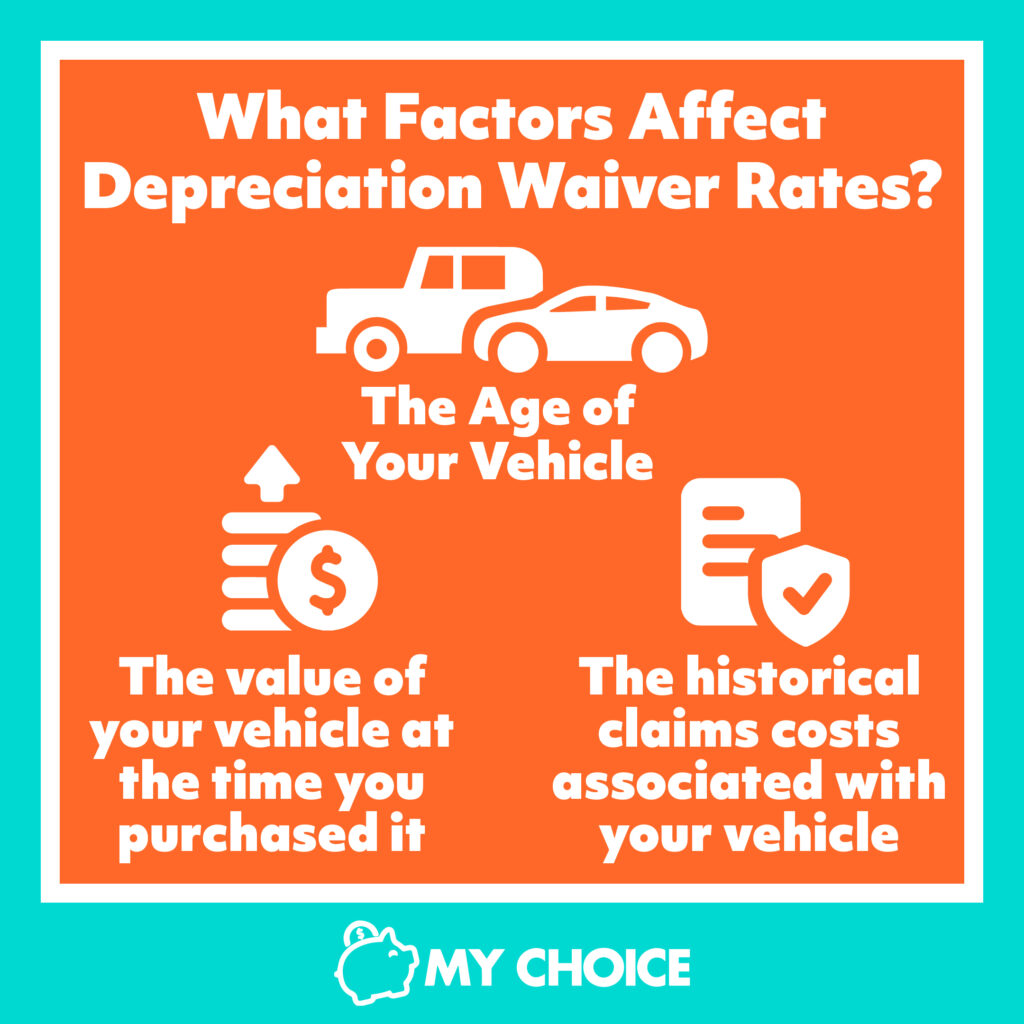

What Factors Affect Depreciation Waiver Rates?

While some car insurance companies may offer a flat premium for all vehicles, others may take the following into consideration when computing your rates:

- The age of your vehicle

- The value of your vehicle at the time you purchased it

- The historical claims costs associated with your vehicle

Generally, the older your car and the higher its price, the higher your depreciation waiver premiums will be. Compare car insurer offers with MyChoice to find the best optional coverage deals for your budget.

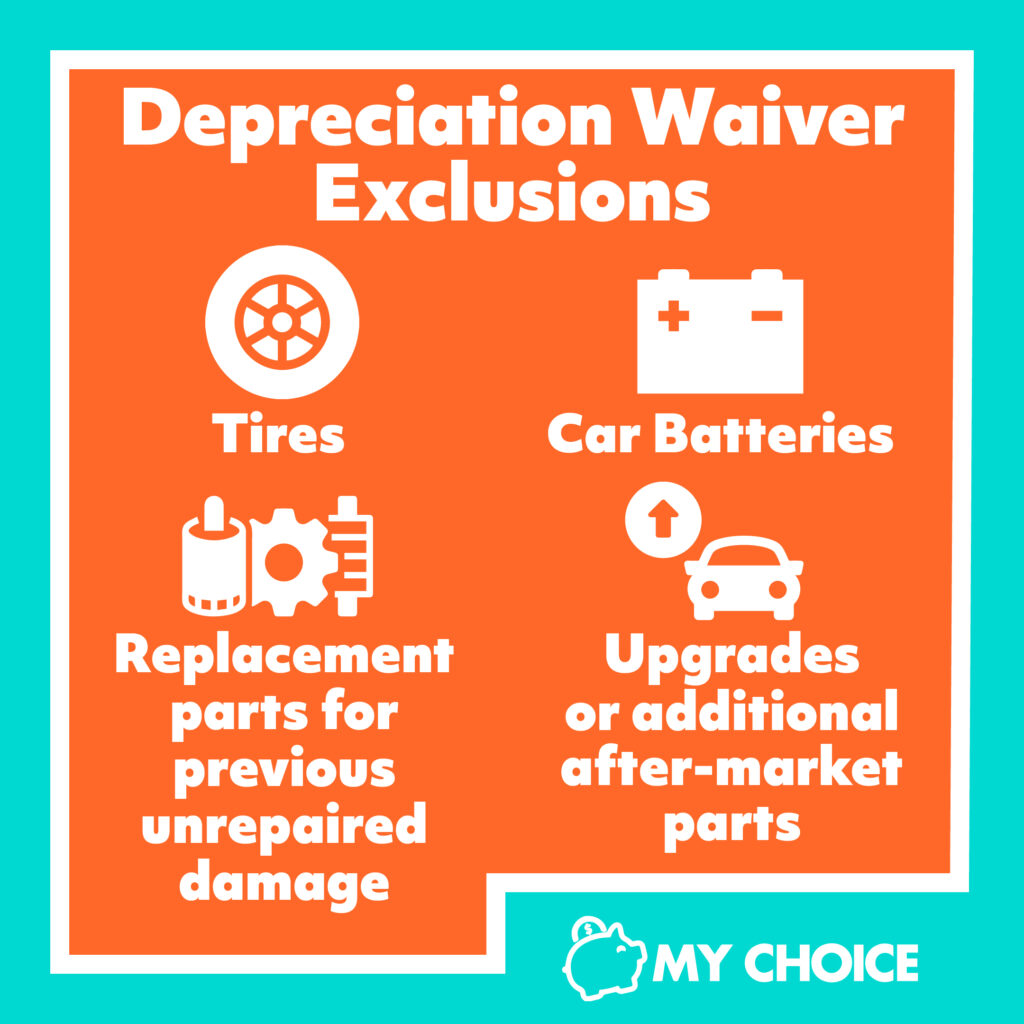

Depreciation Waiver Exclusions

A depreciation waiver is a separate add-on to your car insurance policy, so you’ll still have to pay your car insurance premiums if you get one. Note that the following items aren’t included in a depreciation waiver endorsement:

- Replacement parts for previous unrepaired damage

- Tires

- Car batteries

- Upgrades or additional after-market parts

Who Can Buy a Depreciation Waiver?

Depreciation waivers are only offered to a vehicle’s first owner. This means that depreciation waivers are not available for those buying a secondhand car, no matter how much it’s worth or what condition it’s in. So, if a vehicle was given as a gift or sold, this changes its ownership and the succeeding owner is ineligible for a depreciation waiver.

Note that a limited waiver of depreciation is typically only offered by car insurance companies for newer vehicles. If a car is three years old or older, you may not be able to get a waiver on it.

Why Should I Buy a Waiver of Depreciation?

Depreciation is one of the important costs of owning a car. Houses appreciate in value over time, but your new car starts depreciating the minute you drive it off the dealership lot.

While you’re not actually paying anything, your car is losing value. Unfortunately, this means that if you lose your new car due to damage from an event like theft or a storm, your car insurance policy will only reimburse you the depreciated value.

On average, a new car goes down in value by up to 20% within its first year of use, so your policy claim may not be enough to get you a similar new car. Having a depreciation waiver endorsement allows you to recover the car’s value or replace it with a vehicle that’s similar in make and model.

Do I Need a Depreciation Waiver for Car Insurance?

You don’t need a depreciation waiver for car insurance, but it’s an add-on that can save you a lot of stress and money in the long run. If you only get the actual value of your depreciated car instead of its original purchase value, you may have problems buying a replacement.

It gets even worse if there’s still a lien on your damaged car, as you have to repay the lienholder with the original value. This means you’d have to answer for a price difference that you may not be able to afford.

Think of a depreciation waiver as added protection to the coverage already given by your policy. If you’re interested in getting extra coverage but aren’t eligible for a depreciation waiver, consider getting all-perils insurance instead.

The Bottom Line

Having your new car stolen or damaged beyond repair can be a huge financial blow. But if you have a waiver of depreciation, you’ll be able to quickly replace it with a similar one without fretting about the cost.

If you’re eligible for a depreciation waiver, MyChoice can help you compare car insurance company policies so you can find the best match for your budget.