Life insurance doesn’t just provide a financial cushion in case of your death – it can also make for an intelligent investment move. If you’re looking for a policy that offers peace of mind and helps grow your wealth, a variable life insurance policy may be for you. Learn how it works and what you need to consider before getting one.

What is a Variable Life Insurance Policy?

A variable life insurance policy is permanent life insurance with an investment component. Upon your death, it pays a specified amount to the named beneficiaries. The cash value component is invested in assets like mutual funds, which can rise or fall.

Like any life insurance policy, variable life insurance requires that policyholders pay monthly premiums. You can access the cash value component anytime to pay for major expenses. For instance, most Canadians struggle to cover the average mortgage payment of $3,524 for a 25-year payment plan, but the cash value component of a variable life insurance policy can help cover this.

Example of How Variable Life Insurance Works

Suppose your variable life insurance policy has an initial premium payment of $250,000, and you invest half your premiums ($125,000) in a mutual fund. After two years, the mutual fund grows by 5% ($6,250), giving you a total cash value component of $131,250.

The Key Characteristics of a Variable Life Insurance Policy

A variable life insurance policy offers the following features.

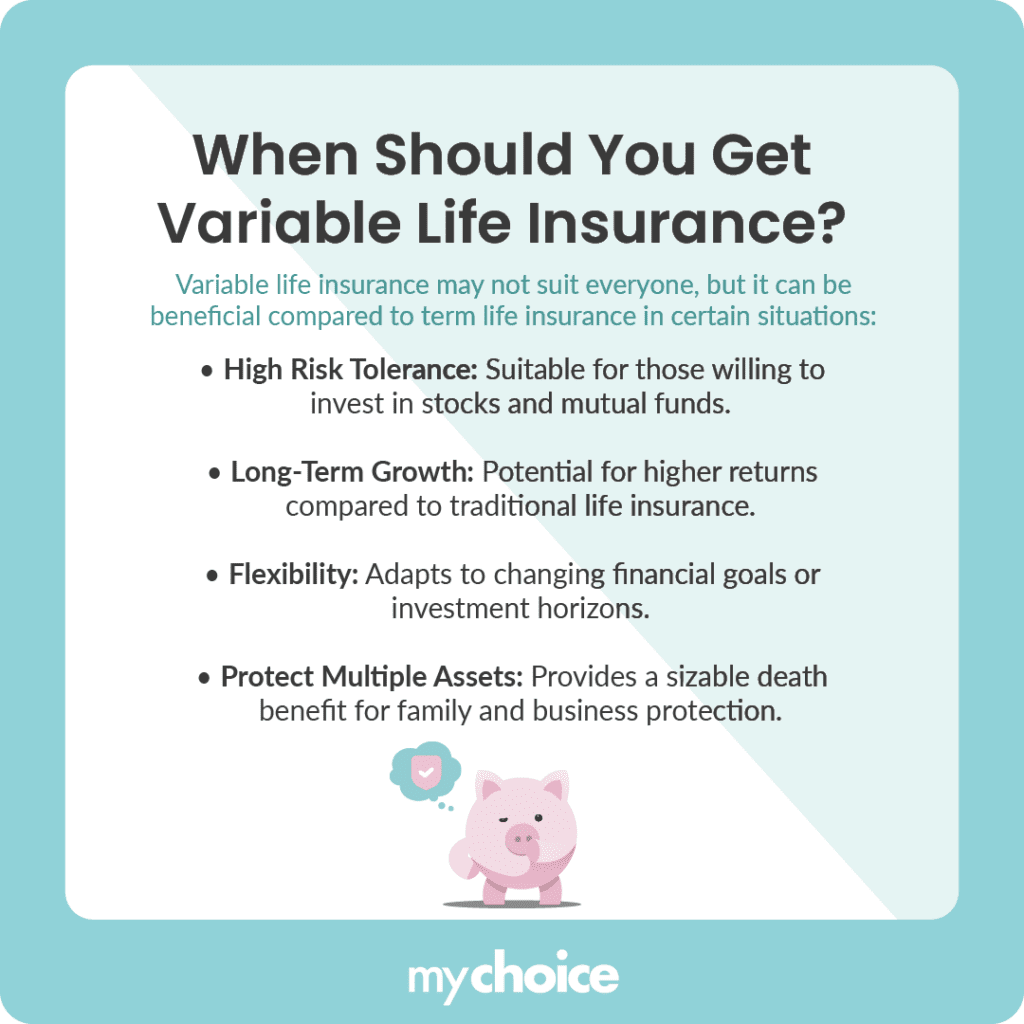

When Should You Get Variable Life Insurance?

Variable life insurance isn’t for everyone, but there are instances in which it can benefit you over a term life insurance policy.

Considerations for Getting Variable Life Insurance

While a variable life insurance policy may be attractive because of its cash component, it isn’t for everyone. Here are some instances in which variable life insurance may not be the best choice:

- You need a short-term savings vehicle and need to access money fast.

- You can’t afford to pay the premiums, typically more expensive than term life insurance. The policy fees can also become a liability, especially if you must pay surrender charges.

- You can’t review the investment option’s prospectus. Investing in a high-risk, high-reward profile will make your funds extremely volatile.

- You can’t handle a complex policy. Compared to term life insurance, variable life insurance has many moving parts that require constant review and management. You may need to spend additional time on this policy.

Alternatives to Variable Life Insurance

If you find that a variable life insurance policy doesn’t suit your needs, you can consider these other options:

- Term life insurance: best for individuals needing temporary coverage over a specific period to pay off a mortgage, significant family expense, or provide for a child’s education

- Whole life insurance: best for individuals needing a guaranteed death benefit payout and who want a similar cash value component but don’t mind lower returns

- Universal life insurance: best for individuals needing a flexible premium payment structure but who value stability

Key Advice from MyChoice

- Before getting a variable life insurance policy, always determine whether you can dedicate more time and effort to it. If you want it for the cash component, set clear financial goals to decide whether your investment is sustainable and worthwhile.

- Have more than one investment option and discuss these options with your insurance provider.

- Consider whether you need additional insurance features, such as a disability rider that keeps your policy in force if you become disabled and can’t pay your fees. Other options include an income benefit, paid out monthly, and no-lapse features that keep your policy active if you don’t have sufficient account value to pay your premiums.

- Review the policy’s look period or when you can cancel the policy without a charge and get your premiums back. Most companies have a ten-day look period, but this may vary.