In early 2025, U.S. President Donald Trump announced a 25% tariff on steel and aluminum imports, sending shockwaves through many sectors, including Canada’s insurance industry. While most of the conversation has revolved around manufacturing and trade, these tariffs have a trickle-down effect that may heavily affect the insurance market.

MyChoice’s COO, Matthew Roberts, provides a unique insight on how the tariff situation will impact insurance costs in the country: “There’s no doubt that U.S. tariffs will impact the Canadian insurance industry in both the auto and property segments. Steel and aluminum are crucial for car manufacturing as well as structural support and roofing in home construction. As material costs rise, so do the repair and rebuilding expenses – inevitably driving up car and home insurance premiums. Moreover, on the home insurance side, insurers may tighten underwriting or reduce coverage in disaster-prone areas, where elevated replacement costs and frequent natural disasters could create a perfect storm for even steeper premium hikes.”

Read on to learn how exactly the new tariffs will impact policyholders and consumers and what steps you can take to prepare for these changes.

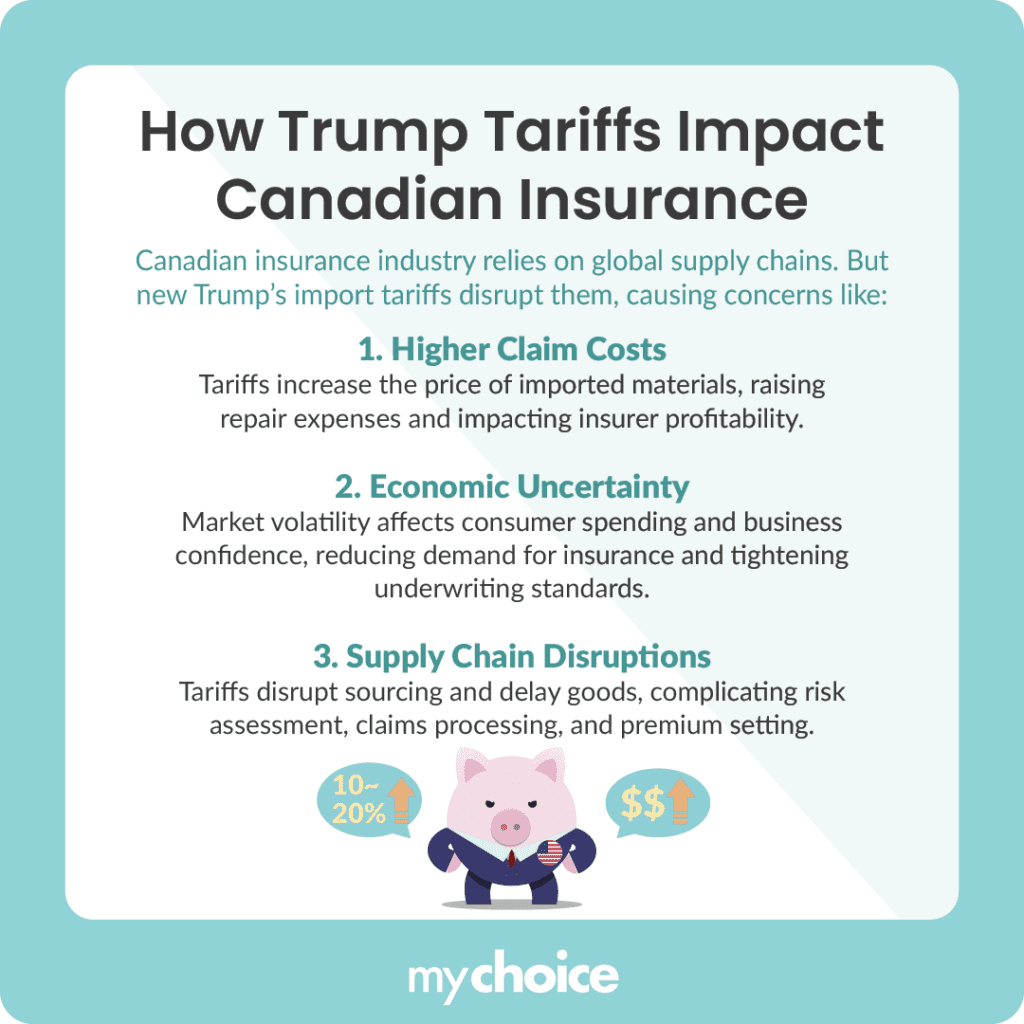

Why Tariffs Are a Concern for the Canadian Insurance Industry

The Canadian insurance industry is closely involved with global supply chains and economic activities. Tariffs disrupt these chains, leading to several concerns, such as:

The Consequences for Carriers & Policyholders

The imposition of Trump’s tariffs significantly affects policyholders and insurers alike. This can lead to new challenges and standards that both groups must compensate for.

How Tariffs Could Impact Premiums and Claims

The effects of tariffs on insurance premiums and claims can be mainly felt in sectors closely associated with imported materials, particularly auto, property, and commercial insurance. Here’s how these tariffs affect each insurance sector:

Key Advice from MyChoice

- With potential premium increases on the horizon, insurance policyholders should review current coverage needs and adjust insurance deductibles or coverage limits to manage costs.

- If your insurer is hiking up premiums, compare similar policies between providers to find the best deal that keeps you adequately covered.

- Insurance premium raises can be offset by bundling multiple policies under one provider, having a clean claims history, and maintaining a respectable driving record.