Many Canadian townhouses have an association that handles monthly upkeep and commonly used areas like sidewalks, offering residents an opportunity to enjoy the convenience of condo renting and the control of home ownership in one. However, sharing characteristics with both condo units and freestanding homes has caused some confusion about which type of insurance a prospective owner may need.

Should townhouse owners get a condo insurance policy or a home insurance policy to cover their townhouse? Keep reading to learn more about different types of townhouses, the difference between condo and home insurance, and what affects the average cost of townhouse insurance in Canada.

Differentiating Types of Townhouses by Ownership and Construction

Townhouses come in different forms based on their ownership structure and architectural design. Understanding these differences is crucial as they distinguish whether you will need condo insurance or home insurance to cover your townhouse.

| Type | Ownership structure | Maintenance responsibilities | Common areas | Cost implications |

|---|---|---|---|---|

| Stacked | Can be condo or freehold | Depends on ownership structure | Shared, if part of a condo | Generally lower than freehold |

| Condo | Condo ownership | Managed by condominium association | Shared | Monthly fees, typically in the form of association dues |

| Freehold | Full ownership | Solely on the owner | None | No monthly fees |

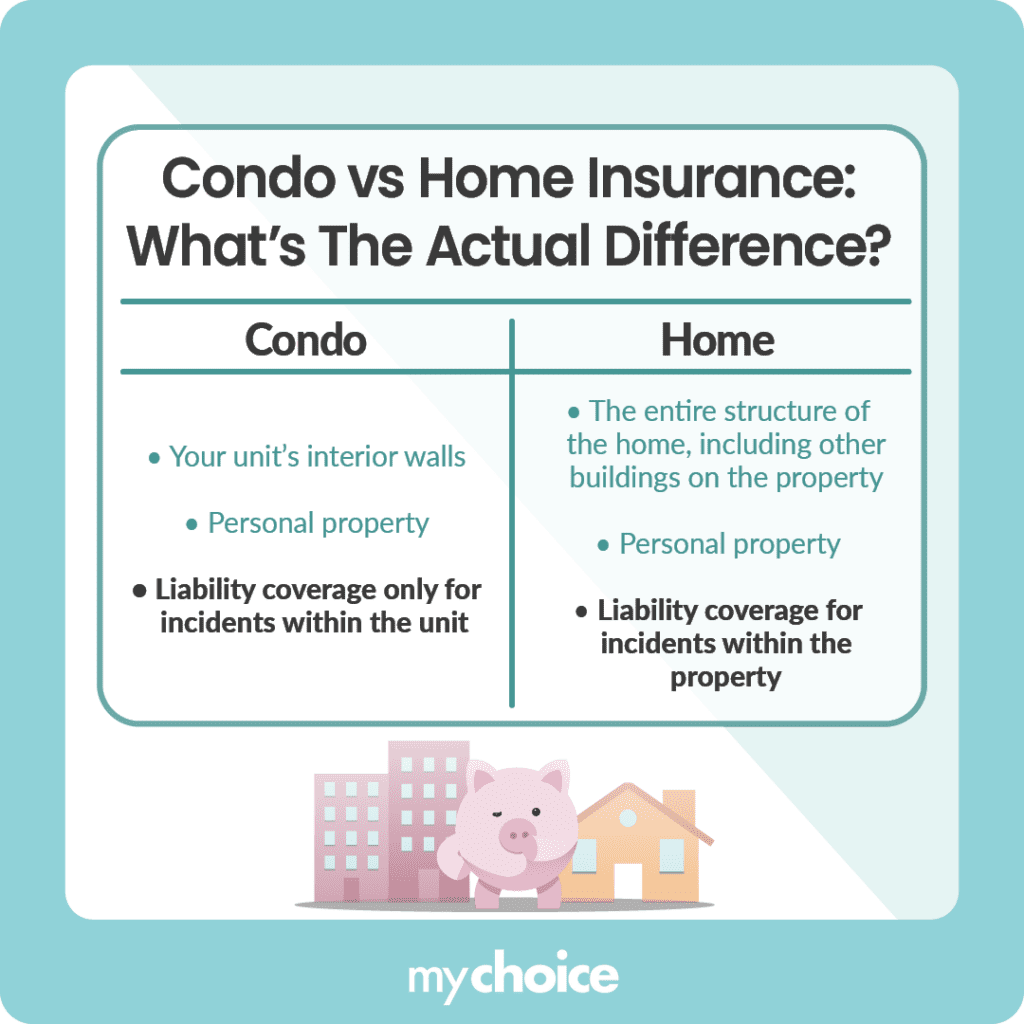

Condo vs Home Insurance: What’s The Actual Difference?

The main difference between condo and home insurance lies in what structures are covered. Here’s a quick comparison of their differences based on key considerations:

Average Townhouse Insurance Costs in Canada

The average premium for home insurance in Canada ranges anywhere from $700 to $1,200, depending on factors like location, individual risk profiles, and the type of home. For example, the average annual home insurance premium in Ontario is $1,155, compared to $718 for Newfoundland. Note that this may be lower for townhouses because of their typically smaller size and shared walls with other units.

Townhouse insurance cost depends on factors such as:

To get an accurate estimate of your townhouse insurance costs, it’s best to first confirm if you need condo or home insurance, then compare quotes from multiple insurers.

Key Advice from MyChoice

- If your townhouse is part of a homeowner or condominium association, obtain a copy of the master insurance policy and review it. This will clarify what’s covered and what additional coverage you may need.

- Regardless of the type of insurance you need for your townhouse, you need adequate liability coverage. Check if your policy’s liability coverage provides enough protection in case someone is injured on your property or in your townhouse.

- Condo insurance isn’t mandatory in Canada, but it may still be a financially sound investment to address gaps in your condo association’s master policy coverage. For example, you may have made improvements like marble countertops with a value that exceeds the covered amount of the original build’s countertops in the master policy. Getting additional condo coverage for your townhouse ensures that if replacement is needed, the value of these improvements will be covered.