MyChoice Reveals the Top 20 Flood-Prone Cities in Ontario and the Correlation with Planned Infrastructure Projects

Flooding has become a growing problem in Canada. According to the Insurance Bureau of Canada (IBC), severe weather in 2023 caused over $3.1 billion in insured damage nationwide. This year’s July flash floods in Toronto and southern Ontario alone caused over $940 million in insured damage. These extreme weather events reflect the increasing frequency and intensity of climate-related disasters in Canada, putting significant strain on insurers and adjusters alike. Canadian Climate Institute claims that a whopping 10% of households – 1.8 million – are currently at a very high risk of flooding. Moreover, it seems increasingly likely that the flooding trends across the country will not get any better in the next few decades. According to the most recent study from the Journal of Hydrology on flooding projections in Canada all the way into 2080, an increase in the probability of summer flooding was observed, especially in the province of Ontario.

In light of this alarming trend, our team at MyChoice, a leading insurance comparison platform in Canada, has conducted this study to identify the areas in Ontario most vulnerable to flooding. Our research also evaluates the current and future infrastructure projects implemented by the government to mitigate flood risks and improve preparedness across the province.

For the purpose of our analysis, we utilized data from the flood susceptibility index dataset across Canada, published by the Government of Canada, Natural Resources Canada and Strategic Policy and Innovation Sector. By extracting and processing the coordinate data from this dataset, we were able to pinpoint which cities in Ontario are most susceptible to flooding. Our study incorporated a range of critical factors, including meteorological conditions (such as daily precipitation and mean annual rainfall), hydrography (i.e. distance to rivers and drainage density), geology and ecology (i.e. land use and soil moisture), terrain characteristics (such as slope and elevation), and urban infrastructure (i.e. road density). These variables allowed us to perform a detailed assessment of flood risks in urban areas. For a comprehensive list of all variables and a deeper dive into the methodology used, please refer to this research paper.

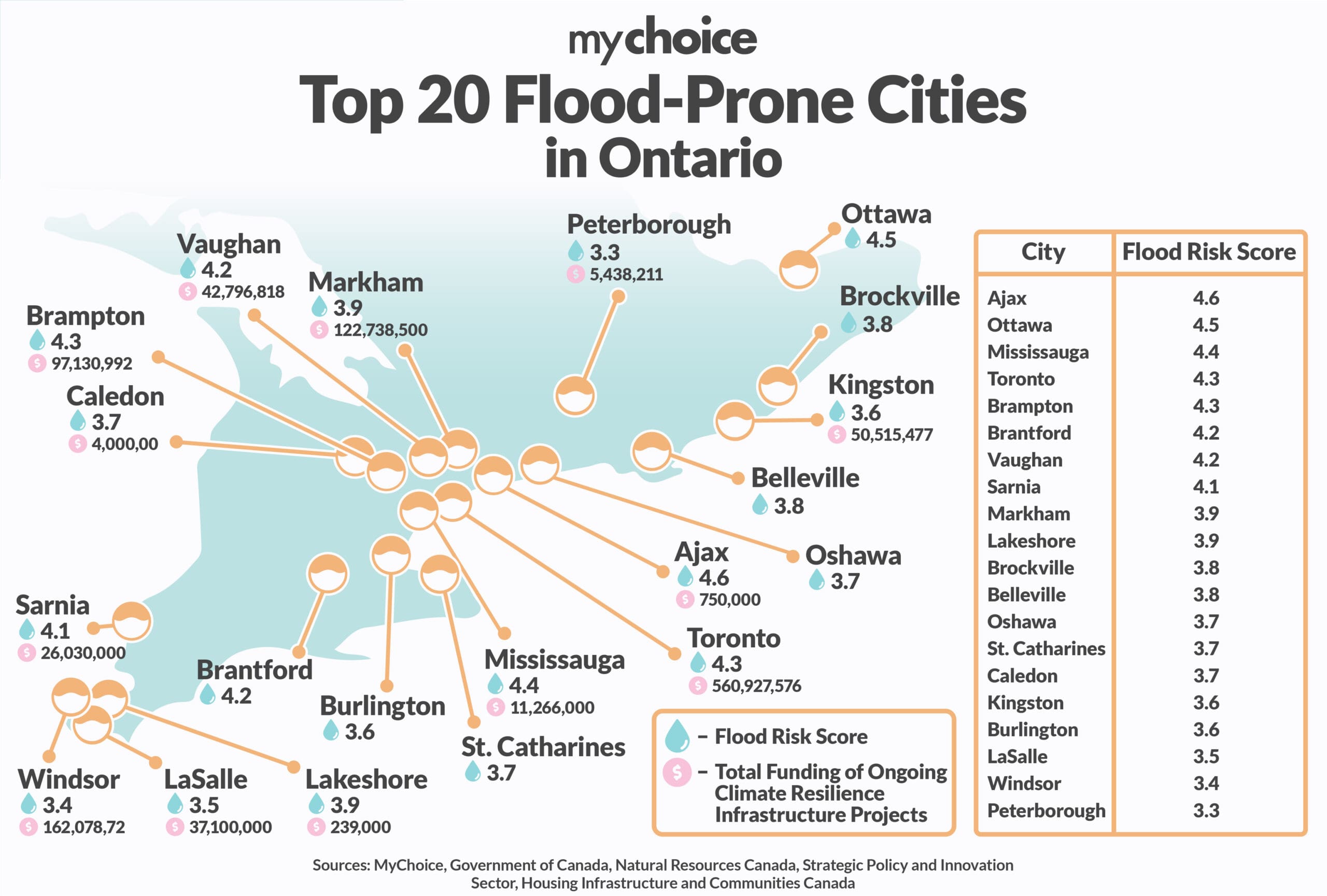

Based on our analysis, we assigned each city a flood risk score on a scale of 1 to 5. Using the coordinate data corresponding to the flood-prone areas, we calculated the extent and concentration of high-risk zones within each city. The results are telling. Cities like Ajax (4.6), Ottawa (4.5), Mississauga (4.4), and Toronto (4.3) top the list of Ontario’s most flood-prone areas, highlighting a significant concentration of at-risk municipalities in both the Greater Toronto Area and Eastern Ontario. These cities are characterized by dense populations, extensive infrastructure, and increasing urbanization – factors that exacerbate their flood vulnerability. Other cities like Brampton (4.3), Brantford (4.2), and Vaughan (4.2) also scored high, reflecting the widespread nature of the flood risk across the province.

The infographic below shows the top 20 flood-prone cities in Ontario and the total cost of the ongoing infrastructure projects in each area.

This study emphasizes the need for proactive flood mitigation efforts in Ontario’s most vulnerable cities. Our team looked at the current and future climate resilience infrastructure projects in Ontario aimed at enhancing stormwater management, flood defences, and emergency preparedness for areas that are prone to flooding. We assessed whether the government’s funding allocation and response to these flooding challenges align with the high-risk areas identified in our study. While the high-risk cities such as Toronto, Ottawa, and Mississauga – previously identified as having significant flood vulnerabilities – are receiving substantial funding for flood defence and mitigation projects, there are areas where the response could be more assertive. For instance, regions like Ajax and Brampton, which have been identified as highly vulnerable, do not appear to receive the same level of investment at the moment. This suggests that while the government’s response is generally in line with the identified risks, there may be gaps that need addressing to ensure comprehensive flood protection across all high-risk areas.

| Municipality | Total Cost of Climate Resilience Infrastructure Projects ($) | Estimated Completion Date |

|---|---|---|

| Toronto | $560,927,576 | March 31, 2032 |

| York | $251,308,000 | March 31, 2028 |

| Windsor | $162,078,727 | December 31, 2032 |

| Kitchener | $125,073,000 | December 31, 2031 |

| Markham | $122,738,500 | December 31, 2031 |

| Brampton | $97,130,992 | March 31, 2028 |

| London | $83,590,000 | December 31, 2027 |

| Kingston | $50,515,477 | March 31, 2033 |

| Sarnia | $46,290,000 | January 31, 2028 |

| Vaughan | $42,796,818 | December 31, 2027 |

| Chatham-Kent | $41,438,000 | December 31, 2031 |

| LaSalle | $37,100,000 | September 1, 2027 |

| Thunder Bay | $33,123,000 | December 31, 2027 |

| Hamilton | $31,715,000 | December 20, 2027 |

| Greater Sudbury | $22,100,000 | December 31, 2026 |

| Mississauga | $11,266,000 | December 31, 2024 |

| Peterborough | $5,438,211 | November 1, 2024 |

| Caledon | $4,000,000 | Completed |

| Ajax | $750,000 | Completed |

| Newmarket | $417,888 | Completed |

| Aurora | $382,306 | Completed |

| Innisfil | $270,000 | Completed |

| Lakeshore | $239,000 | Completed |

| Guelph | $147,500 | Completed |

| Milton | $100,000 | Completed |

| Centre Wellington | $24,424 | Completed |

In light of these worsening weather conditions in Ontario, having the right home insurance coverage has never been more important. Aren Mirzaian, CEO of MyChoice, offers commentary on the subject:

“Unfortunately, many homeowners are still under the misconception that their standard insurance policies provide sufficient protection against floods,” says Mirzaian. “Sewer back-up coverage and overland water insurance are not included in most basic plans but are crucial add-ons for adequate protection. As insurance options vary widely, it’s important to shop around and obtain quotes from multiple providers to ensure you’re getting the right coverage for your specific needs. It’s also recommended that homeowners with basements invest in a sump pump and a reliable backup system to help prevent water damage during heavy rainfall or flooding. Taking proactive steps like this, along with ensuring you have the appropriate insurance coverage, can make a significant difference when disaster strikes.”

| Type of Coverage | What it Covers | Exclusions |

|---|---|---|

| Standard Home Insurance | Appliance malfunctions, burst pipes, roof leaks (not wear and tear), ice damming | Sewer backup, overland flooding, tidal flooding |

| Sewer Back-Up Insurance (Add-On) | Flooding due to sewage backups or stormwater overflows entering the home. Vital for homes with basements | Failures due to sump pumps or exterior drains (varies by provider) |

| Overland Water Insurance (Add-On) | Damage from freshwater flooding due to lakes, rivers, and rainstorms. Necessary for homes near lakes or rivers | Saltwater flooding, earthquakes, landslides, rising groundwater |

| Flood Insurance for Condo Owners/Renters (Optional) | Water damage to contents in condos or rentals. Only covers personal belongings, not the building itself | Structural damage to the building (covered by landlord’s policy) |

| Sewer Back-Up + Overland Flood Insurance (Combined Add-On) | Sewer back-ups and overland flood damage combined. | Tidal flooding and storm surge |

Recognizing that many homeowners in high-risk flood zones face prohibitive insurance costs or are unable to secure coverage altogether, the federal government, in collaboration with the Insurance Bureau of Canada, Finance Canada, and Public Safety Canada, developed the National Flood Insurance Program (NFIP). This initiative, announced as part of the 2024 federal budget, aims to provide affordable flood insurance to vulnerable households by subsidizing premiums and offering reinsurance options. The government has committed $15 million in the 2024 budget announcement to facilitate the program’s rollout, with a target implementation date of April 1, 2025. The NFIP represents a shift towards proactive disaster preparedness and resilience, ensuring that more Canadians have access to essential flood coverage in an era of increasing climate-related risks.

Full List of All Flood-Prone Cities in Ontario:

| City | Flood Index Score |

|---|---|

| Ajax | 4.6 |

| Ottawa | 4.5 |

| Mississauga | 4.4 |

| Toronto | 4.3 |

| Brampton | 4.3 |

| Brantford | 4.2 |

| Vaughan | 4.2 |

| Sarnia | 4.1 |

| Markham | 3.9 |

| Lakeshore | 3.9 |

| Brockville | 3.8 |

| Belleville | 3.8 |

| Oshawa | 3.7 |

| St. Catharines | 3.7 |

| Caledon | 3.7 |

| Kingston | 3.6 |

| Burlington | 3.6 |

| LaSalle | 3.5 |

| Windsor | 3.4 |

| Peterborough | 3.3 |

| Innisfil | 3.3 |

| Barrie | 3.2 |

| Hamilton | 3.2 |

| Cornwall | 3.1 |

| Orillia | 2.9 |

| Newmarket | 2.8 |

| Chatham-Kent | 2.7 |

| Aurora | 2.7 |

| Thunder Bay | 2.6 |

| Niagara Falls | 2.5 |

| Cambridge | 2.4 |

| London | 2.3 |

| Milton | 2.3 |

| Kitchener-Waterloo | 2.2 |

| Welland | 2.2 |

| Sudbury | 2.1 |

| Guelph | 2.1 |

| Collingwood | 2.0 |

| Sault Ste. Marie | 1.9 |

| North Bay | 1.8 |