Ontario is one of the most expensive places to live and drive in, so it’s important to weigh your choices when choosing car insurance. Fortunately, there are many simple things you can do to keep your insurance rates low.

By researching insurance providers and making small efforts to improve your driving skills, you can avoid soaring premiums.

Why is Car Insurance in Ontario So Expensive?

Car insurance rates in Ontario are notoriously high due to insurance fraud, with 80% of FSRA poll respondents claiming it’s the reason their premiums are increasing. These fraud schemes include fake pink slips, insurance agent scams, and staged auto collisions, causing rates to soar.

Increasingly bad weather is also a cause for higher insurance premiums, along with more cases of distracted driving and more expensive vehicles on the road.

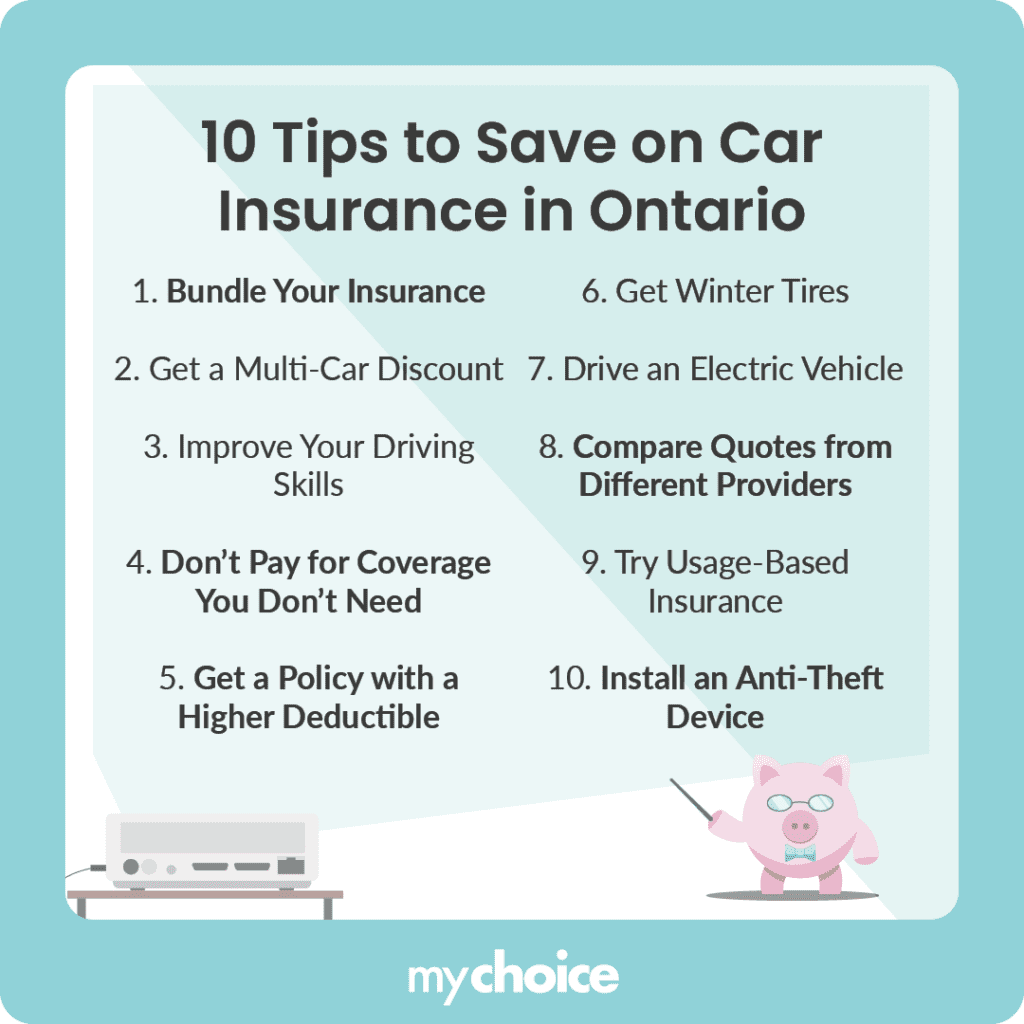

Tips for Lower Your Car Insurance Rate

As car insurance rates in Ontario soar, it’s imperative to find the best ways to save on your premiums. Here are ten useful tips for keeping your car insurance rates low.

Key Advice From MyChoice

- Combining insurance for your home and vehicle is a quick and simple way to get discounts on your policy.

- Choosing the best car to drive in your area that can withstand unpredictable road conditions is a great way to keep your vehicle in shape and insured for lower prices.

- Always compare quotes with as many insurance providers as you can to get the best possible value for a policy that suits your driving habits and vehicle type.