Experiencing a break-in is one of the most traumatic and stressful events a homeowner can experience. While home burglaries have been declining since 2003, over 130,000 break-ins still happen throughout Canada every year. Home insurance can provide homeowners significant peace of mind and protection when this unfortunate event does happen.

Does home insurance cover damage to your house in case of a burglary? How much of your possessions are covered under a standard home insurance policy? What can you do to protect yourself against potential break-ins? Read on to learn what you need to know about theft and break-in coverage in Canada.

Does Home Insurance Cover Theft and Break-ins?

Most homeowners’ insurance policies in Canada provide coverage for theft and break-ins, but the extent of this coverage can vary. Personal property coverage typically includes items such as electronics, clothing, furniture, and other personal belongings. If these items are stolen during a break-in, your insurance may reimburse you for their value up to the limits set in your policy.

While many standard items are covered under personal property coverage, specialty items like jewelry, art collections, or antiques may require additional coverage or riders. These high-value items often have lower limits within standard policies, so homeowners should consider purchasing additional protection to ensure full coverage. This process usually involves providing appraisals or receipts to prove the item’s value.

In addition to covering stolen items, home insurance usually covers damage inflicted on the dwelling itself during a burglary. This includes repairs to broken doors or windows and any other structural damage caused by intruders. Be sure to check your policy limits regarding these repairs.

Exclusions and Limitations in Coverage

While home insurance offers substantial protection against theft and break-ins, certain exclusions may apply. Standard home insurance policies may not cover:

- Large amounts of cash

- Specific high-value items without additional riders

- Items used for business purposes

- Losses due to negligence (e.g., leaving doors unlocked)

Be sure to consult your insurance provider to clarify what exactly is excluded in your policy, and consider purchasing additional coverage options where necessary.If your home insurance policy has deductibles, you will need to pay for that amount out-of-pocket before insurance kicks in. Many policies also have sub-limits on certain categories of items (like jewelry), meaning they will only reimburse up to a specified amount regardless of the item’s actual value. For example, if your policy has a $5,000 limit on jewelry but you own pieces worth $10,000 collectively, you’ll only receive compensation up to that limit unless you’ve scheduled those items separately.

Filing a Claim After a Break-in

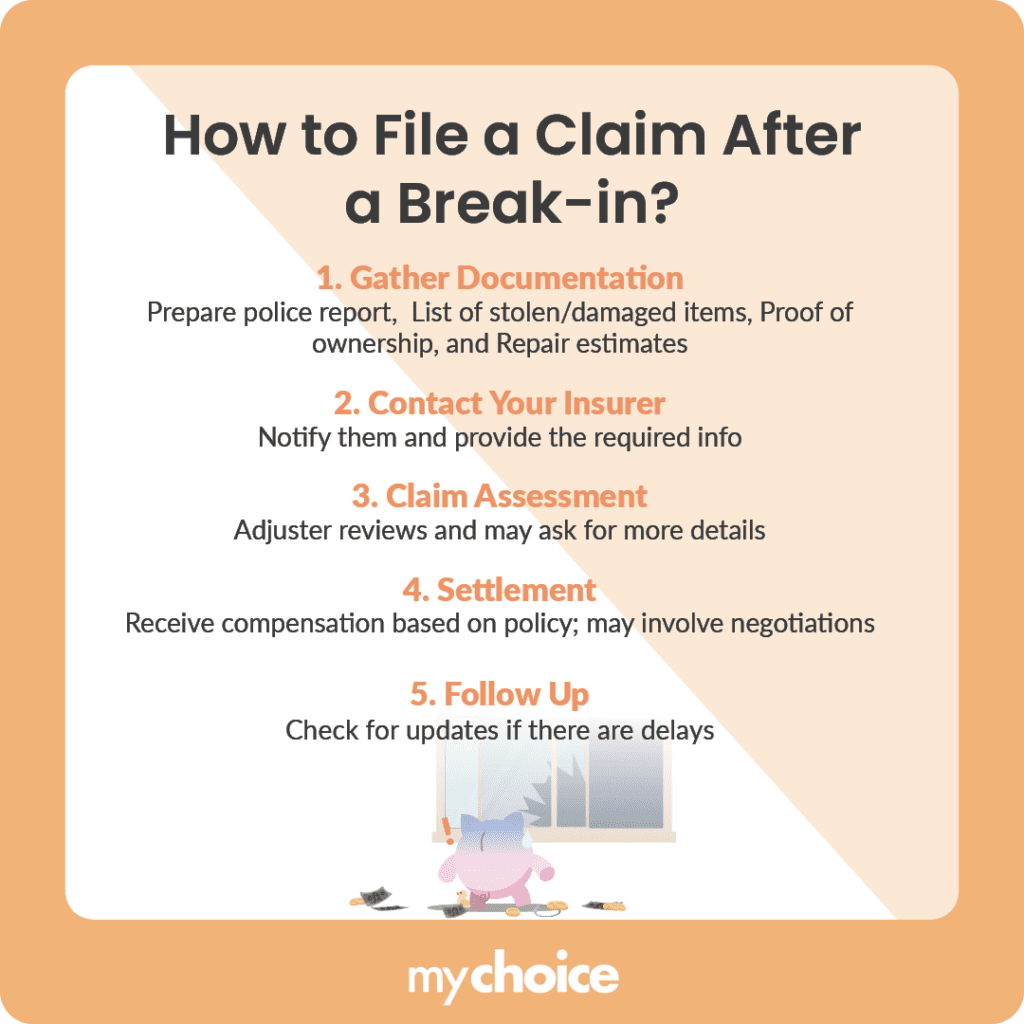

Knowing how to file a claim effectively can help ease some of the stress associated with a break-in. There are two processes that you need to be familiar with: what to do immediately after a burglary and how to file the claim itself.

If and when you find out that your house has been burgled, follow these steps:

After your home has been secured and you’ve taken an inventory of your missing possessions, file a claim with your insurer following this process:

Are You Covered from Theft if You’re Renting?

If you’re renting a home or apartment, you can still enjoy theft and break-in coverage, with a few caveats. Unlike homeowners, renters typically don’t have insurance that covers the structure of the property itself, since that responsibility typically falls to the landlord. However, renters can obtain renter’s insurance, which provides valuable protection for personal belongings.

Renter’s insurance generally covers personal property against theft, fire, and other risks. This means that if your belongings are stolen during a break-in, your insurance can help reimburse you for the loss, up to the limits specified in your policy. Coverage may include items like electronics, furniture, clothing, and more.

It’s important to note that not all renter’s insurance policies are created equal. Some may have specific exclusions or limitations on high-value items. If you have any valuable possessions, it’s advisable to take an inventory of them and discuss your coverage needs with an insurance provider.

Key Advice from MyChoice

- Review your home insurance policy to make sure that your possessions are covered in case of a break-in. Purchase additional riders for valuables that may not be included in your standard policy.

- Take measures to prevent your home from potential thieves. Install security systems and make sure your doors have reliable locks and deadbolts.

- If you’re dealing with a burglary, make sure to document everything. Take pictures of the scene and make an inventory of all the items you lost. This will be crucial when filing your insurance claim.