Sometimes, parents will purchase a life insurance policy for their children at a young age, then ask them to take over the policy when they come of age. But once they’re adults, they may have different financial obligations or life plans that make them rethink if they should take over the policy.

What are the options when your parents ask you to take over a life insurance policy? What are the benefits of keeping an active policy versus cashing it out? Read on to find out more about taking over a life insurance policy bought by your parents.

Understanding Life Insurance Policies Bought by Parents for Their Children

Life insurance primarily falls into two categories: term life insurance and permanent life insurance. Term life insurance provides coverage for a specified period, typically between 10 and 30 years. It’s often more affordable and suitable for those needing temporary protection, but due to its limited coverage, parents usually won’t choose this option for their children.

Permanent life insurance, on the other hand, lasts until death or until the policyholder stops paying for it. This includes whole life and universal life insurance, which can accumulate cash value over time. This is by far the more common type of insurance that parents purchase for their children, as permanent life insurance policies not only last until death, but can also accumulate cash value over time.

Evaluating Your Options

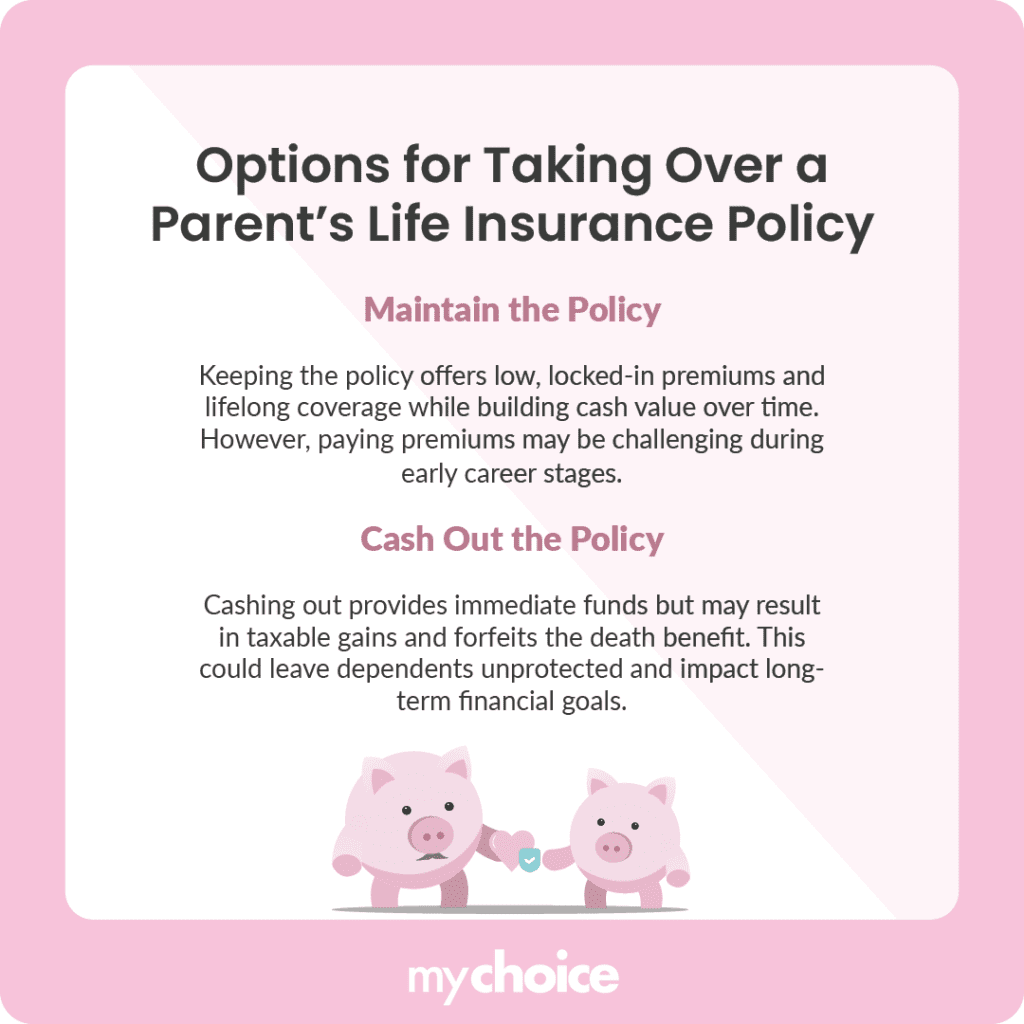

When it comes to taking over a life insurance policy bought by your parents, you have two main options to consider: maintaining the policy or cashing out. Both options have their pros and cons, which you need to weigh before making a decision.

Premium Dividend Offset

A unique feature of some permanent life insurance policies in Canada is the premium dividend offset, which allows policyholders to use dividends earned from their policies to pay premiums. When a participating life insurance policy earns dividends, you can apply these dividends to cover all or part of your premium payments. This feature means that you can keep your life insurance policy going without worrying too much about making monthly payments.

To utilize the premium offset feature, certain conditions must be met:

- Your whole life insurance policy must pay out dividends.

- The accumulated dividends must be enough to cover future premium payments.

If your parents have been paying for your life insurance policy for long enough, the dividends may be enough to cover all future life insurance premiums until either the end of your life or when you decide to cash out your policy. In either case, a “free” life insurance policy will be beneficial to both your financial planning and securing your family’s future.

Making an Informed Decision

Before deciding whether to keep a life insurance policy taken out by your parents or cash it out, you need to consider the following factors:

Key Advice from MyChoice

- If you have pressing financial needs or can’t afford to keep paying for a life insurance policy, then cashing out may be the best option. Otherwise, taking over the life insurance policy from your parents can keep your family’s future secure while also being a good financial strategy in the long run.

- Ask your insurer if you can avail of the premium offset feature. This can make your life insurance premiums much cheaper, or even free.