Canadian business owners wear multiple hats – operators, marketers, and risk managers. Protecting your business is an underrated cornerstone of success, but insurance can often become a headache, especially with separate policies. Instead of juggling confusing clauses and overlapping coverages, you might consider a Business Owner’s Policy (BOP) as a strategic safeguard.

Over 40% of small businesses lack full business insurance coverage for their operations, exposing them to potentially catastrophic losses in case of a lawsuit. However, tailored BOPs can efficiently mitigate these risks by offering affordable and flexible protection. Here’s what you should know about tailored BOPs for your business.

Why “All-in-One” Insurance Isn’t a Cliché Anymore

Many Canadian entrepreneurs may mistakenly believe that all-in-one insurance packages are generic. However, modern BOPs are more comprehensive and customizable, eliminating the need for separate policies for property damage, liability, and business interruption, among other things.

BOPs are no longer the business insurance cliché they used to be because they fill coverage gaps and eliminate administrative complexities. They combine essential business protections, often at reduced premiums, allowing businesses to allocate resources to other critical areas.

Let’s review a real-life example. Suppose you operate a small manufacturing firm in Ontario and previously held separate policies for property insurance, general liability, and equipment breakdown. These policies caused administrative burdens and higher cumulative premiums, taking away from your bottom line. You then transition into a tailored BOP with consolidated coverage, reducing insurance costs by 20% and creating a more streamlined risk management process – it’s not a cliché!

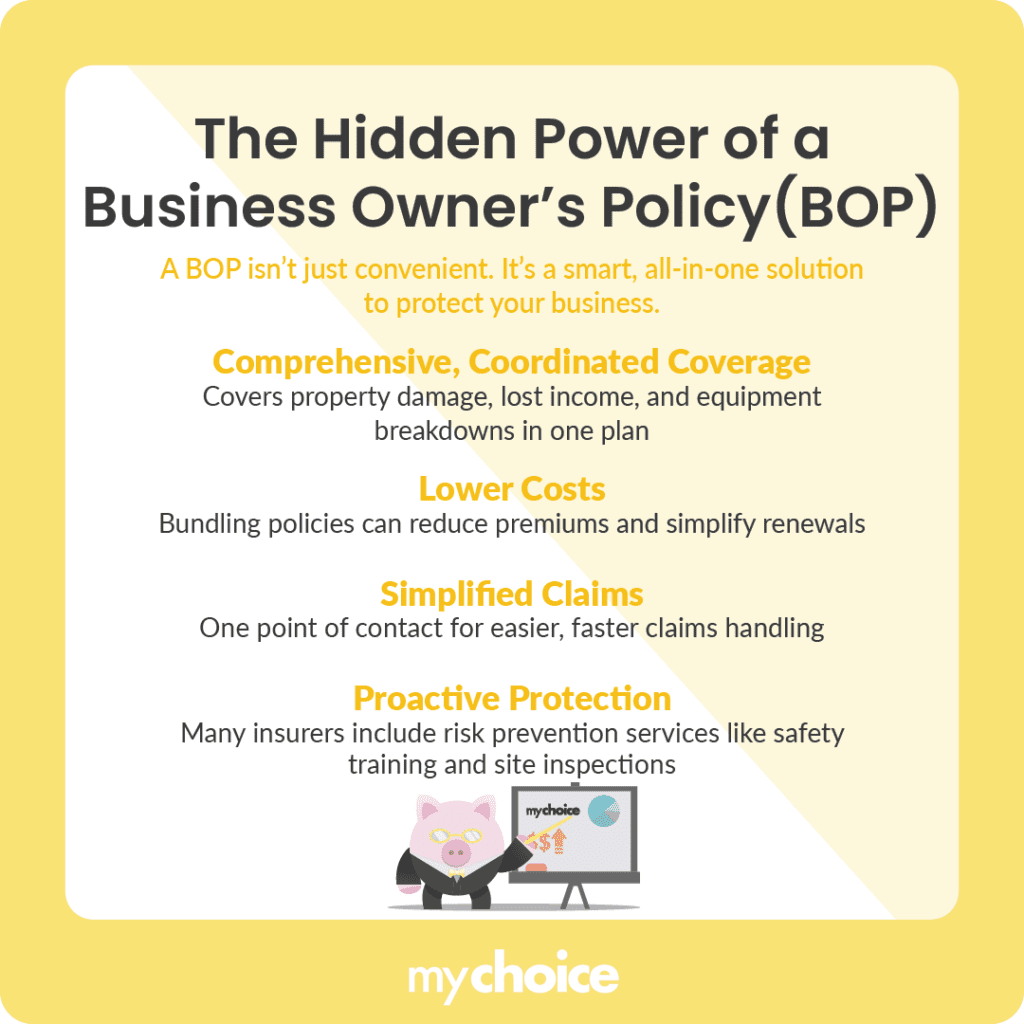

The Hidden Power of a Business Owner’s Policy

From a bird’s eye view, a BOP may seem like a simple convenience, but it’s more than just a bundle of standard business coverages. Thoughtfully designed BOPs can keep businesses resilient, minimize downtime, and avoid losses altogether. Here’s why BOPs are a powerful tool for all business owners.

Which Businesses Need a BOP?

A BOP can benefit any small to mid-sized business facing property and liability risks. It may be appropriate for your business if you have a physical location, customer foot traffic, and equipment or assets to protect. Here are some business types that can benefit most from a BOP:

Conversely, you may not need a BOP if you run a large corporation requiring custom commercial insurance packages or businesses with very niche/complex risk profiles, such as financial institutions or mining companies.

What’s Included in a Modern BOP?

Again, BOPs are customizable and include core coverage sets. However, inclusions may vary among insurers. Here’s what you can expect:

You can tailor a modern BOP by business size, location, industry, risk profile, or regulatory compliance.

Emerging Risks Covered by BOP

While business insurance is becoming more comprehensive, the risks are also evolving. Thankfully, modern BOPs are designed to cover emerging threats that traditional insurance typically overlooks. Here’s how they can protect your business from potential threats.

Key Advice from MyChoice

- Audit your risks annually to determine how to use BOP to protect your business. Consider whether you’re opening new locations, mainly relying on technology, or require additional cybersecurity.

- Work with a broker to tailor your BOP to your business needs. They can provide information regarding regional risks and help you plug coverage gaps.

- Review your policy every time your business experiences a significant change or milestone. Your risk profile may change, so your insurance should grow with your business.