If you don’t have regular term life insurance, a supplementary death benefit from an employment insurance plan can be a viable alternative. However, these plans function differently from traditional insurance and may not offer as much coverage as you need. Still, these plans offer some flexibility and are generally easy to manage.

Learn more about supplementary death benefits and how they can financially secure your family and loved ones.

How Supplementary Death Benefit Works

A supplementary death benefit (SDB) is a lump-sum benefit similar to a decreasing term life insurance benefit. However, it is typically paid out to plan participants on a pension or group life insurance policy.

The lump-sum benefit is twice a person’s annual salary, rounded to the nearest $1,000. Once the recipient reaches age 66, coverage decreases by 10 percent annually to a minimum of $10,000.

Like a regular death benefit from a life insurance policy, an SDB is tax-free.

Calculating a Supplementary Death Benefit

The amount of a supplementary death benefit depends on the participant’s salary. Some plans may impose a maximum coverage limit, and the amount provided decreases as the participant ages.

Multipliers will also vary across different providers. Suppose your plan specifies the SDB as 2.5 times the participant’s average salary. If your annual salary were $60,000, your SDE would be $150,000.

You must also consider vesting, as some companies may require that you stay employed for a specified duration to be eligible for the SDB. Other factors like early retirement, shifting departments, or getting fired may also influence the final SDB amount.

Who Can Claim a Supplementary Death Benefit?

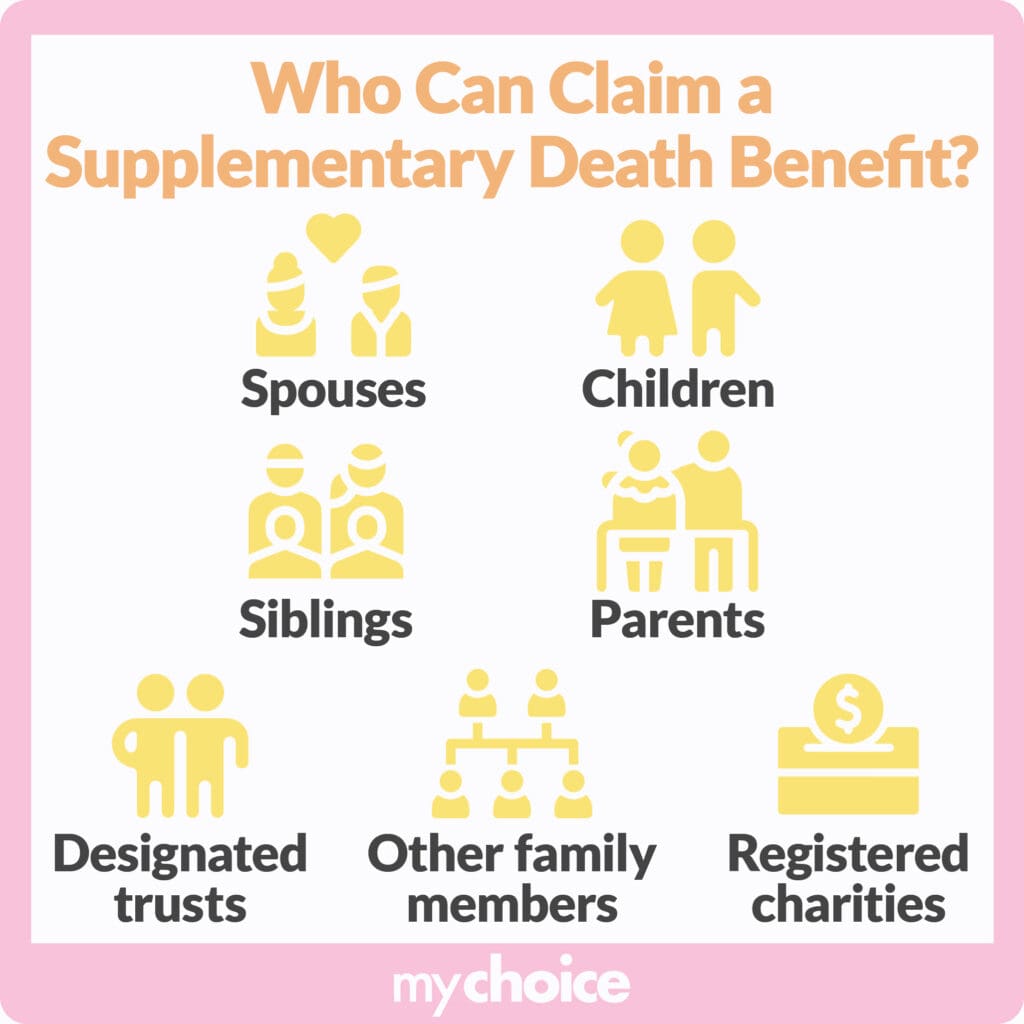

Public servants contributing to the public service pension plan can choose who receives their supplementary death benefit. These beneficiaries might include:

- Spouses

- Children

- Siblings

- Parents

- Other family members

- Designated trusts

- Registered charities

If you name multiple beneficiaries, ensure you indicate how you want the SDB divided among them. You can also name a contingent beneficiary who will receive the SDB if the primary beneficiary dies.

Note that as of June 1, 2024, participants can name a maximum of five beneficiaries, including minors. However, this change is not yet applicable to the Canadian Armed Forces Supplementary Death Benefit.

If you name an estate as your beneficiary, remember that doing so can lead to probate, which can be time-consuming and complex.

Changing Beneficiaries

There may come a time when changing beneficiaries is necessary, especially after a significant life event like marriage, divorce, the birth of a child, or death.

While the process of changing beneficiaries may vary slightly depending on the plan provider, it is generally simple:

- Obtain the necessary forms from a plan administrator or HR representative.

- Provide detailed information about the new beneficiaries, including their names, addresses, and relationship to you.

- Submit the form according to your plan administrator’s instructions.

Participants can review and change beneficiaries through the Active Member Pension Portal. Alternatively, they can request changes to their listed beneficiaries by completing and mailing the designated Naming or Changing Your Beneficiaries form.

How to Claim a Supplementary Death Benefit

Claiming a supplementary death benefit involves a similar process to claiming any life insurance death benefit. Here’s how it works:

- The designated beneficiaries must inform the plan administrator of the participant’s death and provide a death certificate.

- Beneficiaries must fill out the claim form provided by the plan administrator. The form may ask for information about the deceased participant and beneficiary and supporting documentation, such as the claimant’s proof of identity.

- The plan administrator must then verify the information provided.

- If there are no clarifications, beneficiaries will receive the SDB through a direct bank deposit or a specific mode of payment.

Depending on the plan administrator, beneficiaries usually have between 30 and 90 days after the participant dies to file a claim. Some plans may allow more extended periods, while others may not specify a period at all.

Do You Need a Lawyer to Claim a Supplementary Death Benefit?

Beneficiaries don’t typically need a lawyer to claim a supplementary death benefit because the process is straightforward. However, there may be cases in which hiring a lawyer is necessary or at least helpful, such as in the following:

- The deceased left a complex estate with no specific instructions on dividing it.

- There are disagreements among multiple beneficiaries regarding how the SDB should be divided.

- The plan administrator denies the claim.

- The supplementary death benefit becomes subject to tax. SDBs are usually tax-free except in the case of an estate.

Can a Supplementary Death Benefit Claim Be Denied?

The plan administrator can deny a claim for a death benefit under the following circumstances:

- There is insufficient or incorrect documentation.

- The deceased became ineligible for the SDB because of employment complications.

- A disagreement between beneficiaries arises.

- There is evidence of fraud or misrepresentation.

What to Do if the Claim is Denied

Beneficiaries whose claims have been denied can rightfully appeal the decision. Here’s a general overview of the appeals process:

- Review the denial letter, enlisting the help of an attorney if you are unfamiliar with legal terms.

- Collect supporting documents and additional evidence to support your claim, such as papers to prove your relation to the deceased.

- Initiate the appeals process by completing and submitting a form with the appropriate documentation.

- Wait for the decision.

Note the time frame for filing an appeal, which can vary depending on the company.

Key Advice From MyChoice

- Regularly review the beneficiaries named on your plan for a supplementary death benefit. Make the appropriate changes as they occur – don’t delay them.

- If the beneficiary listed in the policy is an estate, it may be best to consult a tax professional to understand the implications.

- Because a supplementary death benefit is different from the death benefit on a regular life insurance policy, it’s best to regularly review your insurance coverage to ensure it meets your potential needs.