Congratulations, you’ve finally paid off your mortgage! Now, is it necessary to notify your insurer that you’re done with your payments? Keep reading to find out why it’s essential, and what other steps you must take to move forward as a full-fledged homeowner.

Why You Should Notify Your Insurer That You’ve Paid Off Your Mortgage

You should notify your insurer that you’ve paid off your mortgage because of a little thing called a “loss payee clause,” which makes your mortgage lender your beneficiary. This clause protects your lender’s financial interest in your property. As the loss payee, your lender gets paid first in the event of loss or damage to your home.

If you don’t want your benefits to go to your lender long after their financial interest in your property has been extinguished, then it’s best to notify your insurance provider once you’ve finished paying your mortgage and make amends to your policy to remove your lender’s status cas a loss payee.

What Else Should You Do After You’ve Paid Off Your Mortgage?

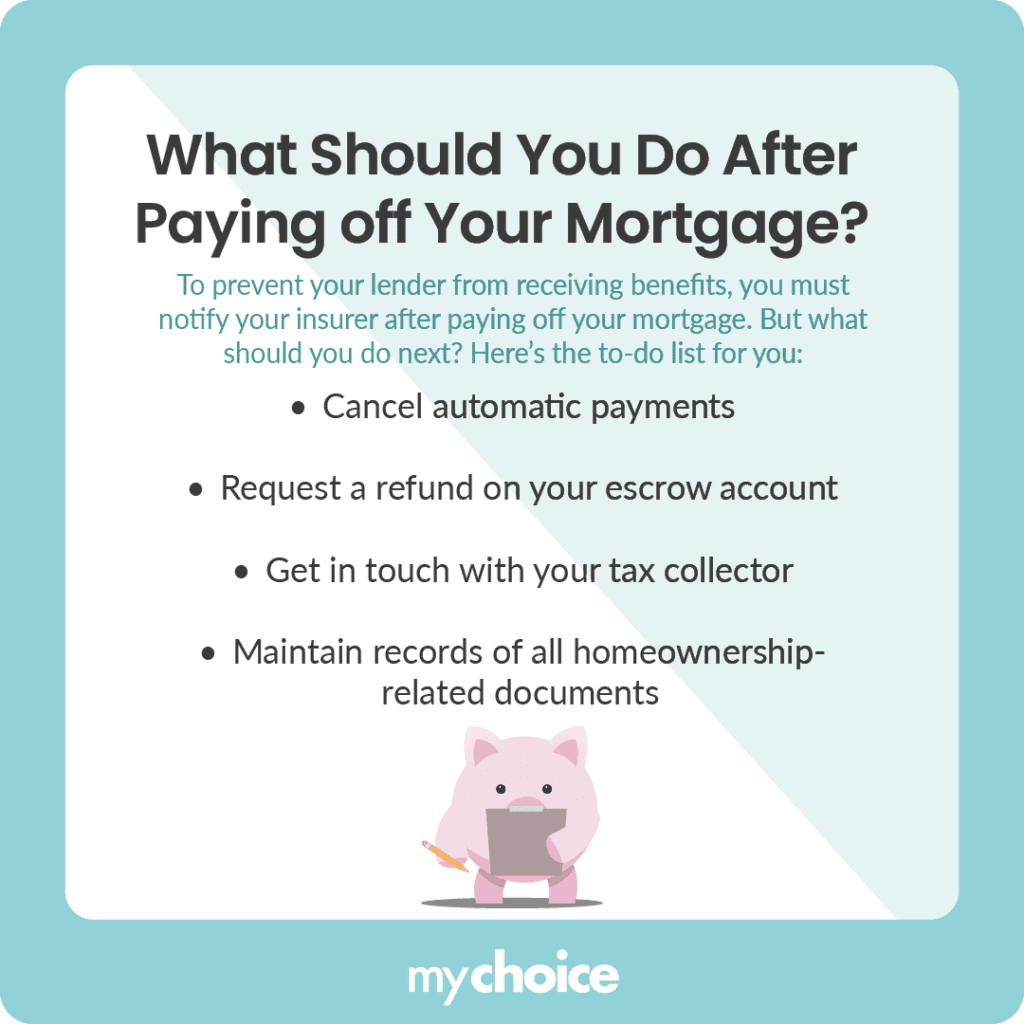

Aside from notifying your insurance provider and removing your lender as a loss payee, make sure to take the following steps after paying off your mortgage:

Should You Maintain Homeowners Insurance After Paying Off Your Mortgage?

Paying off your mortgage means becoming the sole owner of your property. When this happens, you also become responsible for covering the full cost of your homeowner’s insurance.

For some, maintaining home insurance can feel like a huge financial burden — especially since home insurance is not mandatory in Canada anyway. However, there are many benefits to keeping your homeowner’s insurance, such as:

Key Advice from MyChoice

- Notify your insurer immediately after paying off your mortgage to remove your lender as a “loss payee” and ensure that future claims are paid directly to you.

- Maintain and organize important homeownership documents, such as closing disclosures and title insurance, for future reference.

- Find the best rates from best home insurance companies with MyChoice. Compare quotes now and save more money on home insurance today.