People purchase life insurance to safeguard their family’s financial security in case of death. So, why would you want to sell a life insurance policy? Perhaps you’re dealing with a cash flow crisis or can no longer afford to pay for premiums. Whatever the case, knowing whether you can sell your life insurance policy in Canada can come in handy.

Can You Sell Your Life Insurance Policy in Canada?

You can sell your life insurance policy in Canada, but only in some regions. For instance, New Brunswick and Nova Scotia recently rescinded the ability to sell a life insurance policy. In addition, the Canadian Life and Health Insurance Association (CLHIA) continues to lobby against its legality, as it “exposes senior policyholders to financial abuse.”

However, in Ontario, a private member’s bill is pushing to open life insurance to the secondary market.

Still, whether you can sell your life insurance policy in a legal state will depend on the conditions of your policy and your insurance company.

When Should You Sell Your Life Insurance Policy?

Selling a life insurance policy may seem counterintuitive, but there are many reasons why someone might do so:

- They can no longer afford the premiums. Seniors lacking retirement funds may struggle to pay their insurance premiums and benefit more from selling them.

- They need the cash. Someone experiencing cash flow problems may need to sell their life insurance policy to access its cash component.

Who Can Buy Your Life Insurance Policy?

So, you’ve decided to sell your life insurance policy, but who can buy it? Third parties, like other insurance companies, might buy your life insurance policy as an investment. You can also sell your policy to another individual, such as a child, business partner, or friend.

Ultimately, you can sell your policy to virtually anyone, given that both parties have written consent.

How to Sell Your Life Insurance Policy in Canada

Now that you’ve decided to sell your life insurance policy, here’s how to do it:

Alternatives to Selling Your Life Insurance Policy

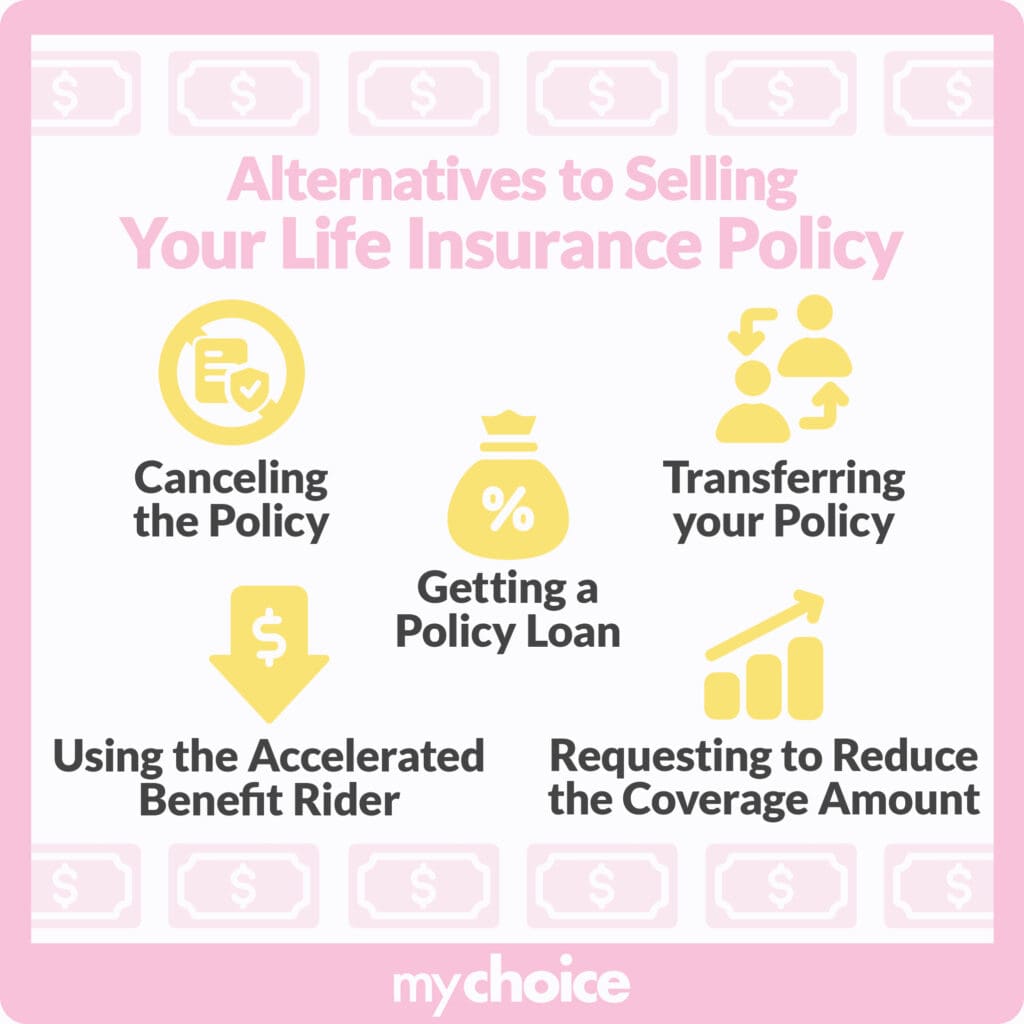

Selling your life insurance policy may not be the most cost-effective option, even if you need the money. Remember, hiring a broker will also cost you. Here are some less complicated options you might consider.

| Factors | When you should do it: | When you shouldn’t do it: |

|---|---|---|

| Canceling the Policy | if your policy is new and you can let it lapse | if you’ve been paying premiums for years or even decades |

| Using the Accelerated Benefit Rider | if you become diagnosed with a terminal illness (you can access between 25% and 95% of the entire sum) | if your policy doesn’t have an accelerated benefit rider and you still have to purchase it |

| Requesting to Reduce the Coverage Amount | if you have a lenient insurance company that may understand your circumstances | if you’ve already requested to reduce the coverage amount before and were denied |

| Transferring your Policy | if selling a life insurance policy is legal in your state and you can transfer it to a relative, such as a spouse, parent, or child | if selling a life insurance policy isn’t permitted in your state or if you’re transferring it to a non-family member who will experience financial loss |

| Getting a Policy Loan | if you have a whole life insurance policy that allows you to access the death benefit amount through a policy loan | if accessing the death benefit will put you in more debt, as the loan will accrue interest (if there is an outstanding balance when the insured dies, the company will deduct this from the death benefit) |

Key Advice From MyChoice

- Consider other, less complicated options like transferring your policy before opting to sell it. You may end up spending more money on hiring a broker or struggle to find a buyer.

- It’s better to prepare for retirement rather than purchase a life insurance policy you may not be able to afford in the future. When shopping for a life insurance policy, remember to compare quotes and get the best deal for your needs.