Owning a second home can come with many perks: a place for weekend getaways, a future retirement spot, or a property you rent out to generate additional income. However, with this extra property comes the responsibility of protecting your investment with the right insurance coverage.

Are insurance premiums more expensive for your second home? What kind of coverage do you need? Do you need landlord insurance? In this article, we’ll discuss key distinctions between primary and secondary residence insurance, why coverage for a second home is a wise choice, and the types of policies available for your second home.

What is the Difference Between Insuring Primary and Secondary Residence?

Your primary residence is the home you live in most of the time, while a secondary residence is a property you spend less time in. Insurance policies for a primary home tend to be more straightforward because it’s assumed you are regularly on-site to address issues like maintenance and repairs.

On the other hand, insurance companies often have separate guidelines or policy types for second homes that reflect the additional risk a second home faces.

Due to less frequent occupancy, a secondary residence can face certain risk factors: small incidents (like a minor leak) can go unnoticed for days or even weeks, and vacant properties may attract theft or vandalism. Premiums for primary residence insurance can be more affordable compared to secondary homes because insurance companies consider an owner-occupied home less risky.

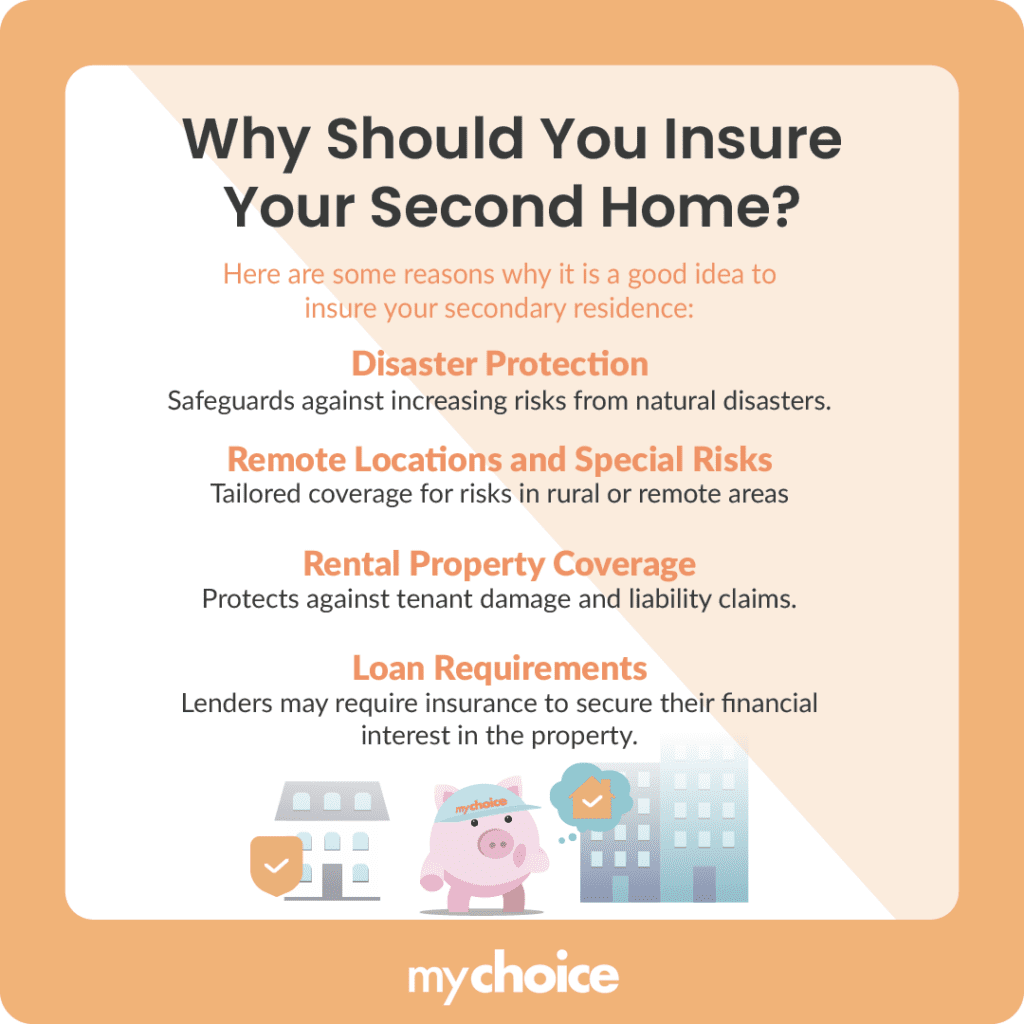

Why Should I Insure My Second Home?

Like your primary residence, unfortunate perils can befall your second home, and it’s important to protect yourself against these events. Here are some reasons it’s a good idea to insure your secondary residence:

What Type of Coverage Should I Choose?

When shopping around for an insurance policy for your second home, one of the most important considerations is the type of insurance coverage you choose. Different policies cater to various scenarios, and homeowners must choose one that’s compatible with how the property is used and what risks it faces.

Here are some of the common options for secondary home insurance:

Can I Get a Discount When Insuring My Second Home?

While second-home insurance can be costly, there are several ways to reduce premiums and secure a better rate. Here are some tips to help you save on premiums for your second home:

Key Advice From MyChoice

- Second homes may need more specialized endorsements and coverage than your primary home. This can mean higher premiums on your second home insurance policy.

- Bundling together multiple policies, choosing a higher deductible, and installing security systems can help lower the insurance costs for your second home.

- Make sure that your second home is insured against climate events that commonly happen in its area. This usually involves purchasing additional riders.