Keeping a roof over your head is necessary for comfortable living, so spotting a leak can feel like a nuisance. Thankfully, you can get coverage for roof leaks from your home insurance plan, but it isn’t as simple as signing a form. Learn what your home insurance covers and how it can help you manage or repair a leaky roof.

Does Homeowner’s Insurance Cover Roof Leaks?

Homeowner’s insurance does cover water damage from a leaking roof on an open peril basis. “Open peril” means you’ll receive financial compensation for damage covered from all sources except those excluded from your specific policy.

Common perils that a home insurance policy doesn’t cover for a leaky roof include the following:

- Mold

- Normal wear over time

- Ground movement caused by earthquakes

- Government action

- Pet damage

- Pest infestations

- Theft if the property is under construction

- Vandalism if the property is vacant

- Intentional loss or neglect

- Foundation or pavement damage caused by ice or snow

Depending on the extent of the damage, various aspects of your insurance plan can cover replacements or repairs. For example, dwelling coverage can pay for structural damage, whereas personal property coverage can finance repairs to damaged belongings.

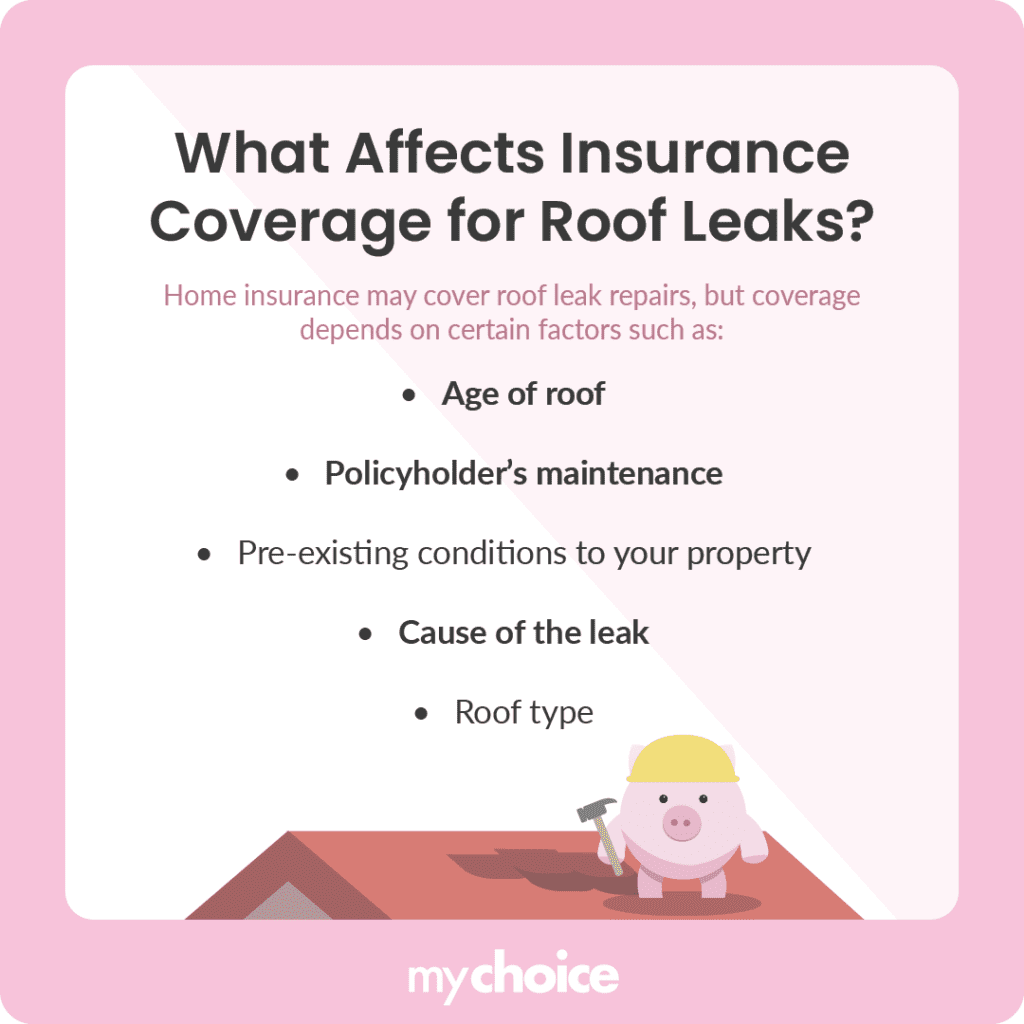

What Factors Affect Insurance Coverage for Roof Leaks?

Remember, home insurance can cover repairs and replacements for roof leaks, but only in most circumstances. These factors can influence whether you get full or partial coverage for your roof:

Does Home Insurance Cover Roof Replacement?

The answer is yes, but before getting insurance to pay for your roof replacement, it’s essential to determine whether it’s worth making a claim. If the leak is sudden and accidental, you have a good chance of receiving compensation. Cover all your bases by reading through your home insurance policy.

Remember that filing a claim can raise your insurance premiums even if the insurance company doesn’t pay you anything, so it’s vital to weigh your options.

Here’s how to make a home insurance claim for roof replacement:

- Document the damage by taking clear photos and videos. Keep a detailed log, noting the dates of damage.

- Contact your insurance provider as soon as you notice the damage. Provide fundamental information about the incident and damage.

- Follow your insurer’s specific instructions for filing a claim, providing the appropriate documentation.

- Schedule a home inspection with an insurance adjuster, who will examine and assess the damage.

- Obtain quotes from reputable roofing contractors. Occasionally, your insurance company may provide recommended contacts.

What Should I Do if My Claim for Roof Replacement Is Denied?

You can appeal your claim by requesting another on-site inspection and working with an insurance lawyer to help generate the appropriate reports.

The Costs of Roof Repair and Replacement

When deciding whether to make a claim or cover the replacement yourself, it’s important to know how much coverage you can receive and what your deductible is.

Asphalt roofs are the cheapest to replace, costing between $10,000 and $24,000 for a 2,000-square-foot home, whereas replacing a slate roof can cost up to $70,000.

How to Inspect Your Roof for Damage

Because home insurance policies only cover some roof-related damage, inspecting and maintaining your roof thoroughly is essential. Here are some tips for inspecting your roof for damage:

Key Advice from MyChoice

- Metal roofs are typically the cheapest to insure in Canada. They are sturdier and pose a lower risk compared to asphalt shingles.

- Maintaining your roof is the best way to avoid making a claim. Inspect your roof with every season change and remove debris like leaves and twigs. Keep your gutters clean and check for any loose shingles. Maintenance is imperative, especially if you live in a high-risk home.

- It’s worth considering your warranty before making a claim. Your roof provider can provide coverage in case of a manufacturer defect, and some providers also have warranties for general damage.