In May of this year, the province of New Brunswick introduced amendments to the Motor Vehicle Act to crack down on impaired driving cases and reduce court backlogs. Given the increase in the impaired driving rate in 2019 by 53% in the province compared to the previous year, these new measures are seen as a swift way to prevent alcohol-related motor fatalities.

What are these changes and how do the new penalties compare to those in other provinces? Learn more about these key changes, how they will affect roadside safety, and what their effect will be on your auto insurance premiums.

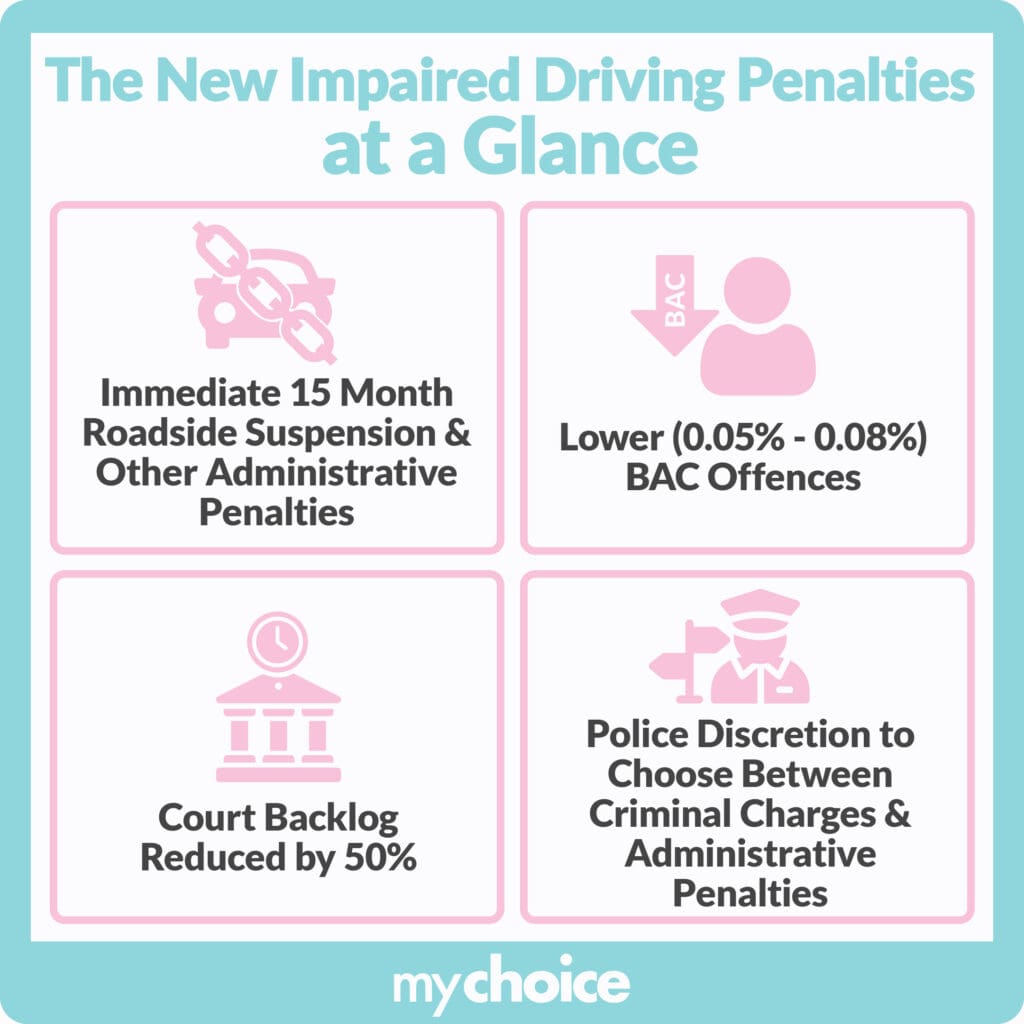

The New Impaired Driving Penalties at a Glance

New Brunswick’s amendments to its impaired driving penalties mean fewer court delays and enhanced road safety. Here’s a basic summary of what changes have been made and what they mean for New Brunswick drivers:

Impact on Auto Insurance Premiums

Impaired driving convictions have always increased auto insurance premiums, but the stricter laws in New Brunswick mean that impaired driving incidents involving lower BAC will be taken more seriously. Before the amendments, New Brunswick only imposed a 7-day suspension for drivers with a BAC in the WARN range, and this would not be noted on their driving record.

The amendments now impose a mandatory short-term licence suspension and vehicle impoundment for these offences. This will keep offenders off the road immediately instead of allowing them on the road after just a week. Lower BAC offences will also have stricter administrative penalties that go on a New Brunswick driver’s abstract, so when auto insurers check a record with these offences, they will likely increase the premiums they offer to that driver.

Even if an offence only stays three years on a driving record, insurance companies can go back as early as 10 years to assess the risk of insuring a driver. These incidents are immediate red flags for auto insurance companies that will result in higher quotes compared to drivers with no record of impaired driving.

Role of Insurance Companies

Impaired driving has serious consequences for drivers in New Brunswick, not just for public safety but for insurance companies that provide auto insurance coverage. Here’s a summary of the role auto insurers will play with the new penalties:

Public Safety and Insurance Implications

The new penalties for impaired driving in New Brunswick may reduce the number of impaired driving incidents on the road. Here’s how that affects public safety and insurance:

Comparative Analysis with Other Provinces

The revamped penalties for impaired driving in New Brunswick share similarities to those in other provinces like Alberta and British Columbia, but key differences with others. Here’s a basic analysis of how New Brunswick’s amendments compare to other provinces:

Key Advice from MyChoice

- Impaired driving has always been a no-no, but with the new penalties for lower BAC, New Brunswick drivers should take even greater care to avoid consuming any amount of alcohol before getting behind the wheel.

- If you accumulate multiple offences on your record because of the new penalties, you may have difficulty finding auto insurance coverage. Even if no one is injured, just one driving conviction can stay on your record for years and raise your premiums dramatically.

- In case you’re deemed a high-risk driver who’s been rejected by traditional car insurers, consider getting coverage from specialized companies and work on maintaining a clean driving record in the future.

- If you get an impaired driving penalty, disclose it to your auto insurer. Concealing it may result in cancellation and non-renewal of your car insurance policy.